WeeklyWatch – US saddle up for possible lower interest rates

27th August 2025

Stock Take

The pressure’s riding high for the Fed

President Trump has been demanding that the Federal Reserve (Fed) cut interest rates for months, and now he may actually get his wish. On Friday, the chair of the US central bank, Jerome Powell, made a speech that strongly indicated interest rates would be cut in September – the first since January.

Following this news, the US markets rallied – a positive sign after a lacklustre week. There was an increase of more than 800 points (1.9%) for the Dow Jones Industrial index, which is its first record high of the year. The broader-based S&P 500 performed its best since May, gaining 1.5%.

Additionally, share prices also closed higher in Europe and the UK. There was also a rise in bond prices (and yields, which move in the opposite direction, fell), and there was an increase in the price of oil and gold. However, the prospect of lower interest rates on dollar deposits meant that the dollar weakened.

The good, the bad and the ugly for investors

So why exactly are investors expecting US interest rates to fall? The interest rate changes at the Fed are decided on by a committee led by Powell, and they have two main responsibilities:

- Achieve maximum employment

- Keep inflation steady and low, with a target of 2%

If they’re able to achieve both, then interest rates remain in a sweet spot – not too high, not too low.

Most investors are supportive of a possible September interest cut, but Powell gave cautious reasoning in his speech. He highlighted how possible economic risks could influence both parts of his mandate – in particular the domestic jobs market and US employment figures.

The latest figures reveal a notable slowdown in job creation, with increasing numbers for people applying for jobless benefits – the number of those collecting unemployment benefits is at a near-four-year high. This has led numerous analysts to believe that the Fed will cut rates at their next meeting in September, with Powell’s words supporting this viewpoint.

Unfortunately, the inflation outlook has got worse. Core inflation (with the volatile food and energy prices stripped out) increased to an annual rate of 3.1% in July – far above market expectations. The latest release of the Fed’s preferred inflation indicator, when focused on personal consumption expenditures, was 2.6%. Both figures are significantly above the 2% target.

And it doesn’t look like this will end anytime soon… Inflationary pressures look like they will increase. As costs on imports increase due to higher tariffs, the signs are that these will be increasingly passed on to US consumers. This marks quite the change from earlier in 2025, when companies absorbed the additional costs at a detriment to their profits. Supply of labour will likely also be affected as the US government seek to crack down on illegal immigration.

Walking a fine line

With the inflationary backdrop looking bleaker, it seems odd that the Fed is hinting at a potential interest rate cut. What it shows is that the Fed has a difficult dual mandate to balance: full employment and steady inflation. Interest rates are their only tool to manage both issues, and at times like now, a choice has to be made on which to prioritise.

So, why in his speech did Powell choose to focus on employment rather than inflation? He noted that there’s an “unusual situation” in the labour market. The outlook could deteriorate quite rapidly and be seen in higher layoffs and unemployment.

Smaller companies rope bigger gains while tech stumbles

Lower interest rates usually indicate positive news for the economy and the stock markets as borrowing costs decrease for companies and consumers, who are able to spend more.

The prospect of lower interest rates led to more than 400 companies in the S&P 500 rallying on Friday. The most significant rises came from areas and sectors seen as prime beneficiaries of lower rates – like the smaller company Russell 2000. Higher levels of borrowing are more common in smaller companies than larger ones. Smaller companies are also more dependent on borrowings as a way of growing their business and, as a result, will gain from a lower debt burden. Another key beneficiary is the financial sector, including banks.

The real estate (property), energy and materials (commodities) companies-led sector returns in the S&P 500. However, two sectors lagged: tech and communication services – but both these sectors are high value and have been performing strongly as of late.

The buck just got bucked

Contrasting with the stock market performance was the weakening of the US dollar as the possibility of lower interest rates was put forward. Bond yields fell and prices increased. Risks of a weaker currency means that imports get more expensive, which fuels inflation further. On a more positive note, exports become a more attractive option, helping support businesses and bringing some balance to trade.

30 days in the market feels like 100 on the range

Lowering interest rates comes with risks. Before Powell made his speech, the Fixed Income Strategist at St. James’s Place, Greg Venizelos, commented:

“[Future effects of the tariffs] will be more disruptive than perhaps the markets think. Both inflationary and negative for growth.”

He goes on to warn of:

“… A certain exuberance, if not complacency, in markets.”

The Fed are due to meet on 17th September and announce their latest decision regarding interest rates. Currently, market data shows that there’s a 75% chance that they’ll decide to make a cut. But there are still reasons as to why the Fed may decide against cutting interest rates, even if it’s widely expected by investors. They include stubborn inflation readings (frequently described as ‘sticky’), a strong jobs report that indicates that the economy is performing well without the impact of further rate cuts, or a geopolitical shake-up that will result in an oil price increase. Any of these factors could give the Fed reason to stop and think, leading to a reversal of some of the moves that have been noticed in the markets.

Wealth Check

How can you reduce your Inheritance Tax bill?

Needless to say, death is an uncomfortable topic to discuss – and then you add finances into the conversation…

It’s therefore not surprising that a large number of people put their estate planning and Inheritance Tax (IHT) to the bottom of the priority list.

But regardless of the discomfort you may feel when it comes to death and taxes, there’s one thing we can all agree on: no one wants to pay more tax than they need to.

That’s where we can help! Here are three ways in which you can mitigate your IHT bill and can leave your loved ones more.

