WeeklyWatch – US tech stocks continue to gain momentum on flat interest rate horizon

6th Febuary 2024

Stock Take

Tech stocks step up the tempo

Market observers will have identified a familiar pattern last week: interest rates remained high, and large technology companies increased in value.

Last week it was the turn of key players Meta and Amazon to make headlines. Meta drew particular attention following its announcement of substantial growth in fourth-quarter profits and the intention to pay its first-ever dividend. This dual revelation contributed to a 20% increase in the company’s value over the course of the week.

While not as striking, Amazon’s robust performance also helped boost its share price, reaching notable levels reminiscent of its historic highs during the COVID-19 bubble.

These results helped drive the S&P 500 to another good week, as it ended up 1.9% in local currency.

Interest rates remain steady

The Federal Open Market Committee (FOMC) met last week, opting to keep interest rates at their current – relatively high – rate for a while longer. Markets were relatively unfazed by the news.

Indeed, the Committee is having to play a careful balancing act at the moment, as noted by Mark Dowding, Chief Investment Officer at BlueBay:

“Although [Federal Reserve chair Jerome] Powell sought to downplay the idea that rates will decline as early as March, the market has shown [an] appetite to front-run the Fed, and a narrative gaining traction is that where the market leads, the Fed will now follow.

“The Fed will have known that removing the bias would invite near-term rate cutting speculation. In this context, if the desire was to downplay and not feed these expectations, the FOMC could have retained the existing bias for a little longer, yet it chose not to do so.”

Certainly, employment data stands out as a key indicator for any decision the FOMC makes. In the previous week, the Bureau of Labor Statistics disclosed an addition of 353,000 jobs to the US economy in January, showcasing the remarkable resilience of the nation’s economic landscape. This figure shocked analysts, as their projections were generally hovering around 200,000.

While these statistics may be encouraging for Joe Biden as he embarks on an election campaign, they present a different perspective for the Fed. Such high numbers will reduce the rush to bring down interest rates. Chair Jerome Powell emphasized this sentiment over the weekend, stating: “The danger of moving too soon is that the job’s not quite done.” The wait for an interest rate cut is likely to be a little longer than previously expected.

UK interest rates also at a standstill

It’s probable that British interest rates will remain at their current, high, level for some time yet. Last week the Bank of England’s (BoE) Monetary Policy Committee chose to keep interest rates at 5.25%. Governor Andrew Bailey highlighted the question the Bank was asking itself was: “How long do we need to hold this position for?”

According to Hetal Mehta, St. James’s Place Head of Economic Research, the UK is likely to be behind its EU and American counterparts in this regard. She said:

“The BoE has confirmed what most market participants had taken as a given: that the MPC as [a] whole doesn’t have a hiking bias anymore. However, today’s vote split was not consistent with market expectations at this stage of the inflation cycle. While much progress on overall inflation has been made, services inflation – rightly so – is concerning the BoE. We still think the BoE is likely to be behind the ECB and Fed in cutting rates.”

Overall, the FTSE 100 ended the week down 0.3%.

Unstable markets and declining equities in China

Shifting focus to China, share prices experienced another tough period. A fortnight ago, Chinese equities saw an increase, influenced by policy tweaks by the People’s Bank of China.

Nevertheless, heavy selling pressure resurfaced in the past week, causing the Shanghai Composite to shed 6.2% in local currency terms. Local indices have now reached their lowest point in five years, prompting the China Securities Regulatory Commission to issue a statement indicating its intention to step up market stabilisation measures. However, the statement lacked detail, and only time will reveal how successful their actions may be.

Wealth Check

As seen clearly over the past two years, interest rates and inflation rates are subject to dramatic fluctuations. And it could have a very serious impact on your daily living expenses as well as the spending power of your assets and savings.

Most things now cost more due to rising inflation. This has the unintended consequence of making whatever savings you have less valuable in the future, unless the interest you receive on them exceeds the rate of inflation.

