WeeklyWatch – Is it Europe’s time to shine?

1st July 2025

Stock Take

From the US to Europe

Financial news has been heavily focused on US equities as of late, but in the background, European equities have been performing impressively and are making their way into the spotlight. As a result, the question arises: is it time for investors to turn their attention to our neighbours?

The MSCI ex UK has risen by 7.90% in the year to date, while the S&P 500 only increased by 1% during this same time frame. The US’s underperformance has been intensified by far-reaching geopolitical volatility and the instability caused by President Trump’s tariff vacillations, and as a result, investors have moved away from US equities, or decreased holdings, instead turning their eyes to European stock markets.

However, these are not the only factors that are influencing investors’ decisions. In the fourth quarter of 2024, European companies posted strong corporate earnings. Additionally, the yield on European equities is higher than on US equities: 3.1% compared to the S&P 500’s 1.4%.

Back in March, the creation of a €500 billion (£420 billion) defence and infrastructure fund was approved by German politicians. And at the start of June, NATO leaders agreed that by 2035, defence spending was to increase to 5% of the country’s economic output – reinforcing the strength of the defence sector if met.

It comes as little surprise that industrials (defence) is a key sector that’s driving the positive returns on European equities. There has also been strong performance from financials (banks), communication services (telcos) and utilities and construction materials (e.g. cement).

Another attraction – valuations and returns

European equities continue to impress investors and surpass US equities through their average valuations, which are significantly lower than those of the US.

The Head of Equities at St. James’s Place, James Courtman, highlights that at the start of 2025, European equities were trading at their largest valuation discount to the US in at least 20 years. Even with the recent outperformance, they remain at a large discount, although in absolute terms, they’re not extremely cheap.

Courtman adds:

“Lower starting valuations tend to correlate with high future returns. Significantly lower valuations in Europe suggest the market is already pricing in a less positive outlook for European equities.

“Another way to think about this is that European markets are more ‘fragile’ to incrementally positive developments. In contrast, US markets are pricing in less risk/more positive future expectations to a much greater extent and are thus more fragile to incrementally less positive developments.”

It’s always challenging to know which is the right or wrong approach – and to what extent – so the value of diversification for investors remains key.

He says:

“It makes sense for investors to have exposure to European equities as part of a diversified portfolio. We have a positive asset allocation view on European equities within the equity component of our multi asset funds and many of our active managers are finding attractive investment opportunities in Europe.”

Which is best? A US or European approach?

Negative sentiment towards the US in recent months has benefited European equities. Investor surveys have revealed a shift away from the US and more of a focus on other international markets, including Europe.

Even though European equities have started 2025 strongly, it’s still too soon to disregard the US market. Longer term, European equities have underperformed US equities – and by quite a large margin. US markets are traditionally prominent, driven by strong US exceptionalism that’s largely led by the size and returns of the Magnificent Seven dominating the market.

Even though there’s been strong investor enthusiasm for European equities lately, Courtman cautions:

“It usually takes a material and prolonged reversal of performance for investor behaviour to change meaningfully, in terms of shifting their portfolio exposures.”

Last week alone demonstrates the importance of ‘shutting out the noise’: US markets reached record highs and another 3.4% was added to the S&P 500, hitting 6,173.07 on Friday – its first new record high since the middle of February. In addition, the NASDAQ reached new record levels following progressive trade talks between the US and China. There was also a de-escalation of tensions in the Middle East.

Europe avoiding tariff turmoil?

Another factor to keep in mind is that the EU haven’t signed any major trade deals with the US. But given the unpredictability of the ongoing tariffs, Courtman emphasises “tuning out from the noise”.

He states:

“There is always a geopolitical or macroeconomic issue grabbing headlines – it is by and large impossible to predict how it will evolve, what the implications will be and how markets will react given their complex adaptive nature. Over the long term it tends not to be as important as it seems in the moment.”

Markets further afield and at home

It was a strong bounce back for Japanese markets, with the Nikkei 225 increasing by 4.6% (in yen terms) – the index’s technology stocks were among the best performers.

In China, the Shanghai Composite went up by 1.9% (local currency) as result of the positive trade actions with the US.

And finally, in the UK, equities had a quieter time with the FTSE 100 ending the week only 0.3% higher.

Wealth Check

A year of uncertainty

We’re only halfway through the year, and it’s already been an eventful one! From tumultuous US tariffs and the Middle East nearing the brink of war, the world’s events have been unpredictable to say the least.

Investment markets don’t respond well to uncertainty, and there’s been quite the escalation of instability in equity markets in 2025.

As an investor, what should I do?

The Head of Research at St. James’s Place, Joe Wiggins, says:

“The chances of people making really bad decisions in these types of environments is high.”

During times of geopolitical risk, when uncertainty is running high, the following key questions serve as a reminder to avoid an emotional response:

- Are you confident in predicting the result of the current situation?

- Can the financial market implications be predicted from the result?

- Will any financial market impacts be material over long-term investing?

- Are portfolios diversified enough to accommodate a range of different results?

- Have investment objectives had to change because of the uncertainty?

Easier said than done, we know. It’s highly challenging to know how and when geopolitical tensions will resolve. The need to remain humble about our investment edge is key. It can’t be found in trying to guess the actions of numerous parties in a complicated geopolitical situation.

No one can be certain in their predictions. In similar fashion, the financial markets reactions are incredibly hard to determine. Macroeconomic or idiosyncratic factors could influence market movements across different asset classes.

Additionally, it’s worth remembering that the investment horizon is long term in nature, and the market impacts that happen during this time are unlikely to be material. History repeatedly shows us that these kinds of events usually carry a short-term influence.

The current high levels of political uncertainty concerning trade, tariffs and fiscal policy underscore the importance of diversifying portfolios to reinforce resilience. This should remain a focus point, and it aligns with our long-term investment horizon – our investment objectives are unchanged.

Wiggins adds:

“The temptation to try and predict outcomes or to overstate the importance of what’s happening from a financial market is high at times like this. Instead, this is a time to have cool heads.”