Begin giving money

In each tax year, you’re allowed to give up to £3,000 tax free – this is called your annual gifting exemption. And if you haven’t used your £3,000 gifting exemption from the previous tax year, you’re able to combine two years and give £6,000.

You can make as many small gifts worth up to £250 per person as you like – this is your small gifts exemption – with the proviso that you haven’t made other gifts to the same person. Once again, these exemptions apply for every tax year.

Moreover, if your child is getting married, you can gift £5,000 to them, £2,500 to a grandchild or great-grandchild and £1,000 to anyone else.

But you must remember, if you die before the seven years have passed and a gift is above your available IHT exemption, it becomes chargeable to IHT and tax may need to be paid. Fortunately, the rate of tax that applies to the gift over the allowance tapers off after three years, and this ranges from 40% to 0% (known as taper relief). If you’re considering making a larger gift, start your giving sooner rather than later to avoid the IHT seven-year rule.

Spare income? Turn it into gifts

Higher earners may wish to make more regular gifts from their disposable income. In tax terms, the ‘normal expenditure out of income exemption’. If you’ve got more income than you need to live on, gifting money more regularly is a good option.

You’ll need to prove to HMRC that you’re able to afford the payments and maintain a comfortable standard of living if you want it to help mitigate your eventual IHT bill.

You must ensure that you keep a record of the gifts you give; let your loved ones know where it is or give them a copy. If HMRC investigate the payments, this will help, whether it’s before or after you pass away.

Life assurance – sort it and write it in trust

An IHT-friendly option could also be to take out a life-assurance policy where the sum assured will cover your predicted IHT bill. This allows your family to be able to use the funds to cover the tax bill.

However, in order to enable this, the policy must be written in trust. The payout will then fall outside your estate for IHT purposes. Any premiums you pay into the policy are considered as a lifetime gift and can be covered under the ‘expenditure out of normal income’ rule or under your annual gifting exemption.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief generally depends on individual circumstances.

In the Picture

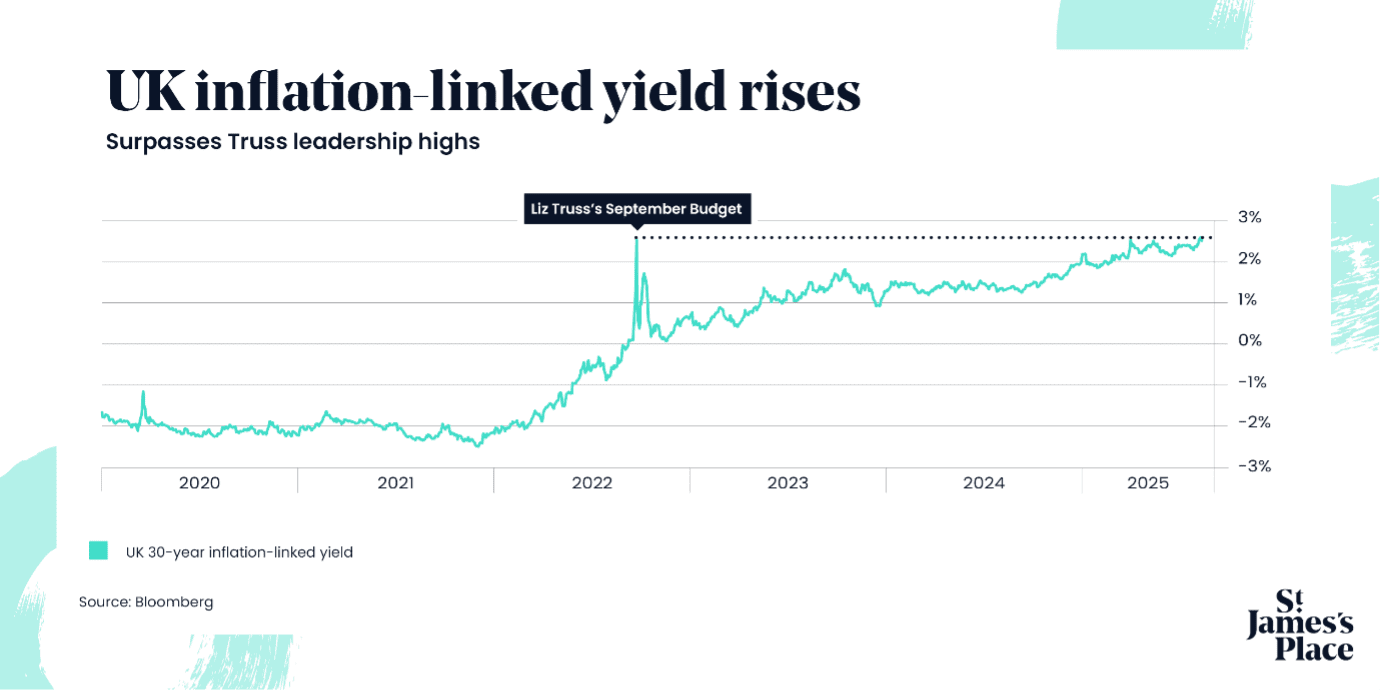

Weak growth, growing concerns surrounding inflation and interest rates as well as a general pessimistic outlook have all contributed to a rise in UK government bond yields over the last few years. In August alone, yields reached prices which were last seen under Liz Truss’ leadership – but this time with fewer headlines.

Increasingly expensive debt is quite the headache for the current government, as more money will need to be sourced to pay it down.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 26/08/2025