WeeklyWatch – Double (digit) trouble for UK inflation

25th April 2023

Stock Take

A big week for UK data

The UK is still feeling the squeeze, and it’s perhaps little wonder when leading economists refer to inflation as being “taxation without legislation” (Milton Friedman).

The Office for National Statistics (ONS) confirmed that consumer price inflation (CPI) fell to an annual rate of 10.1% in March, in what was the key moment of a big week for UK results. The CPI data was higher than the Bank of England’s (BoE) predicted 9.2%, meaning the UK was the only country with double-digit inflation in Western Europe.

Food prices are a major culprit behind this less-than-expected fall, going up at their fastest rate in 45 years. For example, cheddar has risen by 49% in the last year – bad news for sandwich fillers and cheese boards.

Ahead of the BoE’s meeting on 11th May, markets expect a quarter-point rate rise to 4.50% and foresee rates will peak at 5% in September. That would see 1.4 million people with variable mortgages paying £6,670 a year more than they would have done in December 2021.

Mark Dowding of BlueBay Asset Management commented:

“We continue to expect UK inflation to overshoot for longer than in other advanced economies, putting pressure on the BoE to keep hiking rates. But the BoE needs to tread carefully for fear of provoking a collapse in UK house prices. It is a matter of when, not if, consumers are forced to retrench in the wake of rising costs and higher mortgage rates.”

Dowding also notes the narrative around inflation in the UK is very different to other economies:

“Policymakers in other countries talk about the importance of bringing inflation down to create the conditions for medium-term economic prosperity, but the UK narrative seems to be much more about a ‘cost of living crisis’.”

Mixed employment messages

The inflation news was preceded by the ONS confirming that the UK unemployment rate unexpectedly increased to 3.8% in the previous month, while job vacancies fell for the ninth month in a row. There were mixed messages – although these figures suggested the uncertain economic outlook is hitting employment. The ONS also reported rises in both the employment rate and the number of people seeking work.

Last month, UK wages increased at a quicker rate than expected, with an annual growth rate of 6.6% recorded between December and February. Although regular pay fell by 2.3% taking inflation into account, the pick-up in wage growth seemed to disrupt the plans of those who predicted the BoE to halt its interest rate hikes.

The week ended with news of a larger-than-expected fall in retail sales in March as consumers continued to watch their spending and the rain further discouraged shoppers.

China takes centre stage

The UK numbers were arguably eclipsed by a slew of economic data from China. Investors were keeping a close eye on announcements, searching for indications about how the recovery is progressing in the world’s second-largest economy. The economy grew at a faster-than-expected pace in the first quarter, advancing 4.5% year-on-year as the country continued its rapid recovery from its zero-COVID policy.

Factory output rose 3.9% – slightly below forecasts – while retail sales, the main marker of household consumption, surged by 10.6% compared to a year earlier.

Martin Hennecke, Asia Investment Director at St. James’s Place, commented:

“China looks well on track to meet S&P Global’s full-year growth forecast of 5.5%. That might not sound overly impressive, but given China’s economy now measures $18.3 trillion, that growth alone equals the entire GDP of the Netherlands, or twice that of Thailand. The IMF expects China’s contribution to global growth to be twice that of the US over the next five years.”

US earnings season gathers speed

Across the pond, eyes turned to US corporate earnings. Considering the next 0.25% interest rate rise is already largely priced into markets, investors want to know if inflation is driving up costs or denting consumer spending.

The results were varied, with Tesla, AT&T, Netflix and some regional banks posting disappointing results, but some US banking behemoths like Morgan Stanley and Bank of America beating forecasts. The results helped underline that banks remain in a fundamentally healthy operating state, offering some peace of mind to the financial sector.

With more earnings announcements due this week – including from mega-tech companies such as Microsoft, Amazon and Alphabet – markets generally remained stable throughout last week. Notably though, the pan-European STOXX 600 index clocked its fifth straight week of gains.

Thursday brought news that US unemployment benefit claims had risen, and Asian stocks posted their worst week for a month and a half as investors digested the news. This, in addition to last week’s signs that the labour market is losing momentum, led to heightened fears of recession as soon as the second half of this year.

Wealth Check

If you feel now is the right time to bow out of your business to start a new chapter in your life, it’s important to have a solid plan in place.

The first thing on the agenda should be preparing for your post-business life before the exit takes place. With such a big change coming to your professional and personal life, you need to be sure that you’ve done all the necessary tax planning to help maximise the proceeds from the sale of your business and bring financial security to you and your family.