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

In the Picture

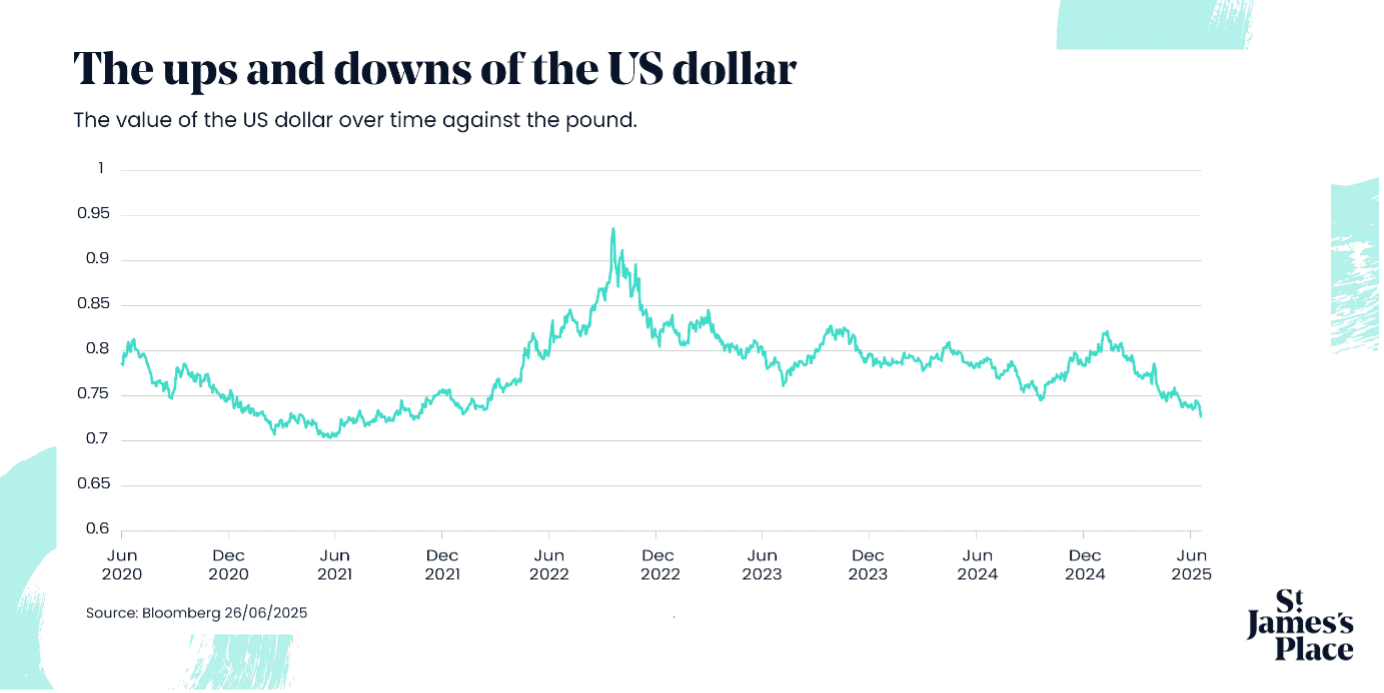

The dollar has hit a three-year low – what impact does this have on you?

In the first six months of 2025, there’s been unpredictable policy changes, economic nerves and tariff debates – all of which have resulted in the pushing down of the dollar to levels last seen in 2022.

If America is part of your upcoming travel plans, you may find that your money will go further than you were anticipating, and imports from the US will be cheaper. As for the US, items made outside the country will be more expensive; however, export prices may be more attractive.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 30/06/2025

Business Matters – Issue 43

We hope you like the new look and format of Business Matters – please spare 1 minute to let us know what you think. Take survey >

What’s your Plan B? Debunking 5 reasons why people don’t take out income protection

We can all see the logic of protection. We insure our cars, the contents of our homes and even our holidays and our pets almost as a matter of course. But have you considered protecting your most valuable asset: your income – and, by extension, your family’s quality of life?

Many financial advisers like to talk about the positive stuff with business owners – like extracting profit from your business, creating a solid exit plan and plotting how you’re going to enjoy that hard-earned retirement. But what happens if something happens before that end point?

While it’s uncomfortable to think about your business plans being derailed by illness – or worse – it’s vital to protect yourself, your business partners and your family from the unexpected. At Wellesley, we help our clients navigate these conversations, tackling those ‘What if…?’ questions proactively.

Mythbusting income protection

Only 6% of the working population have income protection.1 Here, we examine the biggest misconceptions that can put people off taking out income protection – and why they shouldn’t stand in your way. We also break down the key considerations for business owners and sole traders.

- “I don’t need income protection.”

If you value it, protect it.

It’s easy to be optimistic about your health and live by the mantra ‘it won’t happen to me’. But most people who find themselves unable to work due to illness or injury likely assumed it wouldn’t happen to them either.

Some avoid income protection because they believe the application and claims process is complex. Others assume their savings are the only safety net they need. But for business owners especially, personal and company finances are often intertwined.

Taking out income protection insurance might therefore stop you from having to dip into your savings, so you protect your future financial well-being too. It could even mean you don’t need to put money aside in an emergency cash fund either – so you could choose to invest that money instead in your pension or into a Junior ISA for the children.

- “Insurance is too expensive.”

You can’t put a price on peace of mind. Allocating a portion of your financial plan to protection is therefore both smart and strategic.

Rather than focusing on putting large amounts into your pension and concentrating on your exit planning, you could take an element of this funding towards protecting you and your family in case something happens in between now and exit/retirement.

That said, one element of the above myth is true – critical illness cover has become more expensive. As an alternative, consider income protection, which offers a similar outcome in a different manner: it doesn’t provide a lump sum but instead delivers ongoing income to help maintain financial commitments, including debt repayments.

- “I’m self-employed – I can’t get income protection.”

There are over 4 million self-employed people in the UK – none of whom receive employer sick pay or statutory sick pay.²

Being self employed doesn’t prevent you from taking out income protection – and it should be considered a crucial safety net. It can cover your personal income and ensure your fixed business expenses – such as rent, utilities and vehicle leases – are still paid if you’re unable to work. It safeguards both your lifestyle and your business continuity.

- “It won’t pay out.”

Scepticism around insurance is common, but the facts speak for themselves.

Between 2019 and 2023, major insurance provider Aviva paid out £5.37 billion in individual protection claims.² Remember, income protection is regulated by the Financial Conduct Authority and the Prudential Regulation Authority, which exist to ensure products work in consumers’ best interests.

- “It doesn’t cover pre-existing health conditions.”

Having a medical history doesn’t automatically exclude you from income protection. While cover may vary, many providers will offer policies with exclusions or adjusted premiums.

A good adviser will help you find the right provider – one that balances your needs, health profile and budget.

Protection considerations for limited company owners

Now we’ve debunked some common myths, let’s look at insurance options we often discuss with our clients.

There are a number of policies available to cover every kind of personal circumstance – and we’ve previously discussed shareholder protection, keyperson insurance, business wills and talking to your employees about protection. But have you considered Relevant Life Plans or Executive Income Protection?

Relevant Life Plan (RLP)

Ever had “death in service” benefits as part of a corporate package? An RLP offers similar protection, but for directors or key staff within a limited company – with significant tax advantages. Think of it like a mini death in service plan.

A RLP is a life assurance plan. The limited company takes out a policy on the individual that is then placed into a master discretionary trust for the individual’s chosen beneficiaries. These are extremely tax effective as they count as a business expense (rather than a personal cost), thus reducing Corporation Tax. It’s prudent to cover an amount that includes a pay-out to cover costs like clearing your mortgage upon death.

