WeeklyWatch – Flat third quarter for UK economy leads to low equities

14th November 2023

Stock Take

UK economy gains 0.2%, exceeding zero growth predictions

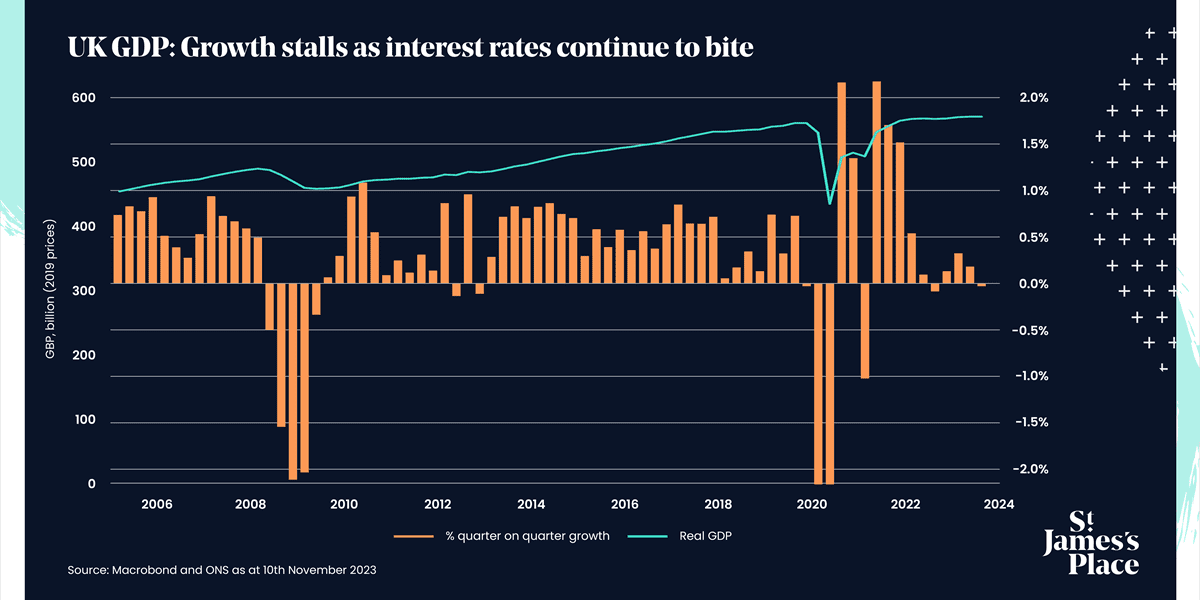

Last week, after figures revealed the UK economy was flat in the third quarter, UK equities ended on a low.

In an attempt to lower inflation, the Bank of England has sharply raised interest rates throughout most of 2022 and 2023, although there’s been a recent hiatus on these hikes. Because borrowing has become more expensive for consumers and businesses, these rising rates have contributed to a slowdown in the already fragile economy by lowering spending and perhaps even investment.

Even though the UK economy is doing poorly overall, the details revealed some better news. September’s numbers showed that the month’s economic activity had increased. Although a 0.2% gain wouldn’t often be cause for celebration, analysts had predicted no growth for the month.

Hetal Mehta, Head of Economic Research at St James’s Place, noted:

“The UK economy showed zero growth in the third quarter due to overall weak domestic demand, although this was offset by a bump in net exports. September saw a modest monthly increase, but consumer-facing service industries are clearly facing ongoing challenges.”

Reduced consumer spending leaves many hoping for rate cut

Consumer spending suffered during the quarter, falling 0.4%, adjusted for inflation, as consumers tightened their wallets. Due to the negative impact of rising interest rates and ongoing high inflation on disposable income, consumers mostly reduced their consumption of goods rather than services.

However, those hoping for a rate cut were probably disappointed when the Governor of the Bank of England, Andrew Bailey, commented:

“It’s really too early to be talking about cutting rates…we are very clear, we are not talking about that.”

Hetal said:

“The Bank of England noted that we’re only halfway through the impact of its interest rate increases, suggesting a prolonged period of weak growth ahead.”

