WeeklyWatch – Global markets affected by challenges in the Chinese economy

22nd August 2023

Stock Take

From inflation to deflation

The past week has seen the return of deflation, which has been rearing its unpleasant head after more than a year of inflation controlling market performance in Western markets.

Inflation in the West has pretty well-established roots by this point. Pent-up demand skyrocketed after COVID-19, and it took longer for supply chains damaged by the pandemic to catch up. Several goods, including fuel and food, saw price increases due to the conflict in Ukraine.

China’s post-lockdown economic challenges

The Chinese market, however, has had a significantly different timeframe. At the end of 2022, it finally abandoned its own approach to lockdown, known as the zero-COVID policy. While some anticipated this would spark an economic rebound, it instead gave rise to a sluggish worldwide market, with dropping demand in many cases. Youth unemployment increased as China’s housing market, which had been in decline for some years, failed to recover. In fact, China recently suspended reporting its youth employment figure completely.

According to official statistics, China entered deflation in July as consumer prices dropped by 0.3%. While the high levels of inflation in the West may be problematic, deflation can also bring about problems of its own. Long-term deflation may encourage consumers and businesses to curtail spending and output, which could result in more unemployment and slower development.

Negative perception and potential opportunities in China

It’s maybe not unexpected that the Chinese market has suffered for a large portion of this year, given the current negative perception of the Chinese economy. Martin Hennecke, Head of Asia & Middle East Investment Advisory & Comms at SJP, cautions against acting impulsively while analysing the market, though. He notes:

“Very often when sentiment is at its most negative for any particular market due to negative headlines and poor past returns, it can also imply a significant valuation opportunity.

“While a recovery may take longer than anticipated, research by London Business School has shown that there is hardly a correlation between macro-economic growth and stock market movements, given that markets are anticipatory in nature. And just like during prior general market crises (for example, the 2008 financial crisis and the COVID-19 crisis), markets could rally back well before a normalisation of the economy. And it is not actually all only negative: Starbucks, Yum brands and Apple all reported strong China earnings rebounds in Q2. However, positive news is being mostly drowned out, for now.”

UK and US markets struggle amid Chinese concerns

Markets outside of China struggled last week, in part due to concern that the poor Chinese data would extend to other economies. The S&P 500 dropped 2.1% and the NASDAQ dropped 2.6% in the US.

An increase in US treasury yields can also be used to explain some of this fall. These sometimes have an inverse relationship with equities so therefore move in the opposite direction. Yields benefited from some economic data that came in stronger than expected, particularly industrial production and retail sales, which raised expectations that the US economy would escape a recession despite the Federal Reserve’s (Fed) rate-hiking cycle’s rapid pace.

The UK’s FTSE 100 fell 3.5%, lagging behind its international counterparts. Last week, headlines pointed to falling headline inflation, but obscured the fact that core inflation (which removes more volatile areas like fuel) remained flat. As a result, there is a higher chance that the Bank of England may raise interest rates again in the future.

The limited global impact from China’s slowdown

Neil Shearing, Group Chief Economist at Capital Economics, cautions that some may be overestimating the effect that a Chinese slowdown may have on the global economy, even while Chinese troubles may have contributed to some of these market difficulties:

“Markets are again getting worried about what a downturn in China means for global growth. But these concerns are based on fundamental misunderstandings about how much influence China’s economy has over the global cycle. Absent a crash, China’s slowdown is more a problem for those multinationals and emerging markets that do most business with it than a threat to the global economic outlook.”

Wealth Check

Throughout his career, entrepreneur Steve Witt has launched and grown a number of businesses, including his current endeavour, The Travel Franchise. He established UKDomains, a provider of online domain services, from scratch and sold it for many millions of pounds in 2008. Despite his newfound fortune and freedom, Steve felt “nothing but grief”. Steve says:

“I thought it would be all champagne and fireworks. Instead, it was the most depressing day of my life. I went through a grieving process – I felt I’d suddenly lost everything I’d worked so hard for.”