Contributions are not treated as a benefit in kind (P11D benefit) on the employee.

Executive income protection

Unlike individual income protection, this is where a limited company sets up executive income protection for an individual/individuals.

The advantage is that it takes out the cover and insures the individual or owner/director for their income (can be both PAYE + dividends), employer National Insurance contributions and pension contributions. For limited companies, it transforms a personal expense into a business deduction – a smart, tax-efficient move for owner-directors.

Protection considerations for sole traders

Sole traders don’t have the same business structure advantages – but they do have essential options.

Life cover

This is usually associated with covering a mortgage liability and can be on a decreasing, level or increasing benefit for a fixed term. They can be used to provide lump-sum death benefits for families or to cover Inheritance Tax liabilities in the shorter term.

Income protection

Pays a percentage of your income so you can continue to cover bills and outgoings if you’re unable to work or lose an income unexpectedly. You can choose the level and term of cover to suit you and your budget.

Critical illness cover

Pays out a lump sum if you suffer a specified illness such as a stroke, cancer or an event such as a heart attack.

Family income benefit

Pays income on death or terminal illness diagnosis to cover families on the death of a paren. It’s helpful for childcare costs or maintaining household expenses.

Protecting your future, as well as your present

No one can predict the future. But you can prepare for it.

Whether you’re a sole trader or managing a growing business, protection provides peace of mind. It ensures that your income, family and long-term plans are safeguarded – even in worst-case scenarios.

Your individual circumstances will always dictate what kind of protection is most suited to you and your business. That’s where professional financial advice comes into its own – so you can be sure you have the right insurance for your needs, helping to ensure a brighter and more secure future.

So, what’s your Plan B?

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

Trusts are not regulated by the Financial Conduct Authority.

SJP Approved XX/XX/XXXX

Sources:

1Financial Conduct Authority Financial Lives Survey (2022).

2Ipse, the self-employed landscape in 2023, accessed April 2024.

3Individual Protection Claims Report 2023, Aviva, May 2023 (Based on 50,600 claims).

WeeklyWatch – Markets march on despite Middle East flare-up

24th June 2025

Stock Take

US enters the Iran–Israel fray

Tension in the Middle East continues to ramp up. Despite his two-week deadline rhetoric, it took just two days for President Trump to push the button on a bombing campaign across three nuclear sites in Iran. Unsurprisingly, oil prices spiked as a result, although the market reactions have been muted (so far). But what does US involvement in Iran mean for investors going forward?

Oil, inflation and GDP

After a turbulent few days, the escalation of geopolitical hostilities is raising many questions. The movement of oil prices continues to be a key issue. In the past two weeks, the price has soared by around 20%. Since the Middle East conflict started, the price of a barrel of Brent crude oil has jumped from the mid to low US$60s to over US$81, before settling at around US$78 on Monday.

St. James’s Place’s Chief Economist, Hetal Mehta, says:

“While this increase brings oil prices back to where they were last summer, the sharpness of the move is the key concern, as well as what lies ahead.

“There are various estimates of what the oil price increase does to GDP and inflation. From a US perspective, if this price level is maintained for several weeks, it could add 0.4% to 0–5% on CPI inflation. That is notable in the current context of the US Federal Reserve trying to bring down inflation and amid tariff uncertainty.”

However, at the time of writing, the announcement of a ceasefire between Israel and Iran has resulted in an immediate drop in oil prices.

Looking at the implications for the UK, Mehta points out that even though the weekend surge in the price of oil only moved up to levels seen earlier in the year, “it’s the change that matters – particularly for the UK”. She explains:

“There are different views on this, but generally you’re looking at a drop of a couple of tenths of GDP for a 10% increase in oil prices. No one knows what’s going to happen in the current situation, but when you get these flare-ups, it’s not uncommon for the oil price to go up 50–100%. If the oil price went up 100%, then you can probably take around 2% off UK GDP growth, which would put it firmly into recession territory.”

Dire straights

As well as the oil market being in turmoil, there’s also the possibility of disruption to global supply if Iran retaliates by blocking the Strait of Hormuz. This vital shipping route supports around one-fifth of the world’s oil shipments. If it were to be closed, it could have a huge potential economic impact.

Mehta says the situation in the Strait of Hormuz is a key current consideration for markets and economists. The US has reportedly asked China to put pressure on Iran to avoid any move to close the waterway, but the situation is still uncertain.

Looking ahead

Despite the worrying escalation in the Middle East conflict and fears of what is to come, so far the impact has been “relatively contained”, says Mehta. She continues:

“When you look at the markets, they have been relatively calm following the news of the US bombing of Iran. For example, there has been little reaction from gilt markets. This suggests markets are waiting to see what happens next. There is an upside risk to inflation from the situation and there are potential stresses on the horizon. However, it is too soon to predict economic outcomes with any real certainty.”

The Chief Investment Officer at St. James’s Place, Justin Onuekwusi, agrees:

“We are paying attention and are reassured by our existing stance on resilience across our portfolios. There are macro clouds on the horizon. The price of oil, the impact the Middle East turmoil may have on inflation, stagflation and global trade are areas of concern we are watching. But for now, it’s important not to react and to focus on the long-term. We continue to emphasise portfolio resilience.”

Robin Ellis, Director of Portfolio Management at St. James’s Place, says:

“Our portfolio construction process is built upon a principle of diversification across asset class, geography, sector and region. Through our research, we look to build further resilience, which means broadening the environments within which the portfolios can perform; our aim is to perform well in environments we think are likely, but avoid performing poorly in environments we deem less likely.”

Market snapshot

The FTSE 100 shed -0.9%, while the FTSE 250 dipped just -0.1%. The pound’s recent strength has weighed down the former – given that the bulk of FTSE 100 earnings are generated overseas – but supported the latter, given the domestic-orientated natures of the companies listed on the index.

Across Europe, the MSCI Europe ex-UK index fell by -1.6% in local currency. In Asia, returns were mixed. Japan’s Nikkei 225 rose +1.5%, while China’s Shanghai Composite dropped -0.5% (both in local currency). Chinese stocks faced pressure following weaker industrial output last month, although recent retail activity showed signs of improvement.

The UK outlook

The Bank of England held interest rates steady last week, as did the Fed. However, the developments in the Middle East add new uncertainty for investors. Rising energy costs tend to push up UK inflation relatively quickly – so policymakers will be closely monitoring oil prices.

The latest data from the Office for National Statistics (ONS) showed the UK inflation rate at 3.4% in May, the same rate as April. Within that, services inflation – previously a persistent pressure point – eased to 4.7%, down from 5.4%. However, inflation in food, non-alcoholic drinks, furniture and household goods edged higher.

