WeeklyWatch – Is it Europe’s time to shine?

1st July 2025

Stock Take

From the US to Europe

Financial news has been heavily focused on US equities as of late, but in the background, European equities have been performing impressively and are making their way into the spotlight. As a result, the question arises: is it time for investors to turn their attention to our neighbours?

The MSCI ex UK has risen by 7.90% in the year to date, while the S&P 500 only increased by 1% during this same time frame. The US’s underperformance has been intensified by far-reaching geopolitical volatility and the instability caused by President Trump’s tariff vacillations, and as a result, investors have moved away from US equities, or decreased holdings, instead turning their eyes to European stock markets.

However, these are not the only factors that are influencing investors’ decisions. In the fourth quarter of 2024, European companies posted strong corporate earnings. Additionally, the yield on European equities is higher than on US equities: 3.1% compared to the S&P 500’s 1.4%.

Back in March, the creation of a €500 billion (£420 billion) defence and infrastructure fund was approved by German politicians. And at the start of June, NATO leaders agreed that by 2035, defence spending was to increase to 5% of the country’s economic output – reinforcing the strength of the defence sector if met.

It comes as little surprise that industrials (defence) is a key sector that’s driving the positive returns on European equities. There has also been strong performance from financials (banks), communication services (telcos) and utilities and construction materials (e.g. cement).

Another attraction – valuations and returns

European equities continue to impress investors and surpass US equities through their average valuations, which are significantly lower than those of the US.

The Head of Equities at St. James’s Place, James Courtman, highlights that at the start of 2025, European equities were trading at their largest valuation discount to the US in at least 20 years. Even with the recent outperformance, they remain at a large discount, although in absolute terms, they’re not extremely cheap.

Courtman adds:

“Lower starting valuations tend to correlate with high future returns. Significantly lower valuations in Europe suggest the market is already pricing in a less positive outlook for European equities.

“Another way to think about this is that European markets are more ‘fragile’ to incrementally positive developments. In contrast, US markets are pricing in less risk/more positive future expectations to a much greater extent and are thus more fragile to incrementally less positive developments.”

It’s always challenging to know which is the right or wrong approach – and to what extent – so the value of diversification for investors remains key.

He says:

“It makes sense for investors to have exposure to European equities as part of a diversified portfolio. We have a positive asset allocation view on European equities within the equity component of our multi asset funds and many of our active managers are finding attractive investment opportunities in Europe.”

Which is best? A US or European approach?

Negative sentiment towards the US in recent months has benefited European equities. Investor surveys have revealed a shift away from the US and more of a focus on other international markets, including Europe.

Even though European equities have started 2025 strongly, it’s still too soon to disregard the US market. Longer term, European equities have underperformed US equities – and by quite a large margin. US markets are traditionally prominent, driven by strong US exceptionalism that’s largely led by the size and returns of the Magnificent Seven dominating the market.

Even though there’s been strong investor enthusiasm for European equities lately, Courtman cautions:

“It usually takes a material and prolonged reversal of performance for investor behaviour to change meaningfully, in terms of shifting their portfolio exposures.”

Last week alone demonstrates the importance of ‘shutting out the noise’: US markets reached record highs and another 3.4% was added to the S&P 500, hitting 6,173.07 on Friday – its first new record high since the middle of February. In addition, the NASDAQ reached new record levels following progressive trade talks between the US and China. There was also a de-escalation of tensions in the Middle East.

Europe avoiding tariff turmoil?

Another factor to keep in mind is that the EU haven’t signed any major trade deals with the US. But given the unpredictability of the ongoing tariffs, Courtman emphasises “tuning out from the noise”.

He states:

“There is always a geopolitical or macroeconomic issue grabbing headlines – it is by and large impossible to predict how it will evolve, what the implications will be and how markets will react given their complex adaptive nature. Over the long term it tends not to be as important as it seems in the moment.”

Markets further afield and at home

It was a strong bounce back for Japanese markets, with the Nikkei 225 increasing by 4.6% (in yen terms) – the index’s technology stocks were among the best performers.

In China, the Shanghai Composite went up by 1.9% (local currency) as result of the positive trade actions with the US.

And finally, in the UK, equities had a quieter time with the FTSE 100 ending the week only 0.3% higher.

Wealth Check

A year of uncertainty

We’re only halfway through the year, and it’s already been an eventful one! From tumultuous US tariffs and the Middle East nearing the brink of war, the world’s events have been unpredictable to say the least.

Investment markets don’t respond well to uncertainty, and there’s been quite the escalation of instability in equity markets in 2025.

As an investor, what should I do?

The Head of Research at St. James’s Place, Joe Wiggins, says:

“The chances of people making really bad decisions in these types of environments is high.”

During times of geopolitical risk, when uncertainty is running high, the following key questions serve as a reminder to avoid an emotional response:

- Are you confident in predicting the result of the current situation?

