WeeklyWatch – Markets rise as inflation falls

21st November 2023

Stock Take

The November comeback

Following a risk-off sentiment in October, world markets are bouncing back this month as investors increased their bets that the major central banks have finally ended their run of interest rate hikes.

This new-found investor confidence was evidenced over the course of last week, which saw several bumps in the road that historically would have raised nerves, but were actually hailed by investors. For example, the much-awaited US consumer prices on Tuesday weren’t much to write home about, with prices increasing at a slower annual rate (3.2%, down from 3.7% a month earlier). But the pressures were milder than predicted – fuelling hopes that we can close the chapter on the country’s fight against inflation. What’s more, world stocks bounced as a drop in petrol prices helped bring US inflation to its lowest rate since July.

A cooling US economy?

On Wednesday, data revealing a decline in US retail sales for the first time in seven months further bolstered expectations that the US Federal Reserve has concluded its interest rate hikes.

That said, the decrease was less than anticipated and followed three consecutive months of substantial gains, adding to the growing signs of a cooling US economy. Additionally, US producer prices experienced their most significant decline in three and a half years. However, there is no sign yet that it’s heading towards recession.

Investor focus is now expected to shift towards speculation about when the Federal Reserve might start to cut rates. Analysts have drawn parallels to the soft landing of the US economy in 1994–95, highlighting that the pause in that period lasted only five months before rates began to decrease. US interest rates have been on hold since July.

China’s retail performance surprises investors

Positive economic news wasn’t unique to the West, with positive news from China boosting markets. Retail sales grew by a better-than-expected 7.6% last month and industrial output also picked up faster than predicted. On the retail side, it was a pleasant surprise following reports of lacklustre sales at the annual Singles Day shopping festival, with China’s top two online retailers – Alibaba and JD.com – opting to withhold their full sales data for a second straight year.

The property sector continues to be a weak spot in both China and the US. Real estate and related sectors account for around a quarter of China’s GDP, and news that investment into the sector fell 9.3% from a year ago added to evidence that property is continuing to drag down the economy. In the US, housing costs (rent, hotel rates and house insurance) have climbed 6.7% over the last 12 months.