Retail sales were weaker, falling 2.7% in May, with food shops being particularly hard hit. According to the ONS:

“The fall was mainly because of reduced sales volumes in supermarkets, with retailer comments talking of inflation and customer cutbacks, alongside reduced sales of alcohol and tobacco products.”

On a similar note, data company GfK found consumer confidence improved slightly in May. But this survey predated the latest geopolitical flare-up, which could affect sentiment moving forward. Confidence also remains significantly lower than during the same period a year ago.

Wealth Check

Greater volatility, greater opportunities?

An increasingly uncertain world, geopolitical tension and one of the most influential powers led by a president who seems determined to be unpredictable – it’s a recipe for market volatility.

Howard Marks, co-founder and co-chair of one of St. James’s Place’s specialist external fund managers, Oaktree Capital, discusses this unusually high uncertainty and the implications of markets responding to this.

Looking back at tariff turbulence

Despite the recent escalation, the global uncertainty didn’t start in the summer. Market shifts around the US tariff announcements have dominated the headlines (and WeeklyWatch!) over the past five months.

Following the so-called Liberation Day announcements, Marks shared a note with his own investors highlighting the impact of the tariffs, saying:

“All norms have been overthrown. The way world trade has operated for the last 80 years may be of little relevance to the future. The impact on economies and the world at large is entirely unpredictable. We’re faced with large-scale decisions, yet again there are no facts or prior experiences on which to base those decisions.”

Finding value amid uncertainty

Despite this backdrop, Marks remains optimistic about the value bonds have for investors – particularly sub-investment grade corporate bonds. He acknowledges the risk of defaults (companies not paying back their debt) has increased – particularly in an environment of rising interest rates, which make it difficult to repay loans during tough economic times. However, he believes the yields now available compensate for that risk. He said in a recent conversation with St. James’s Place CIO, Justin Onuekwusi:

“If you can get annual returns of around 6–8% a year in today’s market, with the kind of uncertainty we face, that’s great.”

He reminds investors that the core appeal of bonds lies in their predictability – hence the term ‘fixed income’. You know exactly the return you’ll get (yield) if they keep their promise to pay back your money at a specified date. Companies with debt rated as sub-investment grade (i.e. high yield, meaning they are rated as riskier than others regarding defaulting) pay even more as an incentive. And even though the promise of a high-yield company is less ironclad, the returns they offer in exchange for that uncertainty remain attractive.

Perspective and patience

Describing risk tolerance as “how much volatility can you stomach”, Marks says investors should tune out the daily noise that often drives markets. Describing his own investment philosophy, he says he tries to think about what the right thing is today for a future he can’t see.

“Yesterday’s solution may not be the same as tomorrow. My job is to position capital to benefit from future events and yet we can’t predict the future.”

Some of the strongest emotions felt by investors are envy and FOMO (fear of missing out), Marks points out in an interview with St. James’s Place’s Director of Portfolio Management, Robin Ellis:

“How can you be a good investor if you let those feelings control your decision-making? The most important thing is not to get it right but to be steady and stay with it – it’s not about timing the market but time in the market that makes the difference.”

Marks concludes on the point that while investors are looking at returns over shorter and shorter time frames, it’s still the long term that matters most.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

An investment in equities and shares will not provide the security of capital associated with a deposit account with a bank or building society.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 16/06/2025

WeeklyWatch – Oil, gold and conflict

17th June 2025

Stock Take

Oil impacted by conflict

Investors were enjoying a relatively positive week…until Thursday night. Israel carried out a ‘pre-emptive strike’ on Iran, which has initiated an intense exchange of missile fire, resulting in a dramatic increase in oil and gold prices. Equities, on the other hand, moved in the opposite direction.

Since Trump was sworn into office in January, oil prices have been quite subdued, even in the face of the Republican mantra: “drill, baby, drill.”

However, in the immediate hours after the first airstrike, the price of Brent crude soared over 10% to US $78, eventually settling in the US $74 range, while the market assessed the potential widespread impact.

While the level remains below the US $80 level prices that were reached in January, it’s a significant increase on the $60 oil that was being traded in May. There has since been warning from analysts that prices could reach US $120 if Middle East tensions get worse.

Only once has Brent crude reached US $120 and this was back in 2022 following the Russian invasion of Ukraine, and China easing their COVID-19 restrictions.

Geopolitical uncertainty often leaves oil prices vulnerable to instability. Where events can impact the supply or economic growth is likely to increase, the price of oil will typically rise.

Oil prices can also have a mixed impact on equity markets. Energy companies usually find that higher oil prices lead to greater returns. But for other companies, higher energy prices can result in further costs which reduce their profits and opportunities for investments.

Another possible side effect of higher oil prices is higher levels of inflation. The Chief Economist at St. James’s Place, Hetal Mehta, says:

“Other recent flare-ups in the Middle East haven’t really moved oil prices so much. This time it looks like that might be different. Coming at a time when countries are still battling inflation, this is something to keep an eye on. Doubly so in the UK, where oil price increases tend to pass through to inflation relatively quickly.”

Bold gold – prices shoot up further

Despite already being high in price, the strike has also caused a spike on the price of gold. Over the last few years, numerous countries have been doing their best to stock up on the precious metal as a form of reserve.

Earlier in June, it was revealed by the European Central Bank (ECB) that gold had overtaken the euro as the world’s second largest reserve asset (after the dollar) in 2024. This has come about as a result of governments looking to gold as political uncertainty prevails.

As central banks acquired more gold, its price increased by more than 30%, in nominal terms, over the course of the year, and the trend continued into the first quarter of this year. But over recent months it’s fallen.

The ECB notes that an increase in financial sanctions being imposed has spurred on gold buying by particular governments:

“Recent research indicates that imposing financial sanctions is associated with increases in the share of central bank reserves held in gold. Notably, in five of the ten largest annual increases in the share of gold in foreign reserves since 1999, the countries involved faced sanctions in the same year or the previous year.”

UK figures make for mixed reading

The FTSE 100 suffered a small dent on Friday as a result of the conflict in the Middle East, following a historic high on the Thursday.

The high happened despite the Office for National Statistics (ONS) revealing that the UK GDP shrank by 0.3% in April, significantly more than the 0.1% that was widely expected by economists. New tax rises for employers that began in April have been pinpointed as partly responsible for the GDP drop.

Despite this, the fall followed a fairly strong first three months of 2025, which means that the British economy is larger than it was at the start of the year. Additionally, the FTSE 100 finished the week up 0.14%.

While the immediate impact of the conflict in the Middle East has been slightly more muted in the UK, Israel’s increased tensions with Iran caused a leap in the shares of large energy and defence companies, which are well-represented in the index.

