WeeklyWatch – Volatile markets trigger global economic concern

16th January 2024

Stock Take

Volatile US inflation data means unlikely rate drop

This week marks 15 years since the renowned ‘Miracle on the Hudson’, in which pilot Chesley ‘Sully’ Sullenberger safely performed an emergency landing in the Hudson River on US Airways Flight 1549. A decade and half later, investors are hoping for another gentle landing – but this time, eyes turn to central banks to guide them.

In keeping with this, some had hoped – or expected – that US interest rates would start to decline as early as March. However, the US inflation data for December, released last week, indicated that things are still complicated. In December, headline inflation rose from 3.1% in November to 3.4%, while core inflation, which excludes the volatile food and fuel sectors, decreased from 4.0% to 3.9% in the same period.

TwentyFour Asset Management partner Felipe Villarroel said the data didn’t indicate any alarming patterns that would prevent inflation from finally returning to the desired 2% rate. But he also said:

“From a macro point of view, it is not surprising to see monthly inflation numbers being volatile. The downward path in inflation is likely to continue to be bumpy and the ‘last mile’ might prove more stubborn than declines seen in previous quarters.”

He therefore predicted that a US interest rate drop in March is unlikely to occur. The US interest rate-setting Federal Open Market Committee will convene again at the end of January. Market players are probably going to be keeping a careful eye out for any indication of the direction they want to take in 2024.

International shipping concerns and tech company success

Geopolitical concerns keep making things more complicated. In Yemen, hostilities between the West and the Houthis are getting worse. The US and the UK have retaliated with missile attacks of their own in the Red Sea, where the Houthis have been shooting at international shipping. Because the Red Sea is crucial to global shipping routes, the increased unpredictability is already affecting fuel prices.

US stocks increased in spite of these concerns. Specifically, the familiar technology companies had a successful week. Notably, Microsoft surpassed Apple last week to grab the top spot as the most valuable company in the world. Both businesses had weekly market values of more than $2.88 trillion; however, Microsoft overtook its long-standing competitor following a 1% gain on Friday.

Predictions of a eurozone rate cut in March cool

In the eurozone, things are still unclear. Governments and central banks have been battling both inflation and a number of slow-moving economies. Following a brief dip two weeks prior, European markets resumed their rather feeble expansion last week. The unemployment rate in the eurozone was found to be 6.4% in December, the lowest since the single currency’s inception.

Chief Investment Officer of BlueBay, Mark Dowding, explained what this implies for the currency block:

“A tight labour market highlights ongoing risks to wage inflation and, in this context, [European Central Bank (ECB) Board member] Isabel Schnabel made comments suggesting that the ECB only sees a modest decline in wages as likely in 2024.

“These comments were taken in a relatively hawkish light in comparison to her comments prior to Christmas, which had been quick to emphasise the progress in bringing inflation down during the fourth quarter last year. Consequently, enthusiasm for a rate cut in March has cooled.”

To somewhat highlight the contradictory worries, German statistics released yesterday morning showed that the largest economy on the continent shrank by 0.3% in the last quarter of 2023 and shrank by the same amount over the course of the whole year.

Declining equities in the UK and China

Last week’s typically mixed equities performance was also seen in the UK, where the FTSE 100 declined. Chinese equities also fell. The problems with the real estate market there still continue to lower values. However, the mood was probably affected by caution ahead of Taiwan’s General Election and Beijing’s retaliatory sanctions on a number of US defence companies.

Wealth Check

It was encouraging to see headline inflation decline in late 2023. However, a lot of small and medium-sized enterprises (SMEs) continue to encounter significant obstacles, such as persistently rising prices and consumers cutting down on discretionary spending.

Businesses are still getting used to higher interest rates, which a lot of economists predict will eventually become the ‘new normal’. The effects of growing energy prices, problems with the supply chain and unstable geopolitical conditions are still being felt. So, it appears that business uncertainty will persist long beyond 2024. If you don’t handle these trading conditions now with a formal, dynamic, long-term strategy, they may have an effect on your margins in the upcoming year.

Short-term adjustments can be made to address specific problems that your company is facing, such as wages and higher interest rates. However, these steps will probably be piecemeal and may have unexpected repercussions if they are not a part of an official, documented long-term plan.

If you, for instance, reduce necessary marketing expenditures or pass on supply chain price increases without proper planning, the demand for your products may be severely damaged, making you weaker when the downturn eases. Businesses should routinely update their sales and cash-flow estimates and incorporate these updates into their long-term plan as economic conditions change.

