WeeklyWatch – UK economy exceeds expectations with 0.2% growth

15th August 2023

Stock Take

Glimmers of hope amid UK economic challenges

For most of 2023, life in the UK has been pretty bleak. Given that the cost-of-living crisis has persisted longer than many would have hoped, inflation has stayed above that of developed market rivals. And these problems have only gotten worse as a result of higher interest rates and poor equity performance.

However, the nation received some welcome news last week. The success of the England Women’s football team sees them move to the next stage of the World Cup with a semi-final match against Australia.

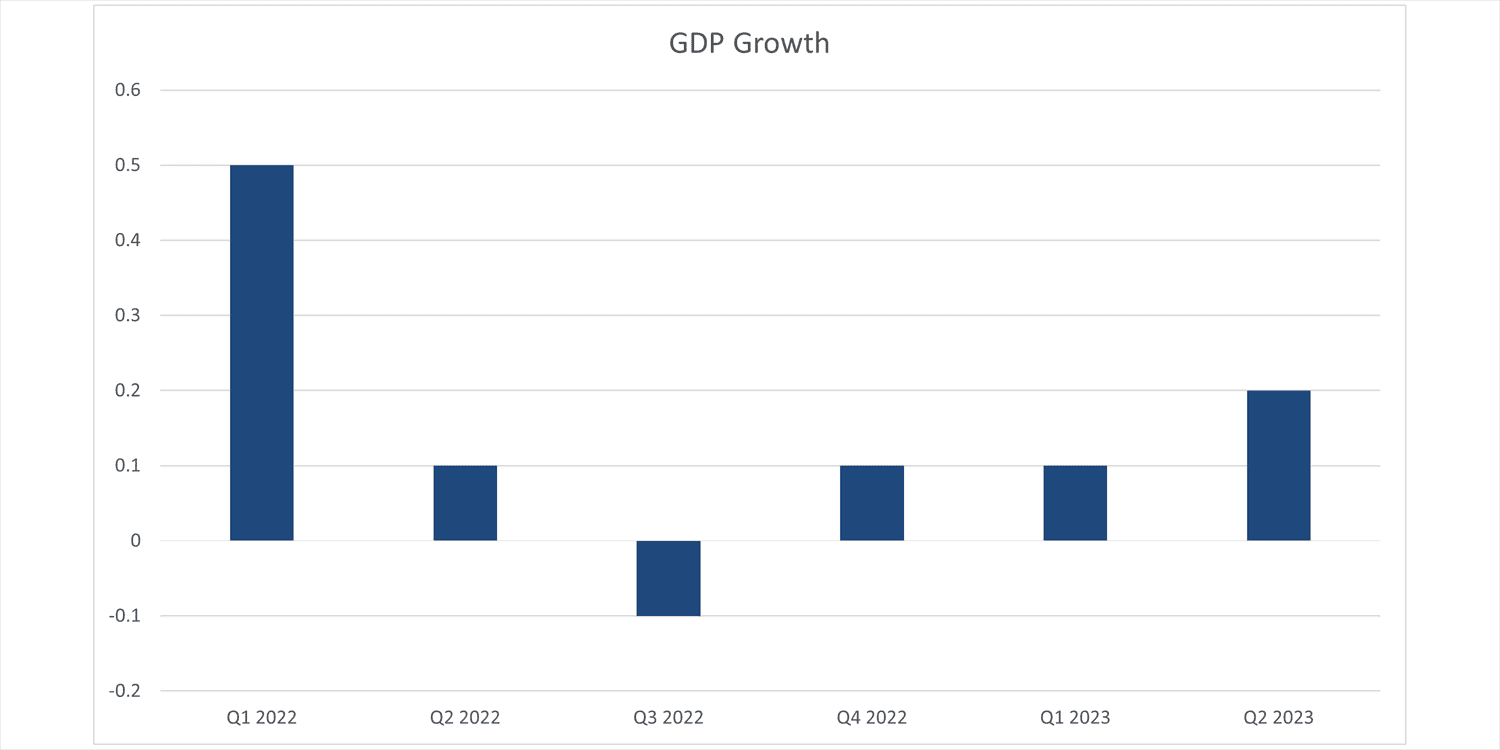

Additionally, it was reported that the British economy expanded by 0.2% in Q2 – welcome news considering the consensus expectations of zero growth. This was also higher than the 0.1% observed in the previous three months, and it was the strongest quarterly reading in over a year.

UK economy defies predictions with resilient growth

The UK economy is still more resilient than many had predicted, even though 0.2% isn’t particularly high by historical standards. As with previous additional public holidays, many economists had anticipated that the May bank holiday would have a greater effect on GDP. Economists were also surprised by a solid 0.5% growth in June, in part affected by the warmer weather.