US equities and trade deal positivity dimmed by Middle East conflict

After finally reaching a trade deal with China, things started to look up for the US, but their equities didn’t continue in the same positive manner. After rising over the first four days of the week, gains took a big hit, almost being reversed on Friday, resulting in the S&P 500 and NASDAQ finishing the week in negative territory.

Despite geopolitical tensions appearing to improve with the above deal, conversation at the end of the week was being dominated and determined by developments in the Middle East.

Wealth Check

Labour’s Spending Review – are wealth taxes on the horizon?

The first Spending Review for Labour in 18 years… It’s been long awaited yet contained few surprises.

It included major pledges such as £113 billion in capital funding for infrastructure projects. In total, the government has committed to £300 billion in future spending.

Some of the standout recipients include the Department of Health, which received a £29 billion boost, laying the groundwork of the NHS 10-year plan, for which we’re expecting published details soon.

Other beneficiaries include energy infrastructure, which will benefit from substantial capital investment, including in nuclear. And defence spending will have an £11 billion increase. But, unsurprisingly, the headline grabber has been Chancellor Rachel Reeves’ reinstatement of the Winter Fuel Allowance.

But how much will this review shape the Autumn Budget?

The economic influences

In regards to economic outlook, it’s not looking particularly bright for the UK… Inflation is sticky – that is to say, higher than expected. Growth is at risk from, particularly, both the US tariffs and ongoing conflict in the Middle East. And with the rise of gilt yields, government borrowing has also increased.

The Chief Investment Officer at St. James’s Place, Justin Onuekwusi, says:

“Despite a strong start to the year, we expect the UK economy will likely slow down through the rest of the year due to weakening business sentiment and the impact of tax increases in increased employer contribution implemented in April.

“We remain concerned about inflation and believe it is likely to remain inflated. Services inflation is still running at over 5% and despite some softening in the labour market, pay growth remains stubbornly high.

“Though the review mainly allocates existing funds, ongoing public spending pressures suggest future borrowing and possible tax rises.”

The Autumn Budget starts to loom

The Office for Budget Responsibility’s forecast in the autumn will be required to address these issues. Additionally, other governmental policy initiatives like changes to immigration will need to be factored in.

The Chancellor is also likely to face pressure from Labour to increase spending in the Autumn Budget.

As part of their election manifesto, Labour said no to increases to income tax, employee National Insurance contribution and VAT. However, there are other levers they can pull. It’s been estimated that the government could levy taxes of around £15 billion without crossing red lines, but by doing this, they leave little room for significant spending commitments. This leads experts to believe that tax rises could be on their way.

What’s down the line?

Numerous tax-rising measures have been speculated on including extending the freeze in personal tax thresholds beyond April 2028, which may raise around £7 billion per annum.

More measures to limit tax avoidance may be put into place and changes to property taxation are possible. This could be an additional band on council tax or increases to existing higher bands to raise up to £2 billion.

There’s been additional speculation surrounding the lifetime allowance on pensions and addressing salary sacrifice arrangements. But both these measures would be challenging to implement and would likely cause sector-specific problems, particularly for the NHS.

The Advice Divisional Director, Claire Trott, says:

“Salary sacrifice arrangements offer valuable National Insurance (NI) savings for both employers and employees, so any changes would be unwelcome, especially in light of the increase to employers’ NI earlier this year.

“Introducing further changes to pension taxation also risks undermining pensions as a long-term savings vehicle. With other changes to the pension system on the horizon, there is a danger that these alterations could cause even more confusion and savers could become more disengaged with pensions – which is especially worrying as individuals have increasing responsibility to plan and save for their retirement.”

Updates to ISAs are also likely to feature in the Autumn Budget. The Treasury is looking to encourage more investment in UK markets. A frequent suggestion refers to the cap on cash ISAs with the belief that people will invest more in equities than in an ISA.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

An investment in a stocks and shares ISA will not provide the same security of capital associated with a cash ISA.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

Please note that cash ISAs are not available through St. James’s Place.

In the Picture

UK GDP contracted by 0.3% in April…not happy reading for Chancellor Rachel Reeves.

Having said this, if we look at the figure over a longer timeline, it’s placed in better context. Growth levels since COVID-19 haven’t necessarily been strong, but the figure still remains above pre-pandemic levels.

The economy remains ahead of where it started the year thanks to good growth in the first quarter of 2025.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 16/06/2025

WeeklyWatch – Is it a bond farewell for investors?

10th June 2025

Stock Take

Bonds are no longer the boring bet

There once was a time when bonds were perceived as safe albeit dull – regarded as good ballast to diversify investment portfolios but not likely to cause any major excitement in the markets.

Alas, those times are long gone. Recently, there’s been an increase in volatility in bond markets, which has given rise to the question: how and where is best to invest?

Is it One Big Beautiful Bill?

President Trump’s tariff wars have caused ongoing market volatility, resulting in more fluctuation in the bond markets over recent months. But Trump’s One Big Beautiful Bill Act (OBBBA) has resulted in the bond yields moving higher yet again. The bill was recently passed by the US House of Representatives and is expected to add a further $2.7 trillion to the already huge deficit of approximately $36 trillion over the course of the next decade.

As the US deficit increases, the US government will be required to spend more to service it. This will lead to higher borrowing costs as investors will regard US treasuries as having an increased risk and will expect a higher yield.

This has proven true with a sharp increase in the yields on longer-duration treasuries of 10 years or more. Over the last few weeks, these reached 5% and then fell back. However, this isn’t just the case in the US. There’s been a rise in yields on longer-term UK gilts, and Japanese government bonds (JGBs) hit yield highs during the same period.

Earlier in the month, the CEO of JP Morgan Chase, Jamie Dimon, warned that if the US doesn’t bring down its record debt levels then the bond market was in “danger of cracking”.

Low appeal for long-term bonds

While some investors believe the higher yields are an investment opportunity, others are voting with their feet and choosing to move away from longer-term bonds.

Last month, Japan auctioned off 20-year government bonds, which was met with little enthusiasm and demand. A subsequent US auction of 20-year treasuries was met with a similar response from investors. In the meantime, the UK is issuing more short-duration gilts due to low levels of interest in 30-year gilts.

The Fixed Income Strategist at St. James’s Place, Greg Venizelos, says:

“Longer-duration bonds are challenging because we get so much noise and movement, even if yields ultimately don’t rise that much.

“The volatility on its own undermines the attractiveness of being at that end of the curve, as we say. And of course, the US treasury market is a massive market, as Jamie Dimon has flagged.”

Venizelos also notes that it’s not just the long-term bonds that have seen yields rise, the same applies to short-term bonds. He indicates that while movement at the long end is as a result of fiscal concerns and fear surrounding debt sustainability, the tariff disturbance is creating short-term inflation issues at the short end.

Consequently, mid-term bonds are more in demand. They’re seen as lower risk than long-term bonds and offer incrementally more yield than short-term bonds.