When Steve turned over his passion project to UKDomains’ buyers, he realised the truth in the cliché that “it’s not all about the money”. Here are some of the company exit strategies Steve has learned:

Be aware of your obligations under the terms of the sale

Steve was prohibited from working in the web hosting industry for a year following the sale as one of the conditions of the sale. “That’s not so easy when your sector is all you know,” says Steve.

Work with an invested partner

In retrospect, Steve believes he wouldn’t deal with an agency again for the sale of UKDomains. According to Steve, the agency’s fees from the sale weren’t proportional to the value of the work being done, and generally, an agent has less of an interest in the company’s future than the exiting founder.

Understand your company’s true value

If you’ve never sold a business before, you might not feel like you have a solid grasp on the financial worth of your company. Look at previous transactions involving businesses in your industry to see how much they sold for and what made them valuable.

Have a post-sale plan

The saying goes: “Every athlete dies twice. Once when they take their last breath, and the other when they hang it up.” According to Steve, who advises considering your “afterlife”, this is also true for business owners who are selling their company.

Find your purpose

Decide how to fill the void created by selling your business and find what inspires you and makes you happy.

Create a wealth management plan

You could have more liquid cash after selling your company than you’ve ever had before. If you want to get the most out of your money, you must save and invest it wisely.

In The Picture

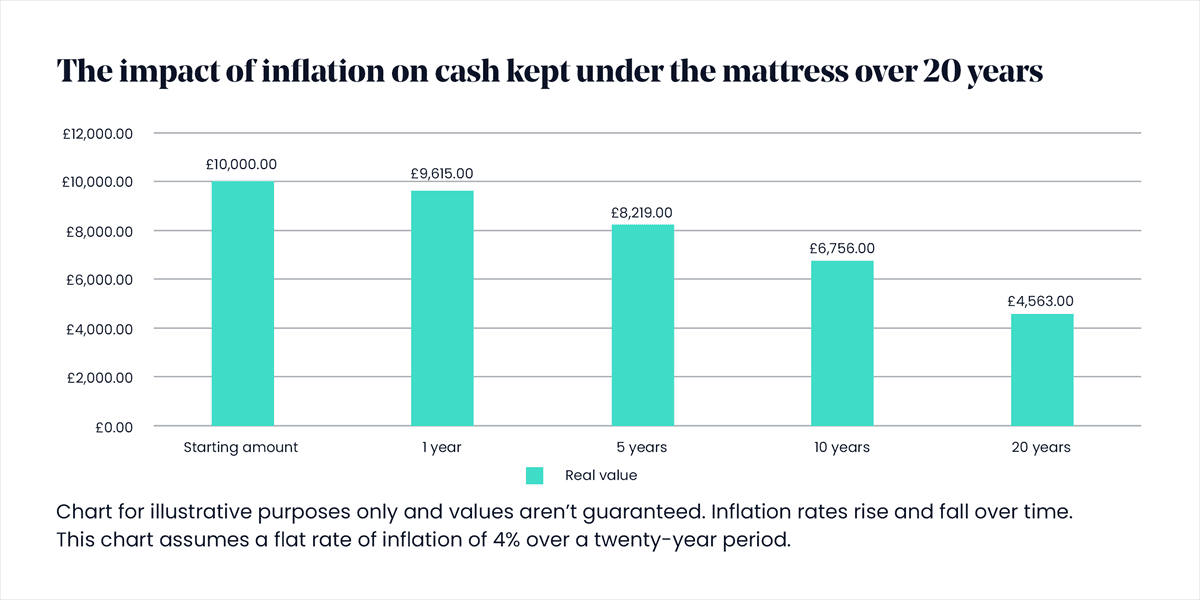

In the short term, you might not feel the effects of inflation. But as time passes, you could start to feel the pinch. The example below demonstrates how, if left to gather dust, a £10,000 sum of cash stored under the mattress might lose all its actual worth in just twenty years due to a steady inflation rate of 4%.

Learn more in this ‘The power of investing to beat inflation’ article here.

The Last Word

“With tournaments like this and the great and professional organisation, we can all continue to build on the further development of women’s football across the world.”

– Sarina Wiegman, Manager of the England Women’s Football team, reflects on the World Cup after reaching the final.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 21/08/2023