WeeklyWatch – FTSE hits record high

21st January 2025

Stock Take

Positive markets make for happy investors

Several major markets posted positive numbers last week, including the FTSE 100, which grew 3.1% – a new record high. The news gave investors much to smile about!

A number of factors supported this rise, including the slight fall in the UK’s inflation numbers from December. While a 2.6% to 2.5% drop may not seem like a large change, the headline figure concealed a bigger fall in services inflation. Services inflation – including hotels and travel – was persistent for the majority of 2024. But in December, the sector saw a fall from 4.9% to 4.4%, which was more than expected. Notable influences on these figures included the significant drop in airfare prices – but given that these are notoriously unpredictable, some of the drop could be temporary.

Stagflation fears persist

The UK GDP figures for November were also released last week and revealed a 0.1% growth. The UK had started 2024 strongly, but the economy struggled to grow as the year went on. By the end of November, the UK GDP was smaller than it was in May.

In her analysis of the numbers, the Head of Economic Research at St. James’s Place, Hetal Mehta, said:

“The November 2024 GDP data are the first positive growth print since August, but only just. The UK economy has grown by a mere 1.8% over the past three years; after the initial post-pandemic recovery, the trend has been much flatter relative to the 2014–2019 period. Consumers are cautious, as evidenced by the upward trend in the savings ratio and weaker business sentiment. Overall, this paints a picture of stagflation.”

As a result, the Bank of England (BoE) is predicted to gradually reduce interest rates over the course of 2025 – this could include a cut next month. However, as Mehta notes:

“The monetary policy response is not straightforward as it is the supply-side policies that are needed to help the economy out of this situation. In the short term, there is enough progress on inflation to allow the BoE to keep cutting interest rates gradually.”

Springing into action ahead of the next Budget

Turning attention to supply, Chancellor Rachel Reeves faces challenging decisions, with very limited options to try and generate economic growth over the next few months. Reeves is expected to reveal her Spring Statement in March, which will likely show that the fiscal headroom she gave herself in the previous Budget will be gone.

UK equity performance was aided by a weaker pound relative to the US dollar. Most of the earnings for companies in the FTSE come from abroad, so a weaker pound meant that these companies could record high sterling revenues and profits. Additionally, a cheaper pound creates attraction around domestic share prices, making them of keen interest for overseas investors – another boost in market optimism in the previous week.

It’s global positivity!

The positive momentum was seen in several markets. The European Central Bank looks to be on course to implement gradual interest rate cuts – provided there are no big economic shocks – and this has helped lift the MSCI Europe ex. UK by 3.1%.

Looking east, Asia also received the positive market memo! Chinese equities ended the week in positive territory when the Shanghai Composite rose by 2.3% (local currency), spearheaded by better-than-expected GDP data.

The next chapter for the US

Across the pond, the S&P 500 rose by 2.9% after encouraging inflation figures were revealed alongside strong corporate results. However, the nation faces uncertainty with Donald Trump’s inauguration, which took place yesterday. Republican voters are looking for Trump to hit the ground running after he revealed plans to make extensive use of executive orders to enact changes quickly, including in immigration and environmental regulation.

Wealth Check

The Autumn Budget and your financial plans

Many of those with long-term financial plans were left feeling uncertain following the 2024 Autumn Budget. The intention behind the Budget, according to Chancellor Rachel Reeves, is to fund investment, fuel growth and fill a £22 billion-pound black hole in public finances. One of the ways that she is looking to fund this is through pensions.

How will my pension be involved?

Pensions are usually the last thing to be touched – and usually only after drawing down on savings and ISAs. By using your savings, you can lower the overall taxable value of your estate, while ensuring the pension is preserved for future generations without being subject to a 40% Inheritance Tax (IHT).

However, this is currently under discussion and could change from 6th April 2027. You can still draw down 25% of your pension as a tax-free lump sum – up to £268,275 – but from 2027, any unspent pension could possibly be counted and taxed as part of your estate when you pass away.

As a result of the Budget, many have been left conflicted as to whether to draw their pension and take the repercussions of income tax but still be able to gift some of their money to loved ones.

5 options to adapt your financial goals

- By using your annual £3,000 IHT gifting exemption (£6,000 for a couple) to gift money to your family members or loved ones during your lifetime, instead of as an inheritance, you can reduce the size of your estate over time.

- Make a gift of more than £3,000. However, if you pass away within 7 years of giving the gift, it’ll be included in your estate for tax purposes.

