Business Matters – Issue 28

Reasons to be cheerful? | Bear with it | Why diversifying is so important | Judgement call | Time in the market, not timing the market

We hope you like the new look and format of Business Matters – please spare 1 minute to let us know what you think. Take survey >

Taking the bull market by its horns

Bear markets – a period where equity markets fall – are an inherent part of investing. They’re the risk that we take on as the price for achieving better returns, which would be significantly lower if it weren’t for bear markets.

Pre-pandemic, investors had enjoyed over a decade of virtually uninterrupted progress. Although no one could have predicted Covid itself, it was only ever a question of what would trigger a market reset – and when.

Although inevitable, bear markets can pose one of the greatest challenges for investors. This is not because of the (hopefully temporary) losses, but the rash decisions we can make during this time.

The noise of daily market fluctuations can be deafening, and even the most level-headed investor will sometimes be tempted to check their portfolios more frequently. Many can even find the urge to make short-term trades irresistible.

Reasons to be cheerful?

Are we saying goodbye to the bear? Current sentiment suggests we’re now moving into a bull market – often defined as a 20% gain from a bear-market low, which the S&P 500 hit last month.

While some are waiting to see if this bull market has legs – especially with more rate hikes expected this year – now could be the perfect time for investors to prepare for a new bull run or even invest in the market, if you have the spare funds to do so. After all, history suggests a correlation between the speed and depth of a bear market and how quickly the market recovers.

Bear with it

At Wellesley, we always champion the timeless, golden rules of investing.

This means being in it for the long haul, with a goal or plan to guide us, and acknowledging that there will always be times when markets are more volatile. Think about these events in the context of your long-term investment strategy. A key factor of this is compound interest, which allows your money to grow exponentially over time, a bit like a rolling snowball.

Hindsight is a wonderful thing, and history shows that, over the long-term, markets have produced strong returns despite wars, recessions and pandemics.

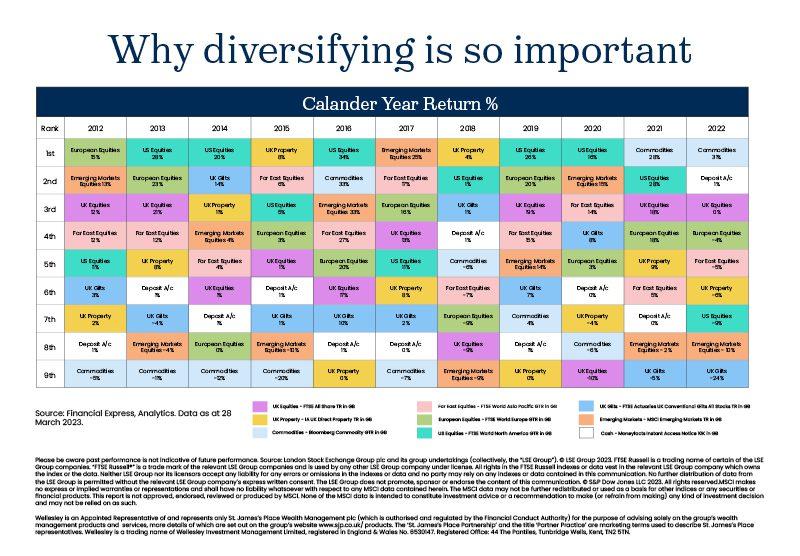

Investing in different asset classes – i.e. spreading your money across a selection of asset types, countries and sectors – can help moderate some of the risks, meaning your investments stand a better chance of achieving more consistent returns.

The proof of the proverbial pudding is this graph, which shows how each asset type has performed over the past decade. As you can see, there are plenty of ups and downs among all of the assets, both in the short and long term. For example, US equities topped the charts in 2020; however, in 2022 it was languishing in seventh place. What’s more, between 2015 and 2022, commodities jumped from the bottom of the chart (2015) to second place (2016) and then back down to the bottom again (2017), before leaping to the top spot in 2021 and 2022.

It’s true: no-one can predict which investment is going to produce the best returns year after year, and the best-performing investment in one year can often turn out to be the worst-performing investment the next. Being dependent upon the performance of one company can leave you exposed to societal changes and global crises.

Of course, it can be difficult to sit tight as your investments fall in value. But to quote Corporal Jones: ‘Don’t panic!’.

Time in the market, not timing the market

We don’t know when volatility will happen, which is why it’s essential for investors to have a plan in place that you can stick to over the long term. Good financial advice can help you drown out some of the noise and continue to look at the long term when considering investment decisions – both personal and business.

We can also review your investment goals alongside the current opportunities – helping you take the bull market firmly by its horns!

Let’s start a conversation: 01444 244551.

Past performance is not indicative of future performance.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested. Equities do not provide the security of capital which is characteristic of a deposit with a bank or building society.

The levels and bases of taxation, and reliefs from taxation, can change at any time. The value of any tax relief depends on individual circumstances.

SJP approved 28/07/23