The expansion also offers the Bank of England a little more leeway to raise interest rates. The Bank decided to increase rates by an additional 0.25% at its most recent meeting. Following the two updates, Azad Zangana, Senior European Economist and Strategist at Schroders, noted:

“The latest GDP figures suggest more monetary tightening is required to slow domestic demand and to, in turn, ease domestic inflation pressures. Indeed, financial markets have responded to the latest figures. Gilts yields across the curve are higher, and the pound has strengthened against both the euro and US dollar.”

Italy’s windfall tax triggers market turmoil

The British economy has so far surpassed the predictions made by the International Monetary Fund at the beginning of the year that it would do the worst of the major markets in 2023. The 0.2% rise was much better than Italy’s 0.3% decline and Germany’s 0.3% flat performance.

These Italian figures applied pressure on Giorgia Meloni, the prime minister of Italy. Initial measures taken by her government included a 40% windfall tax on additional profits made by Italian banks. Italian banks have witnessed an increase in earnings, as has been the case abroad, due to higher lending fees made possible by rising interest rates. A portion of these excess profits, according to the government, would be used to address Italy’s own cost-of-living issue.

The consequences of this move were felt immediately, as the FTSE Italia All-Share Banks Index plummeted 7.6%. European markets were already a little jittery when the damage was done, and several British banks as well as the Euro Stoxx Banks Index also fell as a result of the news.

The Italian government quickly clarified that the levy would be limited to no more than 0.1% of a lender’s total assets in order to prevent a potential market route. Although many banks continue to trade at far lower prices than they were before the announcement, the update did enable the industry to somewhat recover.

US inflation figures rise

Investors in the US had better news as government figures revealed that the inflation rate in July was 3.2%. Despite this figure being somewhat higher than the 3.0% recorded in June, experts had previously expected a rise of some capacity because of soft data from 2022.

Hopes grew that the Federal Reserve wouldn’t need to hike interest rates in response to the news at its upcoming meeting. Even if this was the case, Mark Dowding, Chief Financial Officer at Bluebay, noted:

“The trend in inflation continues to remain significantly above the Federal Reserve (Fed) target and with the labour market remaining tight and the growth backdrop broadly looking robust, it strikes us that we remain far from a point where we should be thinking about lower interest rates, even if the hiking cycle does now look largely done.”

Wealth Check

What are the odds that you’ll require long-term care at some point before the end of your life?

It’s a question that can be pretty hard to answer and easy to avoid completely. But it’s the million-dollar question in terms of financial security. Paying for social care for as long as you need it might leave a significant financial void, and it can significantly affect the amount of money you can leave to your family.

Whether that need is met by paid or unpaid carers, the NHS estimated that in 2021, 24% of men and 28% of women aged 65 and over required support with at least one daily life task1. That’s around one in four. Additionally, more than half of people over the age of 80 require care or assistance in some way.

A fourth of the population are most frequently cited as needing social care. This fact was used by the Dilnot Commission, which looked at the reform of adult social care in 2011, and it is still often cited as a benchmark – for instance, in a 2021 House of Lords private members’ bill intending to change the insurance market for elderly social care2.

Whichever figures you choose to accept, one thing is for certain: the price of social care can be extremely costly. Planning for the worst-case scenario while hoping for the best may be the smartest course of action.

Currently, it’s estimated that a typical week in a UK residential care facility costs roughly £760, but if nursing care is also needed, the cost jumps to £9603. In some areas of the UK, fees can hit £1,250 per week.

Paying for care has an effect on more than just the person getting it. For example, a family member may choose to stop working in order to take care of a parent. And of course, the amount of money spent on social care will decrease the value of your estate. Tony Müdd, Divisional Director at St. James’s Place, says:

“There’s a small group of people who actually have enough money to pay for whatever care they need, and they’ll be able to afford it without any problems.

“And there’s a small minority whose assets are such that they will qualify for assistance from the state. However, there is a huge section in the middle for whom the state won’t provide, and they will have to self-fund – and, sadly, a lot of them may not have enough money.”

Müdd emphasises that even if you are only in your 50s and long-term care seems far off, seeking professional financial advice now can help put you in the best position for the future.

Sources:

1NHS Digital, 16 May 2023

2Elderly Social Care (Insurance) Bill, House of Lords Library – accessed August 2023

3Carehome, April 2023 – accessed August 2023

In The Picture

Despite the UK economy’s modest improvement in Q2 and its improvement as it becomes more robust than many had anticipated, challenges and slow growth remain.

Source: The Office for National Statistics.

The Last Word

“Tragedy that hits one of us is felt by all of us. These past few days, the resolve of our families, businesses and visitors have been tested like never before in our lifetime.”

– Richard Bissen, mayor of Maui County, comments on the recent wildfire that tore through Lahaina in Hawaii last week.

Bluebay and Schroders are fund managers for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 14/08/2023