WeeklyWatch – Festive cheer delivered from the Fed

19th December 2023

Stock Take

Global markets’ festive cheer

Global share markets have rallied in time for Christmas, surging to their highest in over 18 months, along with a record closing high from the US Dow Jones Index.

It came after news earlier last week that US inflation rose unexpectedly in November. Consumer prices were pushed up 0.1% – to register a year-on-year increase of 3.1% – because of stubbornly high rental costs. Investors therefore were forced to push back expectations of any cuts to interest rates until at least May. But the upbeat assessment on Wednesday saw futures markets price in a march to start rate cuts.

Mark Dowding of BlueBay Asset Management comments:

“From a market perspective, it seems like the Fed has given a green light to risk assets and it would not be surprising to see strong price action into the end of the year and early January. Economically speaking, we also wonder whether a boost to animal spirits could lead to an acceleration in economic activity rather than the slowdown many have been expecting.”

But Dowding believes the Fed is taking something of a gamble.

“With wealth effects buoyant, the labour market robust and incomes rising, one also wonders whether inflation will decline as quickly as policymakers are hoping for.”

The declining health of the UK economy

A mass of data came in before the Bank of England’s (BoE) meeting last Thursday, showing the slowest wage growth in almost two years. At 7.3% in the three months leading up to October, however, it’s still managing to outpace inflation. The number of UK job vacancies also continued to fall – it’s the 17th month in a row and the longest period of decline on record.

News that the UK economy shrank 0.3% in October, after a growth of 0.2% in September, reinforced recessionary fears. It was a greater decline than expected, attributed to the bad weather hitting retail and tourism alongside the continuing high interest rates causing a squeeze on consumers. The UK economy has now flatlined in the three months to October.

Predictably, the BoE continued to say it was too early to speculate about when interest rates could be cut, after announcing they’d be held for a third time. The bleak picture continued in minutes from the Monetary Policy Committee meeting, which reinforced concerns of UK inflation being worse than the US and eurozone – wage inflation was also considerably higher.

Eurozone economy almost certainly in recession

The European Central Bank (ECB) followed the BoE’s lead in leaving borrowing rates unchanged while leaving no hints about a possible reduction. The ECB President, Christine Lagarde, highlighted the imminent rebounding of inflation, and price pressures remain strong.

Business activity surveys at the end of the week indicated the eurozone economy is almost certainly in recession.

Michael Kelly at PineBridge Investments commented:

“The disinflationary process is well underway, so lower rates are coming. The ‘new normal’ after the Global Financial Crisis (GFC) was an aberration, so think in terms of a return to the pre-GFC ‘old normal’. Yet pace matters. Markets have run well ahead of the central banks, having already priced in three-quarters of what one should expect outside of a recession developing. After this recent very rapid repricing, expect a pause on the trend towards lower rates in 2024.”

And while the New York Federal Reserve President, John Williams, pushed back against rate cut expectations by reiterating the focus to bring inflation down to its 2% target, the S&P 500 Index still registered its longest streak of weekly gains since September 2017 – up nearly 23% year-to-date.

Wealth Check

Markets were on central bank watch last week as policymakers in the US, UK and Europe met to make their final interest rate decisions of the year.

Firstly, the US Federal Reserve on Wednesday left rates unchanged, but it was the shift in tone from Chair Jerome Powell that got markets buzzing. He gave the clearest indication yet that the Fed believes its era of monetary tightening is over and that cuts are coming into view.

Of the 19 Fed policymakers, 17 see interest rates being lower by the end of 2024, with the central bank’s dot plot suggesting officials anticipate a cut of 0.75% next year. Powell declared “real progress” on bringing inflation back to target and seems optimistic that the US economy was close to an elusive soft landing. Those hopes were boosted by a rebound in US retail sales in November, more evidence of consumer resilience.

Even with the best-laid plans for our finances, life has a habit of disrupting them. Whether you might need to help your children out or you find yourself unexpectedly between employment, these bumps in the road can damage not only your budget but your personal well-being too.

You can plan for big expenses like buying a home or launching a business. But how do you deal with those short-term, high-impact financial challenges that we all face from time to time?

Money worries can have a huge impact on our overall emotional well-being. Any change to our financial situation makes us feel uneasy and less in control.

As financial advisers, we have these conversations about money with families every day – in good times and bad. But we know that for many people, talking about money and budgets isn’t easy, and it can be even more difficult among family members.

Many of us are feeling the pinch right now. The cost-of-living crisis isn’t over, and it’s reaching everyone. Those who have always been comfortable may now find themselves needing to tighten belts. And many of us will know from bitter experience that a conversation about money can be a major flashpoint in families.

But hiding rising debts and unpaid bills can be even worse for our mental health. Feeling guilty that the situation is somehow your fault can make it even harder to discuss the situation and the solutions openly. These feelings are completely normal.