Senior European Economist and Schroders Strategist Azad Zangana called the most recent numbers “slightly better than economists had expected”, but not by enough to alter the outlook for monetary policy. He added:

“The Bank of England has warned that interest rates are likely to remain elevated for a prolonged period of time, as inflation has proven to be higher and stickier than expected. The economy is expected to contract in the final quarter of the year, potentially going into a shallow technical recession in early 2024.”

Eyes turn to Jeremy Hunt’s autumn statement

As a result of the challenging economic climate, people are cutting down on their spending, so all eyes will be focused on Jeremy Hunt when he makes his Autumn Statement next week. Though we won’t know for sure until the Budget is released, indications from the government thus far don’t point to any significant giveaways.

It’s also important to keep in mind that, from an investment perspective, the majority of the FTSE 100’s revenue comes from sources outside of the UK. As a result, even in the event that the British economy continues to face difficulties, many of these businesses can continue to grow.

Gains for international equities, including S&P 500 and Nikkei 225

In the eurozone, the MSCI Europe excl. UK Index had a small increase of 0.2%. Christine Lagarde, the president of the European Central Bank (ECB), issued a warning not to anticipate a decrease in interest rates over the coming few months despite this increase. She said: “Long enough has to be long enough.”

Equity markets outside of Europe last week were largely positive. Both the Nasdaq and the S&P 500 saw increases in the US, the former by 2.4% and the latter by 1.3%. A number of strong earnings reports from businesses in the technology sector supported the rise in US equities.

In Japan, the announcement of further government stimulus to combat inflation and robust company earnings contributed to the Japanese Nikkei 225’s 1.9% rise this week. The stimulus package, which is estimated to be worth $113 billion, contains new subsidies to help reduce utility bills, along with tax cuts. In China, despite ongoing property concerns, Chinese shares ended the week on a good note, with the Shanghai Composite increasing by 0.3%.

Wealth Check

It’s harder to make and manage your money when you’re worried about paying the bills. And this stressful feeling will only grow the more time passes – which can also affect your mental health. Sadly, this cycle can all too easily get out of control.

We all know that the world we’re living in is…unpredictable. For many people, COVID-19 resulted in two years of lower income and stress. After all, other stressful situations, such as the conflict in Ukraine, sharp inflation and volatile markets, quickly followed COVID.

Marketing Propositions Manager at St. James’s Place Kate Whalley comments:

“Although inflation affects those on lower incomes most, anyone with high outgoings can be impacted severely. This applies across the wealth spectrum. If your outgoings are exceeding your income, your finances will be out of kilter – no matter how much you’re worth.”

More than 11.5 million people in the UK said they were borrowing more or using more credit facilities this year simply to keep up with growing prices, according to the Office for National Statistics (ONS).1

You may find that you’re less capable of making any financial decisions at all, much less wise ones, if your anxiety about money is negatively impacting your mental health. Therefore, addressing the issue with a financial adviser could be a smart place to start.

Not feeling in control of your finances is the main cause of poor financial well-being. Speaking to an expert is the best way to improve your financial well-being, according to Kate. They can help you with all aspects of financial planning, including figuring out how to set up a household budget that works for your family’s needs – and that still lets you save. Your sense of control returns as you gain more knowledge about handling your finances.

Talking about money can get highly emotional, especially when it comes to family matters. Having a financial adviser who is sympathetic but a step away from the situation might help you face the problems and move on.

Regaining control of your money and your mental health begins with having a conversation.

Financial advice goes beyond just looking at figures on a paper. It can significantly improve your emotional and financial well-being and help you in creating the future you want. In these unpredictable times, we’re able to help you in making informed decisions and avoiding costly mistakes.

Source: 1ONS, 22 February 2023

In The Picture

Despite a number of obstacles, it was announced last week that the UK GDP growth was flat in the third quarter.

The Last Word

“It is mindful of the legacy of service and devotion to this country set by my beloved mother, the late Queen, that I deliver this, the first King’s Speech in over 70 years.”

– King Charles delivers the first King’s Speech of his reign.

Schroders is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 13/11/2023