WeeklyWatch – While worldwide business activity dips, US economy maintains momentum

12th September 2023

Stock Take

Is an unlucky September ahead?

Markets often have a tough month in September. It is, on average, the worst month of the year for the S&P 500 Index, according to data going back to 1945.

Investors are hoping that this month will indicate that the seemingly unstoppable climb in interest rates will soon slow, providing solace for equities and bonds after a disappointing August. However, there are a number of risk events to be aware of, such as central bank meetings, important US inflation data and a G20 summit.

Apple shares lose nearly £160 billion

Sadly, September hasn’t had the greatest start. In the middle of the week, shares in Apple, the most valuable company in the world, dropped more than 6% – or by nearly £160 billion – in the middle of the week, following news that Chinese government employees were no longer allowed to use their iPhones at work. In spite of China making up over a fifth of the company’s global sales last year, Beijing and Washington have highlighted employing domestically produced technology since technology has grown to be a significant national security concern.

The reports affected the shares of Apple suppliers as well. Some observers believed that markets had overreacted under generally low confidence, but the revelation might provide a new obstacle given that Apple’s sales in China have already been negatively impacted by the nation’s macroeconomic problems.

Good news, bad news in China

During the week, confidence in China’s recovery fluctuated. Markets were uplifted at the start of the week by news that troubled real estate developer Country Garden had received approval from creditors to postpone repayments, as well as expectations that China’s steady drip feed of policy stimulus may stabilise the economy.

Later in the week, however, it was revealed that, as sluggish demand continued to plague the world’s second-largest economy, China’s services sector increased at its slowest rate in eight months in August. For the fourth consecutive month, exports also fell, but the loss was less severe than anticipated and better than the previous month. China’s share of US goods imports decreased to its lowest level since 2006 in the year ending in July, according to a report by the US Census Bureau.

Trouble in Germany with falling factory orders

China’s economy isn’t the only one that’s having trouble. Indebted consumers cut back on their spending last month, significantly slowing down global corporate activity. With the exception of the COVID-19 pandemic, German factory orders fell at the highest rate in 30 years, sending the eurozone services sector into contraction territory. Mark Dowding of BlueBay Asset Management observed:

“In particular, it appears that the German auto sector is struggling with competition from Asian producers, while a reliance on manufactured exports has exposed the economy to downside risks as activity in China stalls.”

The European Central Bank’s (ECB) interest rate decision this month is up for debate since progress in reducing inflation is projected to be very slow. Investors are predominantly betting against a raise, although authorities emphasised that nothing has been decided yet.

Can we expect a decline in inflation this month in the UK?

For the first time since January, activity in the UK’s services sector declined in August, albeit the decline was less severe than anticipated. Along with the general cost-of-living squeeze, the abnormally rainy summer weather also contributed to a slowdown in consumer spending growth. Kristina Hooper of Invesco commented:

“This is problematic given that the Bank of England (BoE) is poised to remain hawkish beyond when the Fed and even the ECB are expected to end rate hikes, which could cause more damage to the UK economy. However, that could change, especially if recent rapid declines in inflation continue.”

BoE Governor Andrew Bailey predicted that UK inflation was headed for a further substantial decline by the end of the year during a question-and-answer session on Wednesday, but he also made it clear that the pace of wage growth is still a major concern. In May, Bailey stated that the BoE was “nearer” the peak, following which the base rate was raised in June and August. This time, Bailey stated that the BoE was “much nearer” to concluding its run of interest rate hikes. Markets expect interest rates to increase once more later this month, reaching 5%.

Lowest level of US unemployment benefit claims since February

The US economy continues to defy expectations as its services sector unexpectedly gained momentum in August thanks to firming new orders and companies charging higher input costs. These indications of still-high inflation were additional clues that interest rates would remain higher for longer. While other statistics suggested that the US labour market was slowing, there was news that the number of people filing for unemployment benefits had dropped to its lowest level since February. This demonstrated that the labour market was still fairly robust, supporting the idea that US interest rates may need to remain higher for longer.

Future Fed policy will be influenced by changes in both employment and inflation, so this week’s consumer price index report will be watched very closely.

Wealth Check

It’s tempting to think you’re in a great position when you first glance at your bank account after your early-stage business has generated some sales. But even in a smaller, growing company, things can rapidly become quite rocky if you don’t put strong financial management practices in place.

Through the challenging early months and years before your company becomes stable, the most important thing is to maintain a constant cash flow. Many businesses fail to survive through their first few years without taking such precautions.