Venizelos continues:

“This is sometimes described as the butterfly trade. As investors are trying to move away from the longer end of the curve, they come towards the belly, say between three and seven years. This is a lower risk to the long end and more value to the short end.”

There’s already been a dip in demand for US treasuries and there are indications that this fall could continue.

All markets have a global component, and if something happens to one market – particularly one as dominant and as influential as the US – it impacts on other markets. The Japanese government bond market (JGB) went through a regime change that has seen the yield on 30-year JGBs rise significantly. Venizelos notes that when comparing the two countries, the yield a Japanese investor would currently receive when buying JGBs is far more attractive than what they’d get in the equivalent treasury after foreign exchange hedging costs.

This doesn’t mean to say that Japanese investors will start selling US treasury holdings to purchase JGBs, but they might be more reluctant to buy treasuries. In terms of demand for the stock of treasuries that need to be refinanced, this is already significant.

Is a bond market implosion likely?

Dimon highlighted the threat to the US bond market – and consequently other bond markets – as a result of escalating US debt, so how likely is a bond market implosion? And do bond investors have cause for concern?

It’s undeniable that if all these factors come together, there’ll be a significant increase in pressure for global markets.

Venizelos goes on to say:

“If you get a major incident in the treasury market, there will be material spillovers to global risk, global appetite, stock markets, currencies and what happens to the dollar – everything can be affected.”

However, he does believe that Elon Musk and President Trump’s public spat could have a silver lining as it’s creating awareness of the likely cost of the OBBBA. A revision to the planned act may therefore be possible, which will ease pressure on the overall bond markets.

“I think more senators are getting cold feet about this so-called beautiful bill. The deficit is already big as a percentage by any standard and on the biggest economy out there. If the bill goes ahead, it may be getting out of control.

“Ultimately there needs to be more caution on what the US administration actually does rather than says. So, while it will pass something, it will hopefully be a lot more diluted.”

Equities on the up

Even though OBBBA has caused uncertainty, US equities maintained their recovery path. Last week, the NASDAQ and S&P 500 rose by 2.2% and 1.5% respectively.

For Europe, the MSCI Europe ex UK finished the week up 1.1%, following the European Central Bank’s vote to reduce rates by 0.25% to 2.0% to help encourage more economic growth. Inflation has been relatively benign across the continent, and the market is anticipating a further cut later in the year.

Additionally, the FTSE saw a 0.8% rise last week, continuing to push back towards the record level that it set earlier in the year.

Wealth Check

Providing your business with a solid foundation

Determining a practical governance framework is a must for every organisation and should be based on the structures and systems that suit them best. There’s no such thing as a ‘one size fits all’, off-the-shelf package when it comes to these matters.

Having said this, there are some core elements that can direct your thinking and help you create your own response:

- Business purpose – This might seem a bit obvious, but clearly articulating and sharing a perspective on the ‘purpose’ of an organisation is a key beginning point. This will help you clarify how you’re structured in order to deliver what your customers are asking for – within the context of broader societal needs and while resonating with your unique position and values.

- Leadership, the board and strategy – At the top of the organisation, you need strong leadership to propel the business forward. In addition, you must establish a well-balanced board who will set objectives and strategies, with the senior management team, that will steer the business to achieving their objectives.

- Risk management and internal control – A risk to your business is anything that will divert you from achieving the agreed objectives. This can manifest as negative threats or positive opportunities – both require a strategic focus. The control environment works to protect key assets, essential systems and daily operations. You must have internal controls in place, which are usually a combination of physical boundaries, human checks and balances, and tech-based routines.

- Culture, ethics and capability – In all areas of business, people are essential. This means that an appropriate culture needs to be established; this incorporates behaviours of the workforce and helps to reinforce pursuing the right thing. Additionally, there needs to be a strong effort to attract, nurture and keep people who are skilled and capable – all while maintaining an appropriate level of quality control.

- Structure, policies and procedures – In every organisation, the best structure to achieve optimal productivity needs to be determined. Smaller organisations can keep things simple, but as they grow, operations may become more complex, meaning that the structure will need to adapt and change as appropriate.

- Information systems and reporting routines – Businesses generate a wide range of data and information, which means that systems are required to capture, store and provide access to it. Usually, these processes are linked to reporting and communication routines. As the saying goes: “The right information is needed at the right time to make the right decisions.”

- Assurance and audit provision – In an organisation, there’s a lot of moving parts! And as businesses grow and develop, a ‘siloed’ mentality can creep in. Boards and senior management often benefit from feedback on how things are operating, so assurance activity in some form may need to be implemented. The job of external auditors is to cover the finance and accounting information of the business, but other areas may need an experienced specialist to assess the other aspects of the organisation every now and then.

- Compliance and stakeholder relations – All organisations must be compliant with legal and other related requirements. Size, sector, geography and customer or client interaction may determine some of these legalities – these areas must be frequently reviewed. All organisations have a wide range of ‘stakeholder groups’ – these are both internal and external and represent anyone with an interest in the organisation. Knowing who they are, what their expectations are and the best way to engage with them is highly important.

- Board procedures and oversight – The cycle of corporate governance is led by the board, which holds ultimate responsibility. As such, the board and its procedures are where the areas outlined above come together – the board should maintain oversight of day-to-day business operations.

- Annual reporting and disclosure – Having trust in an organisation is integral to good governance, and building trust happens with effective communication and reporting mechanisms. Reporting and disclosing of information must be fit for purpose. There are multiple ways to convey key messages and to have healthy dialogue, ensuring all interested parties can make informed decisions about the company. It’s important that you’re in control of your narrative and are able to tell your story.

What’s been summarised above should act as a cycle of activity that applies to your corporate existence rather than be a checklist. Success in these areas will boost confidence in expansion plans, further attracting, supporting and retaining customers, suppliers and a committed workforce.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 09/06/2025

WeeklyWatch – Could Asia help investors weather US markets?

3rd June 2025

Stock Take

Tariff twists and turns

Unfortunately, the trend of market uncertainty continues. Among the major news of the week was the US Court of International Trade’s decision to block Trump’s upcoming tariffs. The global markets welcomed this news and subsequently rallied. But less than 24 hours later, the tariff ban was paused by the US appeal court “until further notice”.

Despite the upheaval, the US S&P 500 still managed to record its best May in 30 years, indicating that Wall Street predicts that some relief on tariffs is on its way – but this can’t be certain. If the tariffs are imposed in full, or increased, there will be further upheaval for global markets, including the US.

As US markets continue to rise and US equities remain relatively expensive, could it be time for investors to turn their attention to further afield – perhaps towards Asian markets?

Is Asia a safer investment option?

