WeeklyWatch – The Fed’s slowing inflation battle sparks market optimism

18th July 2023

Stock Take

Positive market data sparks optimism

Is the US Federal Reserve’s battle against inflation finally turning the tide?

On Wednesday, data released gave fuel to optimism that the string of interest rate increases may have finally slowed the rise in prices. After increasing by 4% in May, consumer price inflation increased by 3% in the year to June. That is the smallest yearly growth in over two years.

This announcement was welcomed by US markets, which saw the main stock indices reach 15-month highs thanks, in large part, to shares of big tech-related businesses, which are often sensitive to rising interest rates. The worldwide MSCI World Index rose as a result of the US stock market advances and is currently up over 14% for the year. On the premise that the Fed’s rate rises will soon come to a halt, the FTSE 100 posted its greatest weekly performance in over three months.

After reports of weak job growth the week before, positive inflation data suggested that the Fed’s hasty rate increases were starting to cool the economy. However, the unemployment rate is still very near a multi-decade low, and wage growth is still exceeding the Fed’s inflation objective.

Concerns remain as core inflation persists

Core inflation, which excludes volatile costs for food and energy, is proving more resilient and continues to be a cause for concern. Core CPI decreased more subtly, from 5.3% to 4.8%, which is still far above the Fed’s 2% objective.

Chief Economist at Schroders Keith Wade predicts that the central bank will proceed with its well-promised rate increase later this month.

“The labour market is cooling but is still tight enough to accommodate strong wage growth. Such second-round effects have the potential to perpetuate inflation by raising labour costs across the economy, which the Fed will be keen to avoid.”

The US has made comparatively quick headway in slowing price rises compared to other advanced economies like the UK, where inflation is still 8.7%. Former Bank of England (BoE) rate-setting committee member Danny Blanchflower pointed out that the US economy was more agile than the UK’s.

“There’s been a COVID shock for everyone and there’s been a war shock for everybody. The question is what distinguishes the UK from everywhere else and I would say the answer is Brexit, which has made it more difficult for firms to do things like switch supply chains to lower cost alternatives.”

GDP shrinks while salaries rise

The UK economy’s difficulties were highlighted by the announcement that it shrank by 0.1% in May, in part as a result of the additional bank holiday for the coronation. This came after an increase of 0.2% in April and indicates that the UK GDP is on course to increase by about 0.1% in the second quarter.

BoE governor Andrew Bailey fortified its vow to “see the job through” on inflation earlier this week in a speech at Mansion House, but he emphasised that “both price and wage increases at current rates are not consistent with the inflation target”.

As if on cue, official data revealed that UK salaries increased at a record annual rate, increasing by 7.3% between March and May, sparking concerns that inflation will continue to rise. But there were indications that the labour market was slowing somewhat. In the three months leading up to April, the unemployment rate unexpectedly increased to 4% from 3.8%, while the number of open positions decreased.

Investors react to inflation data

Following the latest inflation news, the yield on two-year gilts dropped dramatically, indicating that investors were hedging their bets on how much higher the Bank might raise rates. Since December 2021, the BoE has raised interest rates 13 times in a row; its upcoming announcement is scheduled for 3rd August.

The International Monetary Fund (IMF) provided its analysis of the status of the global economy in advance of this week’s summit of G20 finance chiefs in India. The IMF confirmed that first-quarter growth was marginally above its April projections but maintained its expectation for 2.8% global GDP growth, down from 3.4% in 2022. It was stated that while manufacturing suffered across all G20 nations, demand for services remained high, meaning that “services inflation – which is now the major driver of core inflation – is expected to take longer to decline”.

Wealth Check

Your purchasing power with suppliers as an independent business owner may be lower than that of large, powerful businesses.

But even with a business that has the upper hand, there are still strategies for negotiating more favourable conditions.

Your business model, area of expertise, target market and industry sector are just a few of the variables that will affect your capacity to bargain with larger suppliers. You must carefully consider each one, searching for any potential leverage points.

Begin by defining what makes you successful, such as the reasons why your clients like you. You could be more valuable to some suppliers because of your niches or selling points. They might want to work with you if, for instance, your brand is closely connected with environmental preservation because it enhances their sustainability credentials. Or you might have specialised knowledge in science or technology that would be useful to them.