Client non-payment or late payments pose a risk during economic downturns and might reduce your earnings. But opportunities can also arise from downturns, and some SMEs are modifying their strategies to speed up their recovery from the downturn. To take advantage of lower company valuations, a number of well-managed businesses have switched from organic growth to acquisition models, or growth through the purchase of other businesses.

Others are growing into new markets, services or customer segments in order to take advantage of holes in the market when they appear. The more lenient labour market will be used by others to find talent. Unwritten plans are not telekinetically understood by people. Jotting down ideas on paper won’t be sufficient to maintain the viability and growth of your company. Clients, internal teams, investors and suppliers are all people you must bring along.

Explain your strategy, put it in writing and schedule frequent reviews to make sure it stays on track. Now is the time to take deliberate action. Make your arrangements now so you can enter 2024 with confidence.

In The Picture

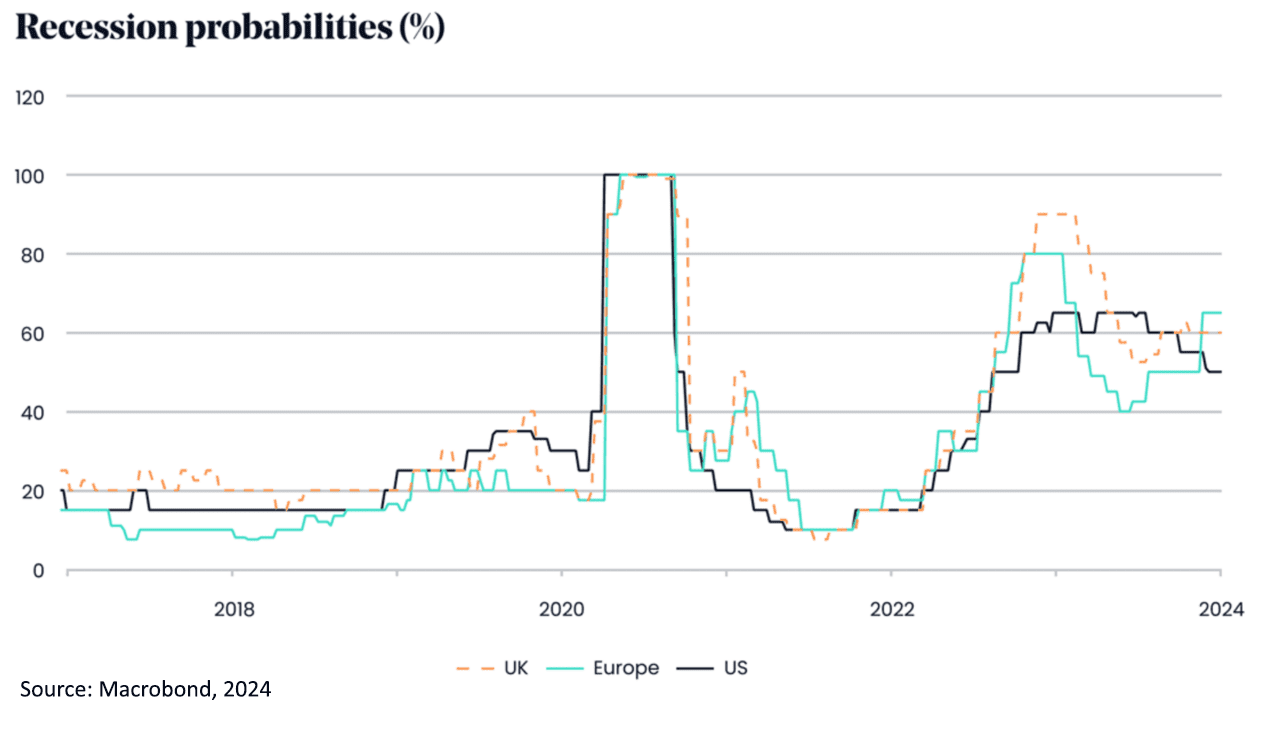

Given the elevated risk of inflation in several countries, maintaining a diversified portfolio remains a crucial investment strategy.

Past performance is not indicative of future performance.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The Last Word

“We very much hope they will take a lesson from this and stop harassing shipping.”

– UK Defence Secretary Grant Shapps explains the UK’s decision to bomb Houthi sites in Yemen.

BlueBay and TwentyFour are fund managers for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 15/01/2024