Volatility is no stranger to the Asian markets either, evident through the ever-changing nature of the trade talks that are taking place between the US and China. Weeks after agreeing on tariffs, the relationship has broken down once again, leading President Trump to accuse China of “violating” the trade deal that was agreed on.

In the previous week, US Treasury Secretary Scott Bessent described trade talks between the two nations as “a bit stalled”. Both countries have been unable to agree on issues, including the production of chips and issuing visas. Additionally, there were further reports that the US are looking to put more restrictions on Chinese tech companies.

Despite this, there are still lots of investor opportunities for those looking to diversify or find better value, in the view of St. James’s Place Head of Investment Advisory, Asia & Middle East, Martin Hennecke. He looks to Jensen Huang, the CEO of Nvidia, and his talk of ‘formidable’ competition from China in the past week and China’s strong economic fundamentals:

“China’s industrial profit growth has been more resilient than expected, coming in at 3% year-on-year for the month of April. This is despite the tariff fallout.”

Even though consumer spending remains fairly weak, Chinese household bank deposits have seen a $10.6 trillion net increase over the past five years. This suggests that there’s a strong potential for a recovery in spending once spending confidence is stabilised.

Hennecke continues:

“If investors are overweight on US equities, and technology in particular, the recent strong rebound in US markets might be a good second chance to broaden out across other relatively discounted markets regionally.

“Investors could also think about different investment styles, such as balancing growth with value.”

What about Japan?

Japan has frequently featured in the news as of late. After struggling for decades with deflation, there’s been a sharp rise in inflation. In April, core inflation hit 3.5% in comparison to the previous year – the fastest rate of growth in two years.

This puts pressure on the government to increase interest rates and on Japanese government bonds, where there’s been a sharp increase in yields. Higher yields on bonds means that there are bigger borrowing costs for the government as a result, which could limit the Bank of Japan’s ability to increase interest as required. It can also mean that Japanese investors could pull money that’s held in the US to invest domestically instead. US markets could therefore see a knock-on effect, particularly in the tech sector, where over the last decade, Japan has been the largest foreign direct investor.

Japanese investors tend to be cash-heavy, but fears surrounding inflation rates exceeding deposit rates (effectively negative real interest rates) and the subsequent impact on purchasing power could result in a shift to equities.

Hennecke notes:

“As the Bank of Japan’s interest rate remains far lower than inflation, we might see Japanese households choosing to redeploy their large deposit holdings into other assets, possibly including domestic equities. This may help protect against inflation.”

There are further reasons to be positive about Japan. The Nikkei 225 rose by 2.2% last week, largely influenced by the optimism that Japan will secure a beneficial trade deal with the US.

The European and UK response

After the US Court of International Trade’s ruling on US tariffs, the markets unsurprisingly had a very positive response. The MSCI Europe ex UK rose by 0.7% last week.

Unlike other countries that have been dominated by challenging inflation figures, this narrative has been less prevalent across the continent. Figures showed slower inflation across numerous key European nations, including France, Spain and Italy.

In the UK, the FTSE 100 and FTSE 250 increased by 0.6% and 1.5% respectively.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Past performance is not indicative of future performance.

Wealth Check

The seven-year rule explained

Passing on large sums to your loved ones while you’re still alive is both a practical and tax-smart option for inter-generational money flow. Often called a ‘living inheritance’, it can be a savvy choice for those wishing to give the next generation a head start.

But you must remember that if you die within seven years of making a substantial gift, the value of the gift will be counted as part of your estate (unless it’s covered by an inheritance tax (IHT) exemption). This money could be liable for IHT if there’s not a sufficient nil-rate band available on death which can protect the gift.

What you need to know:

- Seven-year giving rule

The Autumn Budget announced that there will be changes to pensions and could see taxpayers having to pay an increased tax bill. This has meant that more people are looking to pass on their money or assets during their lifetime.

The seven-year rule means that you’ll need to live for seven years from the date of the gift; if not, the beneficiaries may have to return some of it to HMRC.

- What’s considered a gift?

A gift is defined as anything you give away, according to HMRC, and can include:

- Money

- Property or land

- Stocks and shares listed on the London Stock Exchange

- Household and personal goods

- Furniture

- Jewellery

- Antiques

- Unlisted shares (if you’ve held them for less than two years before your death)

These gifts are called Potentially Exempt Transfers or PETs (unless they fall under an IHT exemption, such as the £3,000 annual exemption). Don’t worry, it’s not as complicated as it sounds! What it means is that your gift is ‘potentially exempt’ from IHT – it’s an outright gift exchanged between two people. IHT is only paid on a PET if you don’t live seven years from the date of the gift and it’s not covered by your available nil-rate band when you pass away.

Gifts worth over £3,000 can be considered a Chargeable Lifetime Transfer (CLT). A CLT is usually a gift made into a discretionary trust, where IHT is paid upfront – at 20% on any amount over the nil-rate band (currently £325,000 per person).

- The ‘tapering off’ rule

Good news! The rate of IHT on gifts made above the available nil-rate band tapers off on a sliding scale, known as taper relief.

How does it work?

- If you die 3 to 4 years after gifting, the rate of IHT on your gift reduces to 32%

- If you die 4 to 5 years after gifting, the rate of IHT reduces to 24%

- If you die 5 to 6 years after gifting, the rate of IHT reduces to 16%

- If you die 6 to 7 years after gifting, the rate of IHT on your gift to 8%

If you live for seven years, your gift is IHT tax-free.

- Can gifts be protected from IHT?

Yes, they can. You can protect any gift amount surpassing your available nil-rate band by taking out a ‘gift inter vivos policy’ – a form of life insurance which works to protect the recipient from IHT if you don’t live for seven years. These policies are created to mirror the tapering effect of your liability – e.g. if you die in the sixth year, it’ll pay out the exact amount to cover any tax that’s due.

You can also protect gifts that are made within the available nil-rate band by using a level term assurance policy. The term is arranged to match the period until gift falls outside of the estate – if the gift had just been made, this would be seven years.

- What other gifts can be made that are tax-free?

Tax-exempt gifts of up to £3,000 every tax year can be made. You can split your annual allowance between numerous people, or you can give it all to one person. When you make your first gift, you can roll over the gifting allowance from the last year, meaning that you can give away £6,000. Gifts under £250 are tax-free and gifts to civil partners or spouses are automatically tax-exempt.

Top tip: Keep a written record of each and every gift you make – if you can’t prove when you made a gift, for example, you may end up paying some IHT regardless.

Planning ahead

If you make a gift in good time, you can make a big difference to your family’s financial well-being in the here and now – and in their future.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

Trusts are not regulated by the Financial Conduct Authority.