UK sentiment see-saws

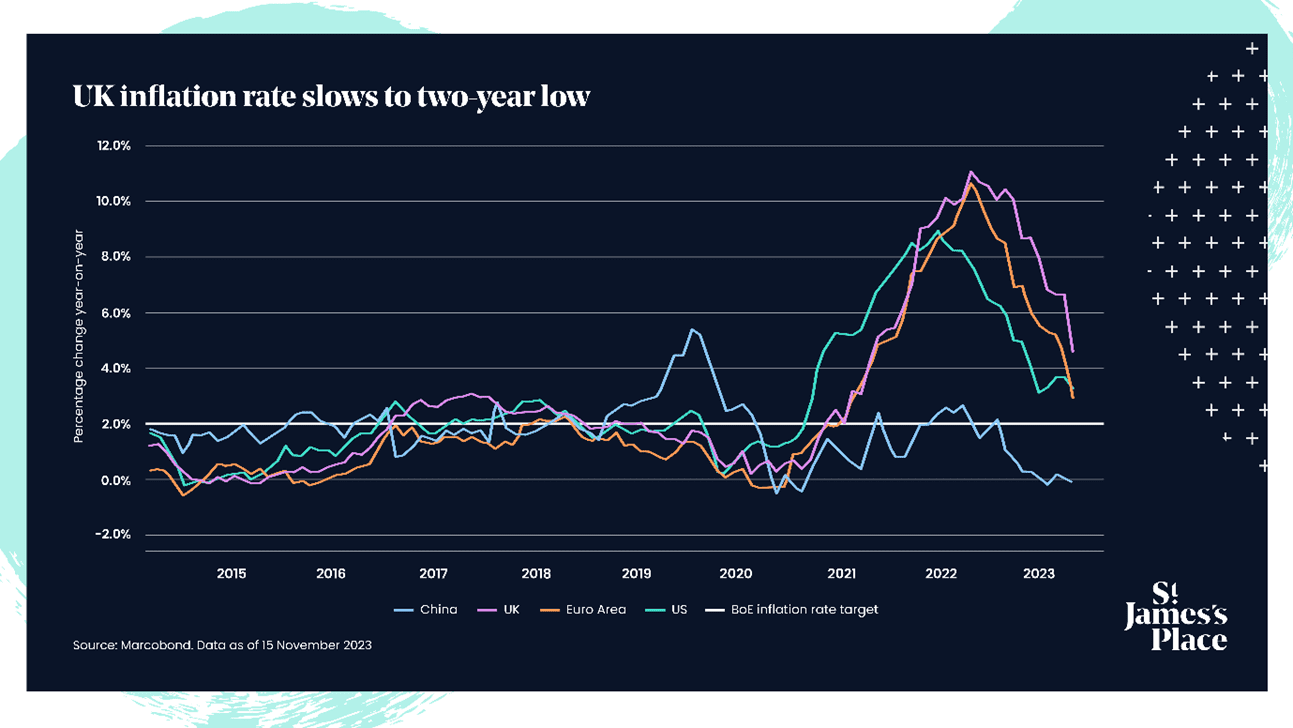

Positive inflation news was in abundance last week, with the UK reporting that its October inflation plunged to its lowest rate in two years. Consumer prices rose at an annual rate of 4.6%, down from 6.7% the month before.

Hetal Mehta, Head of Economic Research at St. James’s Place, commented:

“While the inflation drop to below 5% will be hailed as a major milestone in progress towards the Bank of England’s 2% target, the UK remains one of the highest inflation economies. Core inflation is still stubbornly sticky at 5.7%. The next phase of inflation reduction will almost certainly be more painful for the economy, as the easy wins on energy are now largely behind us.

“While interest rate increases may have subsided, the pass-through of the interest rate hikes to date should keep investors cautious about the UK outlook.”

Despite the good news on inflation, the end of the week brought further evidence of the UK’s economic challenges. Official figures showed retail sales in October slumped to their lowest level since the lockdowns of February 2021. The Office for National Statistics said consumers were continuing to prioritise essential spending and emphasised the impact of the poor weather discouraging would-be spenders from leaving the house.

The government’s latest plans for kick-starting the UK economy will be revealed in this week’s Autumn Statement.

Eurozone interest cut is on ice

Inflation in Italy and France fell back to annual rates of 1.8% and 4.5% respectively. Despite this, the eurozone grappled with the headwinds created by high inflation and record interest rates, leading to a marginal contraction in the third quarter, hinting at a potential technical recession if the final quarter turns out equally weak. Surprisingly, employment bucked the trend, rising amid economic weakening.

Despite the likelihood of recession, a Reuters poll of economists predicted that the European Central Bank’s first interest rate cut won’t come until July next year.

The benign inflation readings in the US and across Europe pushed world stocks to a two-month high. The MSCI World Index and S&P500 have climbed more than 7% so far in November.

Wealth Check

The decision to hand over the reins to your business is a tough one, but appointing an internal successor can help make it a smooth transition. Having a settled team whom you trust to take the business forward in a positive direction can benefit you, the new leadership and the wider business, as they will already be well-versed in your firm’s values, culture and operations.

What’s more, you know the team and believe in their abilities, so selecting one of them as a successor gives you time to plan ahead and develop the candidate(s).

Choosing an internal successor provides another benefit: the ability to hand over operational leadership while still retaining a stake in the business. This allows you to continue earning income from the company, ensuring stability and retaining some control over strategic decisions.

You can create a structure you’re comfortable with, which suits you and your future plans. This can also help your exit from the business, in emotional terms, to be smooth and gradual rather than fretful and abrupt.

If you think internal succession could be a viable option, the earlier you recognise and develop future leaders the better.

This approach will improve your return on investment in staff training and encourage loyalty and motivation from your team. After all, keeping all those years of experience in-house is in everybody’s interest!

If you’re a small or medium business owner who’s thinking about a business exit – no matter how far into the future – speak to us and we can help make sure all your plans fit together and match your personal financial objectives.

In The Picture

Is the fight against high inflation over? Not according to central banks. Despite inflation falling in both the US and UK last week, it remains above the 2% target.

The Last Word

“I’ve decided to join this team because I believe Rishi Sunak is a good prime minister doing a difficult job at a hard time…I want to support him.”

– David Cameron on his unexpected return to government last week.

Past performance is not indicative of future performance.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 20/11/2023