Once the sale has gone through, the question is what to do with the money. The questions you should be asking yourself include: ‘How can I use that cash to create a retirement income for me and my family?’, ‘Have I got enough?’ and ‘How much can I take from it without eroding the capital?’ and ‘How can I do this in a tax-efficient manner?’.

Steven Lea of St. James’s Place says:

“You may have invested every single penny into your business and so don’t have a great deal of experience in making personal investments. Now, almost overnight, you might have several million in that account. A financial adviser will be able to help you carefully manage this nest egg.”

Leaving it in the bank will probably see it grow only very slowly. In fact, it may well cause the real value to go down over time due to interest rates currently languishing behind the high levels of inflation. That means you might want to invest at least some of the money.

One key thing to think about is how much risk you’re comfortable with. Once you know that, you’re in a better position to look across the different asset classes and diversify appropriately. For example, that might mean investing in a portfolio of equities, government and corporate bonds and commercial property.

What’s more, you may still need some income, so might be considering staying in work or wondering how to effectively draw income from the sale money. After all, you’ll no longer receive any earnings the business used to provide for you. Lea comments:

“It is important to consider different types of tax wrappers, so you have the flexibility to draw your income tax-efficiently.”

An experienced financial adviser can review your personal finance plan with you, help you navigate towards a successful exit and ensure good future planning post-exit.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Investing in real asset classes (equities, bonds and commercial property) does not provide the security of capital which is characteristic of a deposit account with a bank or building society. The value of capital, and income from it, can fall as well as rise and you may not get back the original amount invested.

The levels and bases of taxation and reliefs from taxation can change at any time and are dependent on individual circumstances.

In the Picture

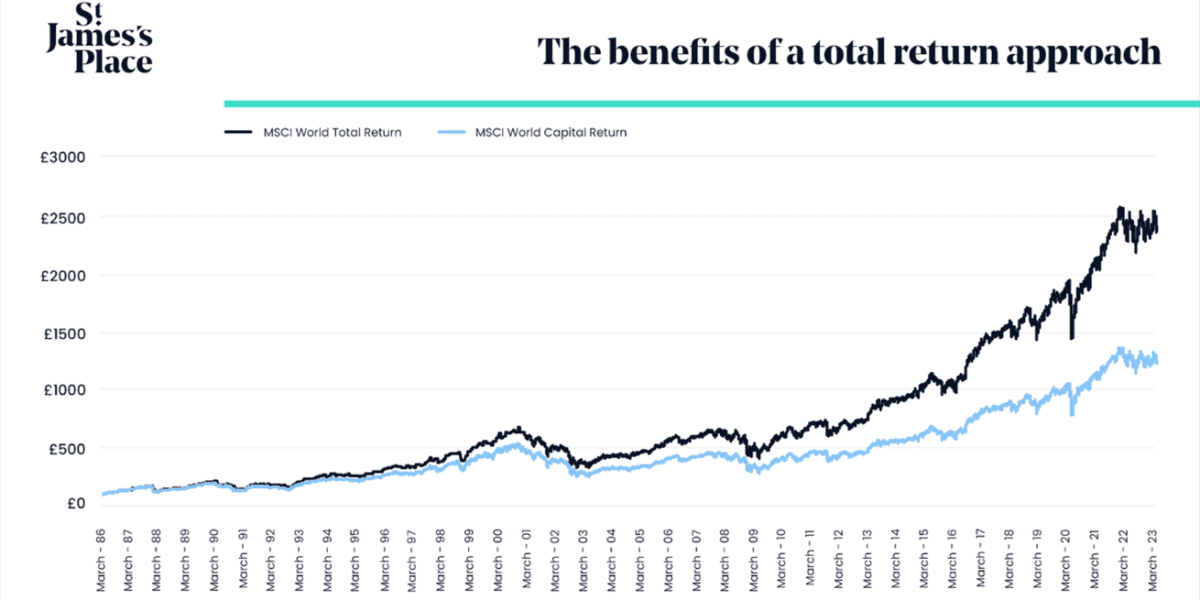

Over the long term, reinvesting dividends can provide a substantial contribution to total returns – as this graph shows.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Source: Bloomberg as at 28th March 2023. Based on an initial investment of £100. Global market represented by the MSCI World Index. Past performance is not indicative of future performance.

The Last Word

Everything I own smells like champagne, beer and grass. I’m still somewhere between giggling and sobbing. This town and this sport is one of the most romantic things on Earth.

– Wrexham football club co-owner, Ryan Reynolds, celebrates his team winning the National League.

BlueBay Asset Management is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP Approved 24/04/2023