WeeklyWatch – Unexpected spike in inflation wounds the UK market

23rd January 2024

Stock Take

UK inflation heads away from 2% goal with small rise this week

UK figures released this week indicated a slight rise in inflation in December, which was an unpleasant shock for those anticipating that inflation had been firmly heading down towards the 2% objective.

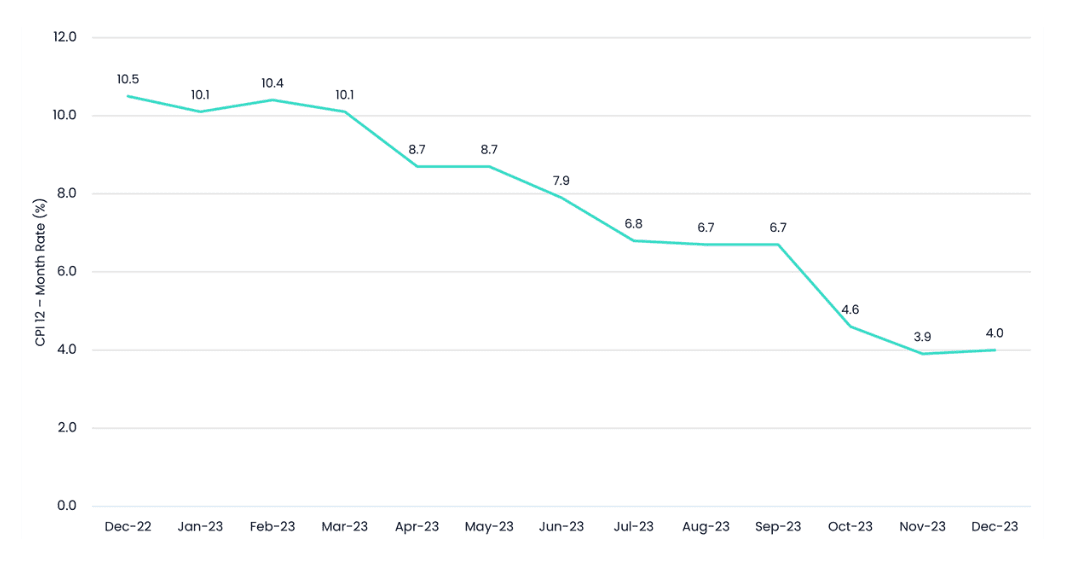

The Office for National Statistics (ONS) reports that during November and December, the UK’s inflation rate went from 3.9% to 4.0%, a small increase.

Even though it was only a modest spike, this was the first increase in inflation in 10 months.

The government’s announcement of new tobacco duties during the Autumn Statement was the main driving force behind it.

Head of Economic Research, Hetal Mehta, explained what this could mean:

“After coming in weaker than expected in November, UK inflation numbers for December surprised to the upside, so we ended the year at 4%. Inflation will continue to fall through this year, but the trajectory will be bumpy.

“The Bank of England will need more convincing evidence of inflation getting sustainably to 2% before signalling a willingness to cut rates. The third quarter of 2024 is still more likely than [the] first half of the year for the beginning of the easing cycle.“

Eurozone markets watch closely for signs of an interest rate cut

The FTSE 100 dropped throughout the course of the week as reports indicated that the path to 2% inflation would not be as smooth as many had anticipated.

Similar events occurred in the eurozone, where stocks declined due to dwindling expectations of a cut in interest rates as early as March. As inflation decreased over 2023, these expectations grew; however, some European Central Bank (ECB) officials pulled back on their support for the plan last week.

President of the ECB, Christine Lagarde, told Bloomberg:

“There is still a level of uncertainty and some indicators that are not anchored at the level where we would like to see them.”

A cut is still most likely to come next, although this is now predicted to happen later in the year. Nevertheless, when the ECB meets on Thursday, markets will be watching closely. Every indication as to when interest rates could shift will be closely examined by market players.

Tech stocks and AI help boost US performance

Those who followed US markets in 2023 would have recognised the pattern of an increase in US indexes headed by technology firms this week.

This momentum has been supported by the optimism around artificial intelligence (AI), which has been fuelled by predictions of significant earnings growth over the coming years. A number of companies involved with AI experienced further excellent performance last week.

In local currency terms, the S&P 500 gained 1.2%, while the NASDAQ, which is dominated by the technology sector, increased by 2.3%. This happened in spite of a drop in Federal Reserve (Fed) rate-cut expectations for this year, which have subsided in light of inflation data that is above expectations.

China faces declining equities and a tumultuous real estate market

In China, where the Shanghai Composite index fell for the eighth time in nine weeks, the situation remained complicated. 5.2% GDP growth during the three months prior is impressive when compared to Europe, but it was also a little less than anticipated.

The continuous difficulties in the real estate market and the reports that China’s population would decline by more than 2 million in 2023 have probably soured people’s moods.

Martin Hennecke, Head of Asia Investment Advisory and Communications at St. James’s Place, pointed out that technological and regulatory advancements might still support Chinese company valuations even if the country’s economic and demographic situation remains challenging. He commented:

“With China observers focused on GDP data last week, many investors seem to be unaware of the security regulator’s (CSRC) recent drive to promote shareholder value by pushing companies to raise dividend pay-outs and facilitating stock buy-backs – akin to a similar initiative we saw in Japan that helped drive the Nikkei 225 to a 34-year high the prior week.”

Wealth Check

How do you imagine your future? Cruising the Norfolk Broads by narrowboat, or relocating to the Bahamas? Maybe you’ve decided that you’d like to start that micro business you always dreamed of, or move closer to family?

As humans, we’re hard-wired to live in the present – it’s part of our survival instinct. But we all need to be clear about the future life and lifestyle we want if we’re going to make them a reality.

Our priorities and goals change as we grow older, and it can be difficult to keep them clear in our minds. You will want time to think things through, but you don’t have to make a snap decision. However, you shouldn’t enter retirement without considering your post-retirement plans.

Some personal objectives, like leaving employment before turning 60 or raising a family, are connected to significant life events. Others are focused on our goals and aspirations, such as becoming a pilot or launching a small company later in life. We may wish to travel with our children, provide them with the greatest education possible or leave them a good legacy.

Some people are fortunate enough to have a clear vision of their objectives. But as we age, most of us have different aspirations. Our experience in helping individuals in realising their life’s ambitions and goals has taught us that the most significant personal objectives you establish have to be based on your own values.

For instance, a lot of us have strong beliefs about investing sensibly, combating poverty and protecting our planet.

Setting objectives is easier and more obvious when you know what you believe in. These objectives form the cornerstone of every person’s financial strategy. Before even beginning to plan, financial advisers spend a lot of time listening to their clients and helping them in determining what matters to them, so, together, they can build the strategy that would bring them there.

Since every person has specific financial aims, every financial strategy should be tailored to each of us.

In The Picture

December’s UK inflation figures offered a reminder that the battle against inflation isn’t over. That said, it’s worth looking at what is driving the numbers – in this case new duties on tobacco.

The Last Word

“I can’t ask our supporters to volunteer their time and donate their resources if we don’t have a clear path to victory.”

– Ron DeSantis drops out of the race to become the Republican candidate in this year’s US Presidential election.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 22/01/2024