WeeklyWatch – Are Japanese interest rates climbing?

9th December 2025

Stock Take

Sell-off initiated after BoJ governor comments

Needless to say, the governor of the Bank of Japan (BoJ) carries a lot of influence. And when he speaks, markets move. Kazuo Ueda’s latest comments hinted at a possible further rise for Japanese interest rates which resulted in an increase in bond yields (and a fall in their prices) in the US and UK, and a decline in global stock markets.

So why does the notion of higher Japanese interest rates rattle the global markets? Let’s take a closer look.

Negative Japanese interest rates – investors are a fan

Japan’s economy is the fourth largest in the world but has battled with low domestic consumer confidence and weak demand for several years. The result: falling prices, also known as deflation. Cutting interest rates was the BoJ’s solution to reverse this, with the hope that domestic consumers would spend more on goods and services rather than watch their savings lose more value.

The low, sometimes negative, interest rate environment was an advantage to overseas investors, who began to borrow yen and convert it into US dollars or euros. They then purchased higher yielding assets overseas, like US Treasuries, which delivered returns of 3% to 4%, as well as shares.

This relatively low-risk investing strategy is called yen carry trade. One way to compare it is using a cheap Japanese mortgage to buy a more expensive rental yield property in the UK or US – this has been popular among international investors.

An unwinding in carry trade in 2024

In early 2024, the BoJ raised their interest rates for the first time in 17 years. In August of the same year, a more substantial hike followed, leading to a double-digit percentage sell-off for the Nikkei index. With higher interest rates, overseas investors needed to rapidly pay off their now more expensive yen loans which they did by selling some carry trade investments, meaning that these prices fell. Additionally, the higher rates boosted the value of the yen which made it more challenging for Japanese exporters as products were more expensive overseas.

The Head of Asia and Middle East Investment Advisory at St. James’s Place, Martin Hennecke, said:

“The sharp rise in the yields of Japanese government bonds (JGBs) in a relatively short period of time serves as a reminder of the risk of using leverage when investing, with the yen being one of the most popular carry trade currencies.

“Any advice on the use of leveraged strategies can be conflicted as it often results in large amounts invested. This in turn can often backfire badly in an adverse scenario. Investors enticed into this type of strategy by high future return projections based on ‘historical evidence’ should tread very carefully. Financial markets can be more unpredictable than we would like to think.”

No historical repeats, but familiar patterns

At the beginning of the week, after realising the possibility of higher Japanese interest rates, global bond and share markets sold off. 10-year JGB yields now sit at their highest level since mid-2008. Japanese investors who’ve invested in US bonds are facing the temptation to sell their US Treasuries and repatriate funds to purchase JGBs.

Why is this important? Japanese investors are the largest buyers of US Treasuries. If fewer purchases are made, there’s a fall in price for US Treasuries, and yields rise to compensate. For the US federal government, this isn’t good news… They’re forced to pay a higher interest rate on the debt that is regularly re-financed. Their figures forecast that these interest payments will be $1.2 trillion in 2025 on the national debt, which is $37.6 trillion. Both sides have agreed that this option is unsustainable, but the rises continue.

Summarising global market activity

The BoJ comments created rather a weak beginning to the week, but despite this, US stock markets ended the period higher – the S&P 500 was less than 1% below its record closing high. And the remaining S&P 493 were outperformed by the tech-centred Magnificent 7.

Investor sentiment towards AI remains upbeat, and hopes are fuelled by the expectation of a 0.25% interest rate cut tomorrow (10th December) from the US central bank, with potentially more to come in 2026. This will come as positive news for interest-rate-sensitive sectors and smaller companies as they often have higher levels of debt.

With the prospect of lower interest rates on the horizon, there was an easing on the US dollar. As a result, this makes gold (which is priced in dollars) cheaper for buyers using alternative currencies like the euro or yen. By the end of the week, gold had closed around 4% below its recent record high.

Across Europe, shares ended higher. And in Asia, there was a rallying for Japanese shares after a weak Monday, finishing almost 1% up. Additionally, shares also increased in China, where sentiment is underpinned by tech and AI themes.

Wealth Check

The gift that keeps on…taking

A freedom of information request has revealed that hefty Inheritance Tax (IHT) bills are becoming a reality for thousands of households in the UK, after falling foul of the seven-year rule on gifting.

More than 14,000 families are being asked to pay tax by HMRC after receiving gifts from relatives who have passed away within seven years of leaving their assets. The bills range in amount – some families are facing payments of millions of pounds.

Gifts that are over the £3,000 annual gift allowance become part of the person’s estate, meaning the recipient can become liable to pay IHT on them. IHT levied on gifts is charged on a sliding scale and is dependent on when the person passed away. If the person passed away more than seven years after issuing the gift, then no IHT needs to be paid.

As it stands, people can leave an estate worth up to £325,000 without recipients needing to pay IHT – known as the nil-rate band. This increases to £500,000 if a property is left to a direct descendent and the estate is valued at less than £2 million.