Inquire about softer areas too, because every provider will have flexible and inflexible factors. Andy Benson, Business Growth Advisor at Elephants Child, says:

“You may think your suppliers don’t want to negotiate, but the more you talk to them and understand their needs, the more that might change. Even if they have a reputation for dominating their distributors, try talking to them first. If you can help them grow a certain market or increase margin, you never know.”

Some suppliers might agree to price negotiations, while others won’t. Nevertheless, depending on your business model and financial circumstances, they could offer you better terms in other areas that might be more significant. If you’re pressed for cash, an extension of credit or longer payment terms, for instance, may relieve your cash flow, which may be far more beneficial to you than a tiny discount.

As an alternative, you might be able to set up unique goods or bundled products with better profit margins and chances for upselling. For example, gaming consoles tend to be items with low margins. Offering bundles and add-ons to devoted, enthusiastic players, however, may help increase your and your suppliers’ margins.

In The Picture

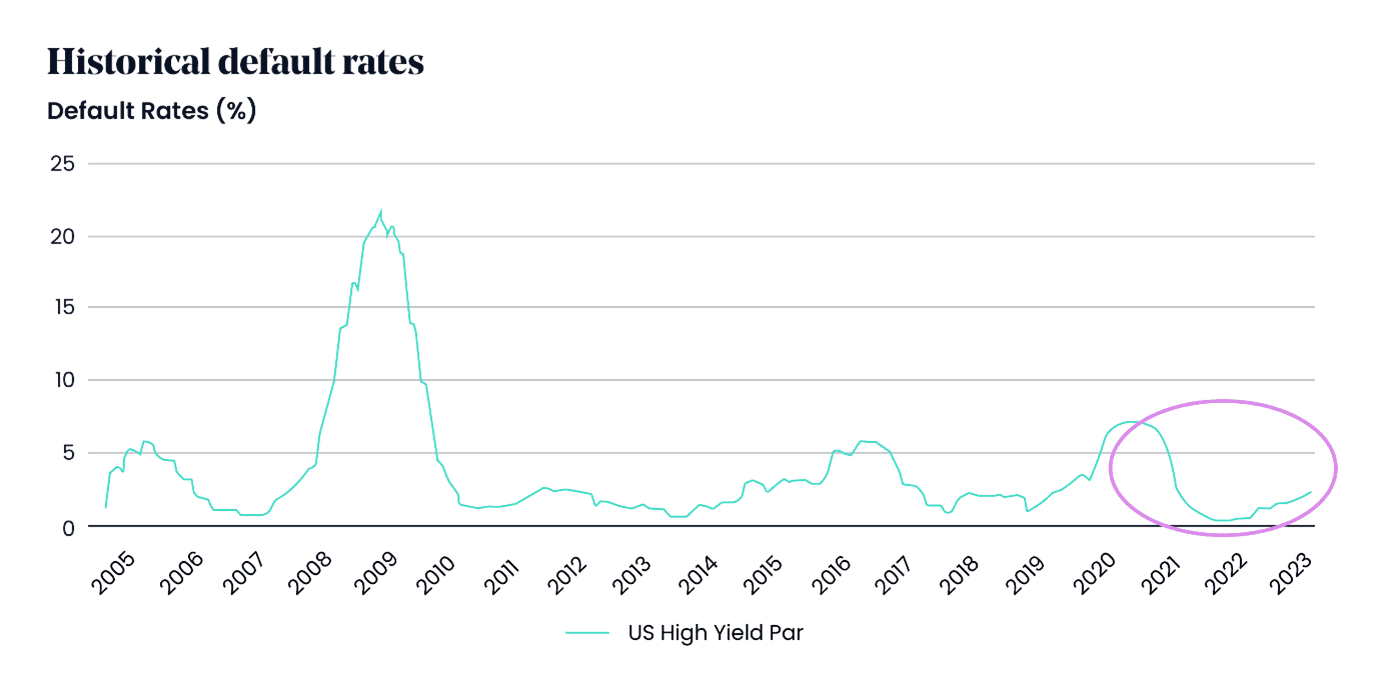

Despite recent macroeconomic difficulties, US and European high-yield companies continue to see relatively few defaults.

Source: ICE BofA Global Research. Data as of 31st May 2023.

The Last Word

“Act now or face the full force of the law.”

– The Department for Energy Security tells fuel retailers to begin voluntarily sharing live prices or else be legally forced to do so.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 17/07/2023