- Make regular monthly ‘gifts’ to family or cover some of their outgoings, including things like childcare or school fees. These are tax-free, as long as they’re made from a disposable income and don’t impact your standard of living.

- Consider spending more of your pension pot on yourself, or others.

- Take out a Lifetime Assurance policy to help cover the eventual IHT bill.

One more route that you can put into action is to accept your IHT liability but protect your family by planning for it. If you have the appropriate disposable income, you could take a whole of life insurance policy which will cover some of the anticipated bill. These whole lifetime policies last for the duration of your life and also pay out a tax-free lump sum to your family when you pass away, which can be used to pay the IHT. Aside from being a comforting sum of money, it can also provide peace of mind for everyone. However, you need to make sure that you can afford these payments until the end of your life.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

In The Picture

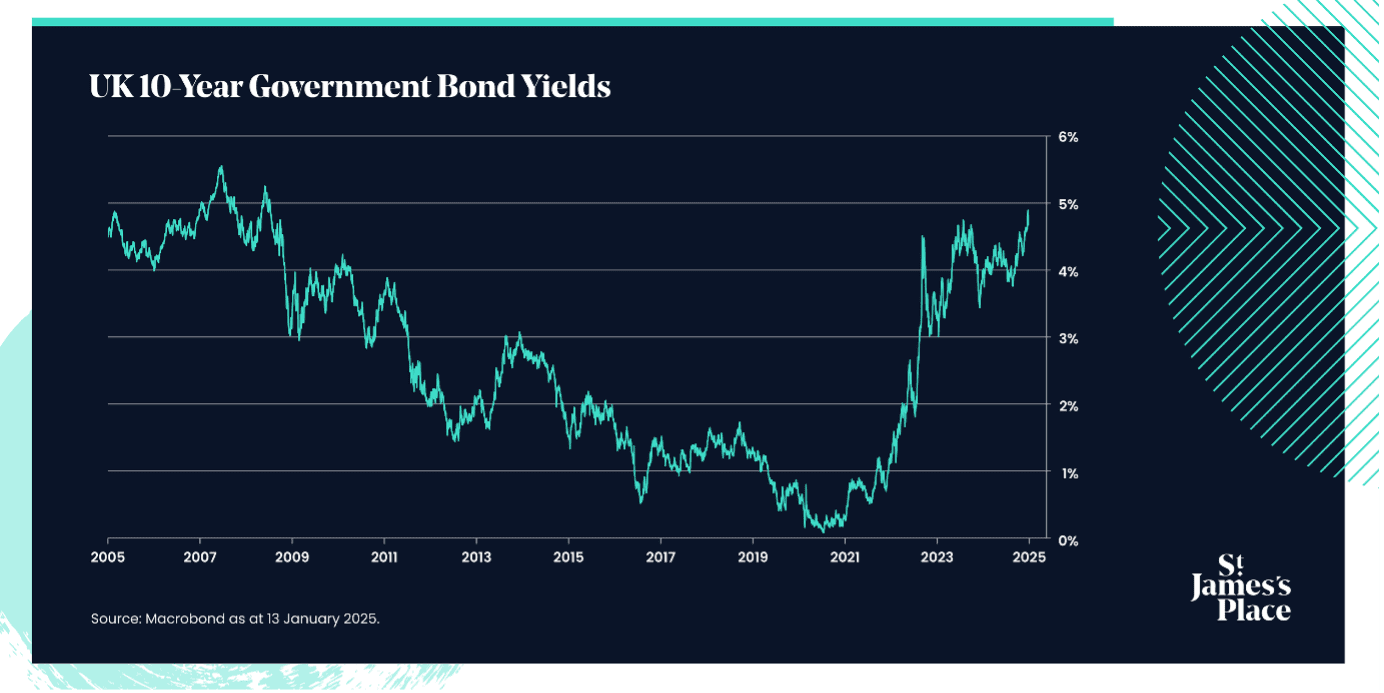

Although the start of 2025 has brought back memories of the brief extreme gilt crisis in September 2022, it appears unlikely that a similar situation will unfold at this time. The recent volatility has been driven by a mix of global and domestic factors, including ongoing concerns about inflation.

The Last Word

“Starting tomorrow, I will act with historic speed and strength and fix every single crisis facing our country.”

– US President Donald Trump speaking on Sunday as he promised to hit the ground running for his second term as President.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 20/01/2025