Here are four habits that any company should adopt:

Forecasting your cash flow

SMEs often fail in their second and third years because they grow too quickly and overtrade. But you’d be mistaken in thinking these businesses don’t have enough customers – they have too many. And are therefore unable to fill orders or bridge the time between when orders are dispatched and when payments are received.

Establishing robust credit control

Running out of money while waiting for invoices to be paid is one of the biggest concerns for start-ups. Therefore, reducing days sales outstanding (DSO) or the interval between shipping items and receiving payment is a priority. This could be achieved in a variety of ways, beginning with efficient invoicing procedures and an effective credit-collection function.

Finding the right cover

Although having comprehensive business insurance may seem like an extra investment, it’s an essential part of building a financially resilient company. Take into account protections like key person policies to cover the impact if you lose senior staff members and credit insurance against potential bad debts.

Separating business and personal finances

Mixing personal and business finances is risky, but the line blurs more easily than you might think.

A successful start-up owner may be tempted to withdraw excessive amounts of money too soon. This can make the business weaker; for instance, receiving a huge tax or supplier bill and discovering you don’t have the money to pay it, which can lead to knock-on effects that quickly snowball.

Potential investors and buyers will check your trading history to find out if you’ve ever crossed this line. If the transgression is serious, it can make it more difficult for you to get financing or maximise the sale price. It could entirely ruin a sale. Therefore, it’s imperative to properly separate your personal and business finances from the get-go.

In The Picture

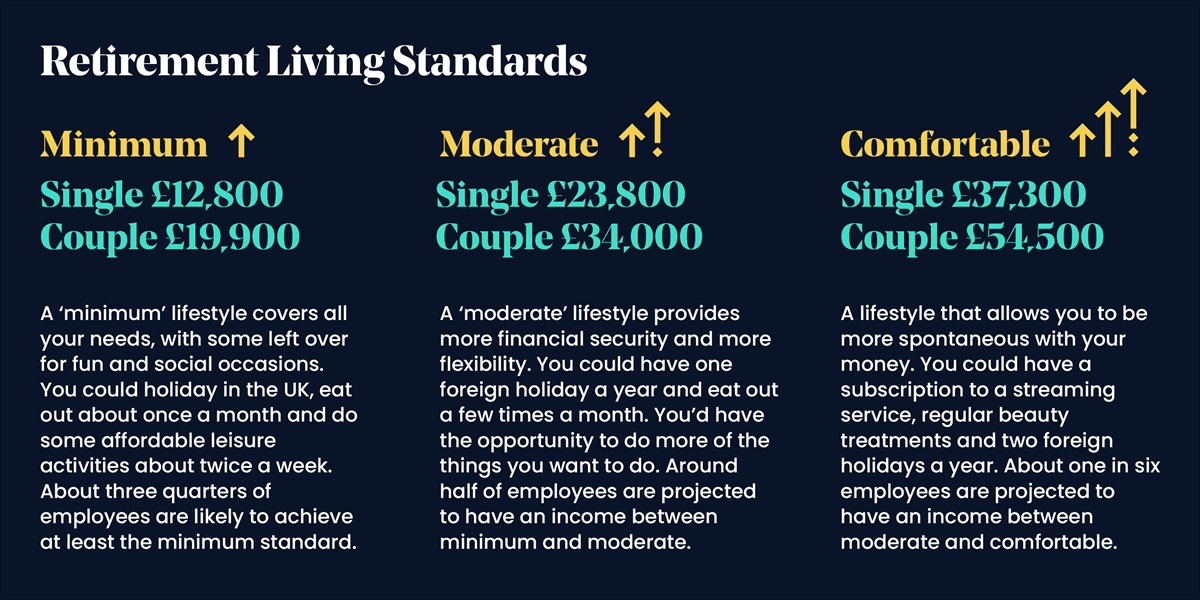

It’s the return of Pension Awareness Week! No matter where you are in life, it’s a good idea to figure out roughly how much money you’re going to need to maintain a comfortable standard of living once you’ve retired.

Source: Retirement Living Standards, Pensions and Lifetime Savings Association, 2023.

The Last Word

“There needs to be accountability on this, and it needs to be done in an independent way.”

– Birmingham City Council leader John Cotton discusses the aftermath of Birmingham Council declaring bankruptcy last week.

BlueBay Asset Management and Invesco are fund managers for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 11/09/2023