In April 2027, pension pots will become part of a person’s estate and therefore susceptible to IHT. Thus, more estates are likely to be pushed over the tax thresholds, meaning that more families and individuals will face IHT bills.

In recent years, HMRC have noticed more gross IHT receipts, with inflation pushing up asset prices. Between April and October of 2025, IHT receipts totalled £5.14 billion, an increase of £3.8 billion compared with the same period last year.1

Do you have any questions about IHT and how it could affect you and your loved ones? Our expert advisers are able to evaluate your finances and help you plan the best way forward to help mitigate these costs.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief depends on individual circumstances.

Source

1HMRC tax receipts and National Insurance contributions for the UK (monthly bulletin) – gov.uk

In the Picture

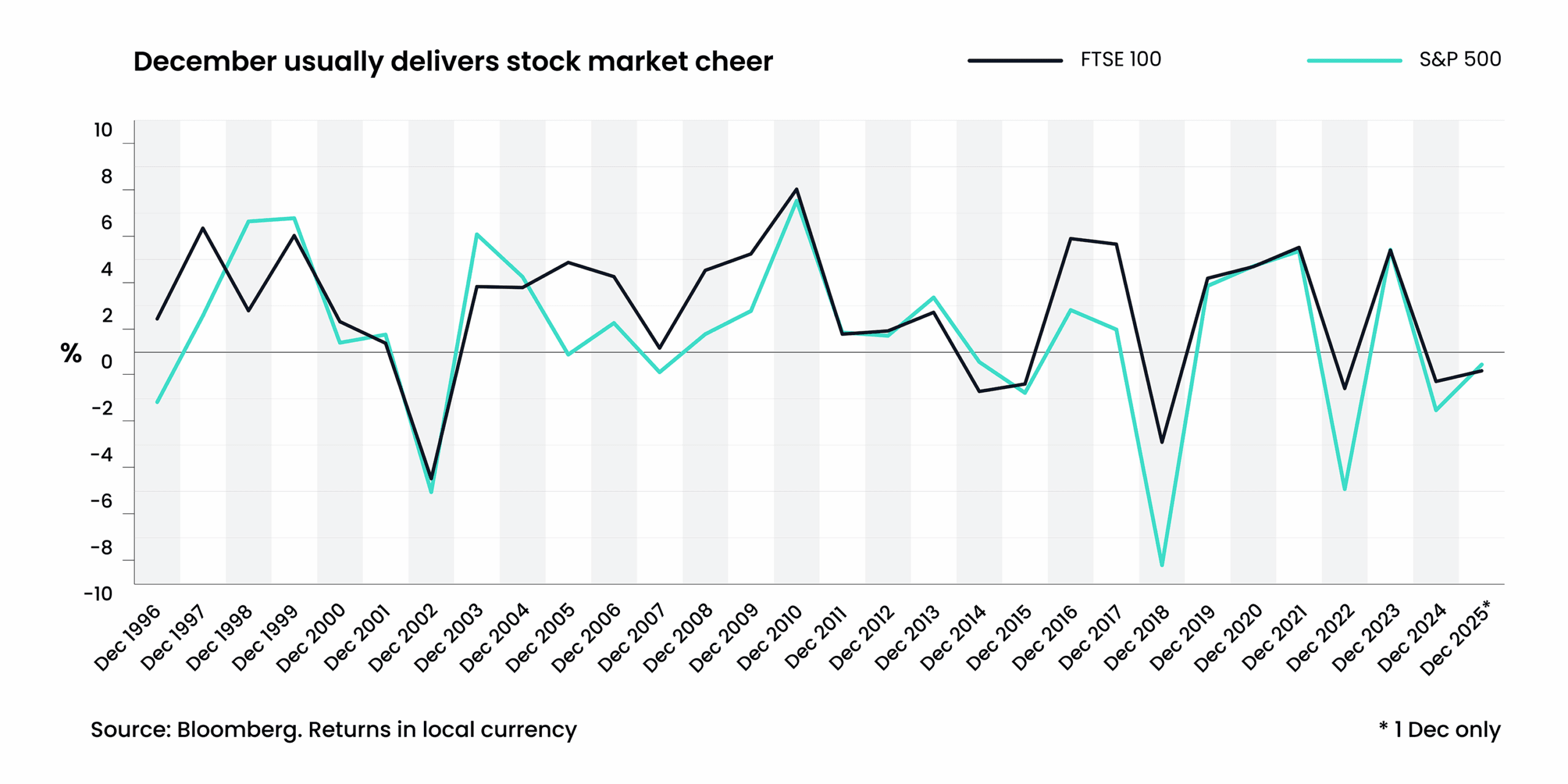

For monthly stock market returns, December usually delivers some of the best! With the new year approaching, investor sentiment tends to be more upbeat or ‘bullish’. And with many market participants away on holiday, trading volumes are lower. What this means is that fewer purchases are required to deliver a positive effect on performance.

Over in the US, technical moves like selling underperforming shares for tax purposes and reinvesting proceeds also contribute to this upbeat yearly conclusion.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 08/12/2025