In The Picture

All that glitters is gold…or is it? There’s been a large increase in gold prices while investors seek out a safe haven as the geopolitical noise continues. Sentiment hugely influences markets, but it shouldn’t be part of your investment decisions. These sharp rises in gold prices are reflective of the effect of short-term noise on markets and are no guarantee of future returns. Instead, portfolio resilience is more effective when opting for a long-term approach and building a diversified portfolio.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 02/06/2025

WeeklyWatch – UK inflation woes return

28th May 2025

Stock Take

Inflation is on the rise again

Inflation makes an unwelcome return… In April, UK headline inflation increased to 3.5% – the highest level seen in over a year and which surpassed the expectations of both analysts and the Bank of England.

With higher inflation figures, costs of some goods and services will increase for consumers, which will come as disappointing news when it was widely believed that the economic tide was turning in their favour. Increased inflation figures aren’t usually welcomed by investors either, as they erode the real value of investment returns.

For bond investors, the picture is more mixed. A rise in inflation usually results in lower bond prices. Additionally, inflation reduces the purchasing power of the yield on bonds (the interest payments) which makes them less attractive. Consequently, yields on bonds usually go up to try and draw in investors.

The recent inflation figures have diluted hopes of further cuts to the Bank of England base rate. But the Director of Advice at St. James’s Place, Alexandra Loydon, says:

“The higher-than-expected rise in inflation has likely brought this optimism to a halt.”

The Head of Economic Research at St James’s Place, Hetal Mehta, agrees that interest rate cut prospects have ‘receded’. In addition to the recent inflation figures, she highlights the meeting of the Bank of England’s Monetary Policy Committee (MPC) that’s taking place in May, describing it as “hawkish”.

“While the rate cut announced by the MPC in May was expected, the fact that two members voted for no reduction at all was a surprise. In fact, Huw Pill, the BoE’s chief economist, has since been hawkish in his view and last week talked down the need for further aggressive interest rate cuts.”

Markets are now factoring in one to two further rate cuts by the BoE by the year’s end. Mehta identifies that earlier this month, before the MPC meeting, there had been an expectation for three rate cuts in the second half of 2025.

Many moving parts

Rising UK inflation has resulted in concerns in some quarters about an economic slowdown, whereas others say this is too soon to tell. There are many moving parts that have an impact on UK inflation which include the energy element as the energy cap was increased in April, which has fed the higher inflation. Additionally, firms have indicated that the higher costs of national insurance will be passed onto consumers.

Mehta says the largely anaemic UK growth will likely have the opposite effect on inflation figures longer-term.

“It may just be a case of sequencing and timing. When we look at what the market is expecting, UK inflation is expected to pick up a bit as we head into the next few months and then start falling slowly.

“In the near-term, the commodity price increases from a few months ago will continue to exert more upward pressure on inflation.”

Mehta adds that while UK inflation is moving upwards, to date it hasn’t been substantial and is unlikely to be.

“Inflation had fallen back significantly after the initial Russia/Ukraine shock but there are signs that it’s sticky and it’s unclear how quickly inflation can get back to the 2% target.

“It would take a huge, unpredictable shock to see double-digit inflation again.”

For a more positive outlook, the UK economy is resilient and can withstand a fair amount of volatility. The independent central bank is able to adjust interest rates when necessary to respond to the economic changes. And unlike the US commentaries, it’s not under huge government pressure to move fast when it comes to cutting interest rates.

The impact of inflation is felt in everybody’s lives, but the likelihood of returning to a higher inflationary environment that caused widespread issues a few years ago is highly unlikely as it stands.

Inflation elsewhere

Is current inflation an upward trend? Or simply swings and roundabouts? In 2024, we saw the largest global increase in inflation since 1996 (Statista) at 5.76%, even though across wealthier Western economies, inflation spiked at 11% in 2022.

Across the pond, the inflation outlook for consumers doesn’t look much better than in the UK, as Trump’s tariff policies are likely to increase inflation and future rate expectations. The University of Michigan recently published their figures which showed that consumers predict that inflation will rise by an annual rate of 7.3% over the next 12 months.

US–EU trade discussions

There was another injection of volatility to the markets last week following some quick-fire announcements from President Trump in regard to the potential EU tariffs. On Friday, he announced that from 1st June, there will be a 50% tariff on EU imports – driving markets down across both continents.

Thankfully, the volatility was short-lived. Trump agreed to delay the introduction until 9th July which will give the regions more time to negotiate a trade deal. Even though markets have responded well to the delay, the rapid and unpredictable changing events exemplify the mantra: ‘Time in the markets, not timing the markets.’

Wealth Check

Numerous factors can impact the growth or restriction of a small or medium-sized enterprise (SME), ranging from limited internal capabilities to external elements like supply and demand.

The Business Growth Advisor at Elephants Child, Kevin Petley, identifies four key areas for SMEs to strengthen their market position and increase growth that’s sustainable…

- Market access – In order to gain a foothold in any market, you have to look beyond just offering a product or service. Essential to your success will be elements such as brand recognition, optimal distribution channels and compliance with regulatory requirements.

- Competition – Businesses rarely have no competition. For SMEs, their competitors tend to be larger companies with more significant economies of scale. This is where your unique value needs to be leveraged in order to boost your growth.

- Networking and partnerships – Many business owners often express little confidence in this avenue, saying that they don’t see the benefit or simply don’t have the time to put aside for networking. It can mean that you miss out on impactful insights and isolation can limit growth. Laying the groundwork now is important to reap future benefits.

- Customer demand – When businesses have spent time analysing their potential for growth they’re in a better position to enter a market and experience growth. As part of the analysis, businesses should determine the size of opportunity, monitor competitor activity, decide on pricing and consider possible volatility including seasonal movement.

Going beyond enthusiasm

A successful business will have innovation, enthusiasm and commitment at its heart, and to accomplish this requires effective planning, researching and good financial management.

In order to grow, it’s essential that businesses take all available options into consideration, understand the levels of risk involved and put clear measurements in place in order to track progress. This allows business owners to quickly validate success or anticipate and identify where change is needed in a timely manner. This will put your business on a stronger growth trajectory.

We work in conjunction with an extensive network of external growth advisers and SME specialists, such as Elephants Child, who have been carefully selected by St. James’s Place. The services provided by these specialists are separate and distinct to the services carried out by St. James’s Place and include advice on how to grow your business and prepare your business for sale. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

In The Picture

As soon as stocks start to fall, the temptation is usually to sell and sell fast!

But if economic history has taught us anything, it’s that when markets are down, panic selling does your long-term finances no good.

Not long ago, American indices rapidly fell following the Liberation Day tariff announcements. Giving into temptation and selling in the subsequent days would have locked in the losses.

Following this, the S&P 500 has recovered well and is now higher than it was pre-Liberation Day. By panic selling holdings before the recovery, the losses will have been locked in, and you’ll have missed out on the benefits that came from the recovery. Patience is a virtue.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Past performance is not indicative of future performance.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2025; all rights reserved.