- Can the financial market implications be predicted from the result?

- Will any financial market impacts be material over long-term investing?

- Are portfolios diversified enough to accommodate a range of different results?

- Have investment objectives had to change because of the uncertainty?

Easier said than done, we know. It’s highly challenging to know how and when geopolitical tensions will resolve. The need to remain humble about our investment edge is key. It can’t be found in trying to guess the actions of numerous parties in a complicated geopolitical situation.

No one can be certain in their predictions. In similar fashion, the financial markets reactions are incredibly hard to determine. Macroeconomic or idiosyncratic factors could influence market movements across different asset classes.

Additionally, it’s worth remembering that the investment horizon is long term in nature, and the market impacts that happen during this time are unlikely to be material. History repeatedly shows us that these kinds of events usually carry a short-term influence.

The current high levels of political uncertainty concerning trade, tariffs and fiscal policy underscore the importance of diversifying portfolios to reinforce resilience. This should remain a focus point, and it aligns with our long-term investment horizon – our investment objectives are unchanged.

Wiggins adds:

“The temptation to try and predict outcomes or to overstate the importance of what’s happening from a financial market is high at times like this. Instead, this is a time to have cool heads.”

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

In the Picture

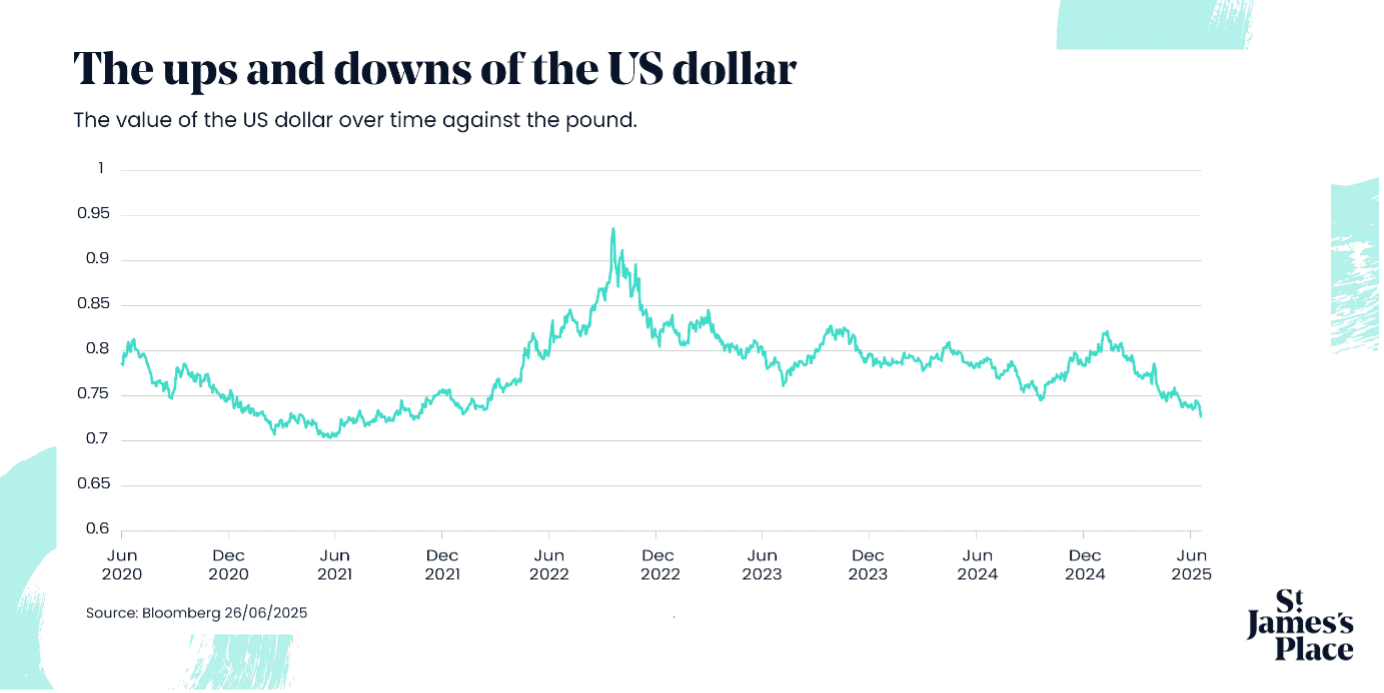

The dollar has hit a three-year low – what impact does this have on you?

In the first six months of 2025, there’s been unpredictable policy changes, economic nerves and tariff debates – all of which have resulted in the pushing down of the dollar to levels last seen in 2022.

If America is part of your upcoming travel plans, you may find that your money will go further than you were anticipating, and imports from the US will be cheaper. As for the US, items made outside the country will be more expensive; however, export prices may be more attractive.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 30/06/2025