Therefore, whenever new monthly figures are published, it’s a good idea to check your existing interest rates on any Cash ISAs or savings accounts to see how they stack up against inflation.

It’s not always the smartest strategy to rely only on your high street savings to beat inflation.

Even when banks pay interest on Cash ISAs and instant access savings, the usual high street rates don’t always keep up with or surpass inflation. This implies that your funds’ purchasing power gradually decreases, as we’ve seen.

Investing can be a better option to protect your money against inflation if you intend to save for the long run.

Investing in assets that have the potential to yield a higher rate of return than interest rates is the key to trying to combat inflation. In the long term, that’s often equities or stocks and shares. Though there is no guarantee that they will, they have the capacity to outpace inflation.

Investing in a variety of assets, such as bonds, stocks and real estate, is another effective strategy to strengthen and diversify your portfolio.

However, you should be aware that there is some risk associated with investing. You can always discuss the level of risk you are comfortable with with your financial adviser. They can also help you in choosing a diversified portfolio that complements your long-term financial goals.

Please be aware past performance is not indicative of future performance.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select, and the value can therefore go down as well as up. You may get back less than you invested.

Equities do not provide the security of capital which is characteristic of a deposit with a bank or building society.

In The Picture

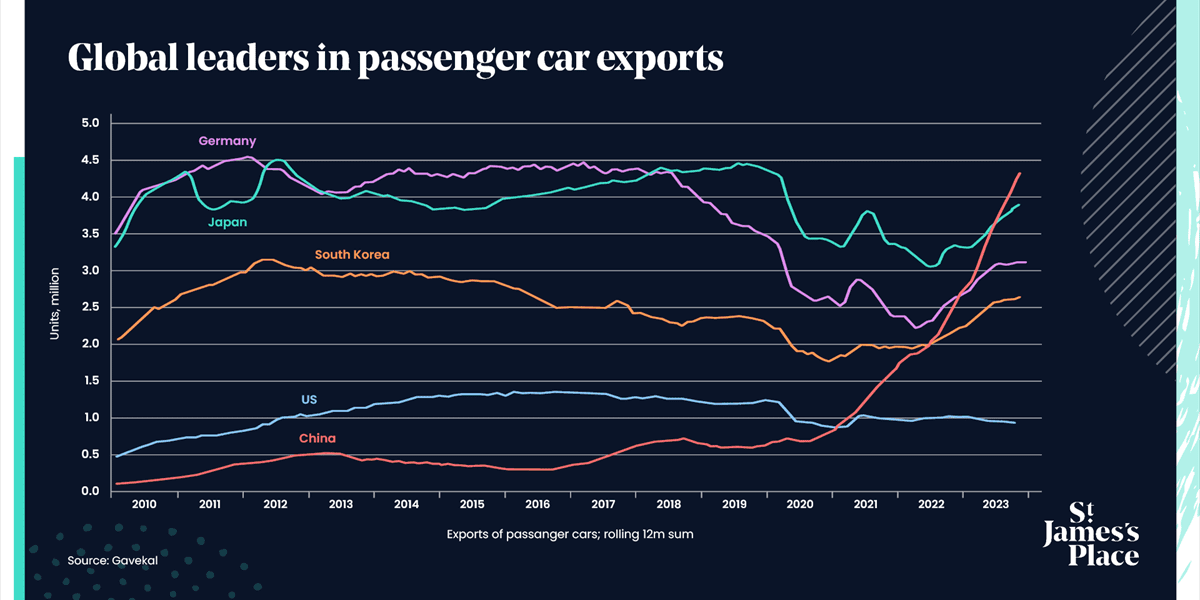

China has emerged as a global automotive powerhouse during the last four years, with a sharp increase in the export of passenger cars.

The Last Word

“All I want to do is keep being able to do this. I love it so much. It makes me so happy. It makes me unbelievably blown away that it makes some people who voted for this award happy too.”

– Taylor Swift after becoming the first artist in history to win four Album of the Year awards at the Grammys.

BlueBay is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 05/02/2024