Having expert, family-led advice from someone who’s one step removed can be a relief for everyone. It can also help you avoid more drastic action that might seem like appealing short-term solutions, such as cancelling insurance or stopping your pension contributions. Taking money out of your pension while markets are falling, or increasing your withdrawals if you’ve already retired, could put significant pressure on your pot.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

In The Picture

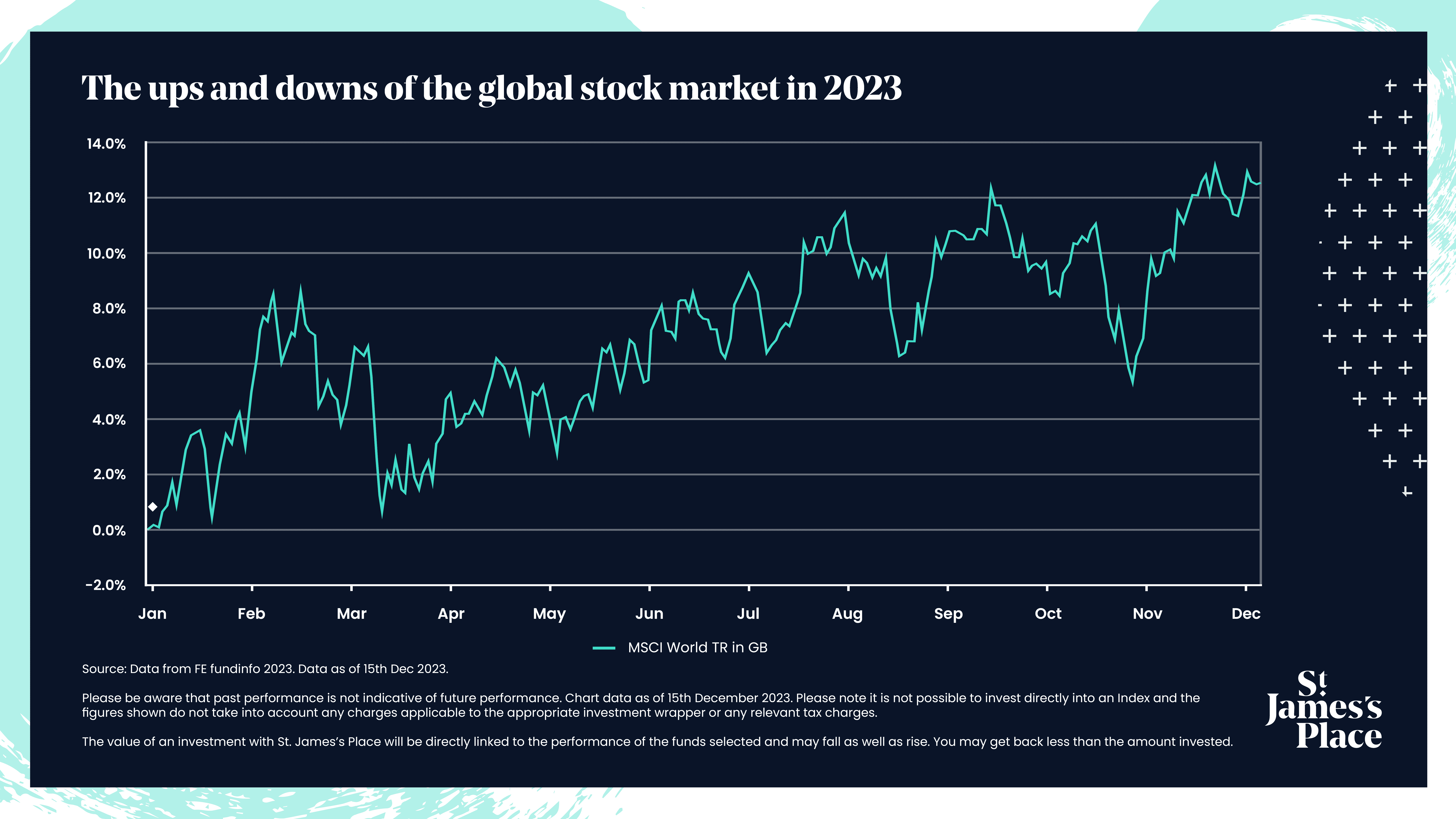

Significant challenges and short-term volatility aside, 2023 has proved to be a generally positive year for stock markets. That said, performance was uneven, and some sectors and regions have notably outperformed others.

Past performance is not indicative of future performance.

The Last Word

“Words cannot describe how I am feeling right now. It’s been a life-changing opportunity and I’ve had the time of my life dancing with Vito every week.”

– Coronation Street star Ellie Leach celebrates winning Strictly Come Dancing.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of Wellesley Wealth Advisory.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 18/12/2023