WeeklyWatch – Markets respond to UK recession amid release of latest economic statistics

20th February 2024

Stock Take

FTSE and the UK recession

Sometimes, economic figures and stock market performance don’t match up – as demonstrated by the UK last week. Newly released figures showed that the economy shrank by 0.3% between October and December 2023. This came on the back of a smaller contraction in the previous quarter; as a result, the UK is now in a recession. Yet in spite of all of this, the FTSE 100 rose as the week went on.

Falls in consumer spending on food, beverages and retail trade have been highlighted by the Office for National Statistics (ONS) as causes of the slowdown. These falls could be seen as a sign that the Bank of England’s efforts to slow down the British economy to help reduce inflationary pressures are going according to plan. Over the course of the entire year, the UK economy grew by just over 0.1% – but the ONS’s figures are subject to revision.

For the investment world, it must be noted that most of the FTSE 100 revenue comes from outside of the UK. FTSE companies can still thrive despite the UK’s economic struggles.

Better news for UK inflation statistics

In more promising news, the ONS went on to reveal that inflation was flat at 4% in January. General consensus predicted that it would rise slightly, and the resulting figures spurred markets on, the success of which can be seen in the way that the FTSE 100 ended the week up 1.8%.

St. James’s Place Head of Economic Research, Hetal Mehta, stated:

“UK inflation moved sideways in January. Whilst the uptick that economists were expecting was avoided, it still remains at double the Bank of England’s 2% target. What will still be concerning the Bank of England is the stickiness of services inflation, especially as it comes on the back of strong wage growth. But compared to big upside surprise in US inflation, today’s UK numbers come as slight relief in relative terms.”

US rocked by inflation statistics

In comparison, US inflation is still lower than the UK. But it wasn’t quite what was expected – after predicting a sub-3% figure, January’s US inflation figure came back at 3.1%. This shock assisted in causing a drop in US equities on the day the figures were revealed. Due to this higher data coming back, it makes it more likely that the longed-for interest rate cut will be pushed back further.

Despite having reached a record high the previous week, in dollar terms, the S&P 500 declined by 0.4% and the NASDAQ declined by 1.3%. Value shares outperformed growth shares – an unprecedented occurrence in the last few months – and smaller companies also celebrated a good week.

Variability across Asian markets

The Japanese economy also entered into a recession at the end of 2023, but similarly to the UK and the FTSE, the Japanese Nikkei Index performed well. In part, this was because of the weakness in the yen, in conjunction with a series of strong company results.

Chinese equities have been unstable in the last few months and the mainland markets were shut last week. But despite this, Hong Kong companies started trading again midweek.

Head of Asia & Middle East Investment Advisory & Comms, Martin Hennecke, notes:

“Chinese share buybacks in January reached their highest levels since 2021, when the data was first compiled, as companies increasingly look to take advantage of historically low valuations.”

Wealth Check

Passing on pensions

A lot of people only begin to contemplate inheritance when it comes to drawing up their Will. But deciding how much to allocate and to whom is a good focus for the mind. Financial planning ensures real value and tax efficiency and will take retirement and inheritance into consideration to produce a good, long-term family financial plan.

Other than property, your pension savings are one of the biggest legacies you can leave when you’ve passed away. It’s therefore a good idea to evaluate whether you’ll require it for your retirement.

By passing on a pension, you can support your children in realising and achieving their life goals. This could include paying off a mortgage early, enabling your grandchildren to go to great education establishments or setting up a new business. But a pension doesn’t have to be set aside just for children or other relatives; you can leave it to anyone you wish. Leaving pensions to grandchildren – effectively skipping a generation – is becoming a more common choice.

Bear in mind that you can’t pass on your State Pension. A Final Salary or Defined Benefit pension also cannot be passed on the same way as a Defined Contribution pension. These pensions most commonly pay out to a spouse or nominated beneficiary should you pass away before them.

It is occasionally possible to transfer Defined Benefit pensions into a pot of money that is held in a Defined Contribution scheme. This can be passed on to an heir. In order to do this, professional advice must be sought if the pension transfer value is more than £30,000.

Passing on a Defined Contribution pension can be dependent on the type of scheme that is, your age at death and if you have accessed some of the existing money. It is strongly suggested that you speak to your financial adviser before any decisions are made. The last thing you want to do is leave your dearest ones with a big tax bill instead of a good inheritance.

If retirement and planning family finances are relevant at your stage of life, please get in touch with us.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. It is possible that you may get back less than the amount invested.

Levels of taxation, and reliefs from taxation, can change at variable times. The value of any tax relief depends on individual circumstances.

In The Picture

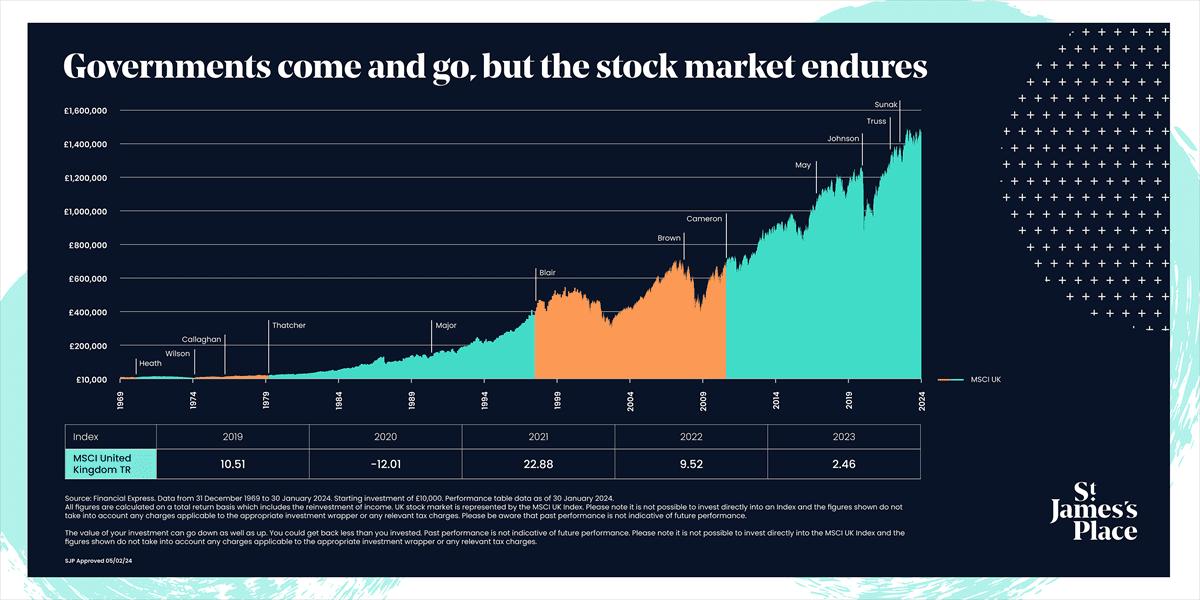

64 countries are holding elections this year, meaning that half of the world’s population will be going to the ballot boxes.

Elections cause speculation, and consequently, temptation arises for investors to time the market. But history has demonstrated that markets prove their resilience over time, no matter what the political and global landscape. While geopolitical events can cause short-term instability, overall it is rare that they undermine the growth potential of well-diversified portfolios.

The Last Word

“There have been countless Marys throughout history who have never had the chance to wear a beautiful gown and stand on this stage here in London. Telling her story is a responsibility I do not take lightly.”

– Da’Vine Joy Randolph celebrates winning the BAFTA for Best Supporting Actress for her role in The Holdovers.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 19/02/2024