WeeklyWatch – Global economic data alters political directions

12th March 2024

Stock Take

The UK Budget revealed

In the UK, the main economic news of the week was the Budget. Chancellor Jeremy Hunt revealed few surprises and confirmed a large amount of pre-election tax sweeteners. This included a 2% cut in employee National Insurance contributions. The markets remained quiet in their reaction to the statement.

Jeremy Hunt went on to announce a consultation on a new British ISA, extending the annual ISA allowance to £25,000 for those investing the extra £5,000 in UK assets. The industrial response was mixed towards the idea, highlighting concerns over its complexity and whether the goal of boosting investment in UK companies would be achieved.

The Office for Budget Responsibility, the government’s official forecaster, had some good news, saying that they now expect the UK economy to grow 0.8% this year, which is an increase from the previous prediction of 0.7%. They also increased their expectation for 2025 from 1.4% to 1.9%.

Head of Economic Research at St James’s Place, Hetal Mehta, stated:

“With all the big headline grabbers already leaked or rumoured, there was little unexpected in the chancellor’s announcements, undoubtedly bringing a welcome sigh of relief from the gilt market. Taxes are down, with a focus on workers, but that won’t prevent the tax burden from rising to the highest [level] since the late 1940s.

“The remaining fiscal wriggle room is now even smaller than it was back in November, which gives little scope for the OBR’s relatively upbeat forecasts to disappoint. We could still see one more fiscal event if the election is in the autumn, but the room for more giveaways seems slim.”

Chinese pensions under risk

It’s predicted that the Chinese pension system will run out of money by 2025 if it continues on its present trajectory. Last year, the Chinese population dropped by three million. With a decreasing and ageing populace, the country faces a significant demographic problem, which has been driven by its former policies, including the one-child policy. What’s more, young adults across the country are also now less inclined to have children and, as a result, this puts its economic revolution and the change to a consumer-led growth model at risk.

It’s been a busy week for central bank news, political events and the release of economic data. Investors kept their eyes on the annual meeting of China’s National People’s Congress (NPC) and Premier Li Qiang’s promise to completely change its economy, which is currently being hampered by deflation risk, property crisis, weak household consumption and local government debt issues. Li Qiang has put forward a bold economic growth target of around 5% for 2024. This has caused much scepticism and invited a wave of new stimulus measures.

This familiar talk from China’s leaders has left investors feeling underwhelmed, particularly with their apparent contentedness with the current track of the economy and reluctance to put stronger stimulus in place.

Senior Emerging Markets Economist at Schroders, David Rees, suggested:

“There was little to cheer at the NPC, but bad economic news could eventually become good news for Chinese equities if the rising risk of outright deflation prompts the authorities to take more aggressive fiscal and monetary action.”

The challenges that the Chinese are currently facing have been compared to Japan’s ‘lost decades’ since the 1990s. However, there’s an important distinction; Japan became rich before it became old, but in China, it’s happening the opposite way.

Looking to markets, there was another record high for Japan’s Nikkei 225 index before it retreated on Thursday. Corporate spending on plant and equipment increased massively in the fourth quarter of last year; this surge is likely to change GDP from negative to positive, meaning that Japan was not in recession.

Great wages data provoked a Bank of Japan (BoJ) official to hint that the country was moving in a sustainable direction towards its 2% inflation target and increased hopes that the BoJ could cease negative interest rates as early as this month.

Europe and US gearing towards June rate cuts

Federal Reserve Chair Jerome Powell testified to members of Congress on Wednesday and repeated his wait-and-see rhetoric on when and how quickly there will be cuts to US interest rates. He warned that sustained progress on lowering inflation was “not assured”. However, he did imply that rate reductions would “likely be appropriate” if the economy changes as they expect.

Investors predict rate cuts to begin in June, with more decisions to be taken on this throughout the scope of a presidential election year. Primary election results that took place on Super Tuesday almost certainly guaranteed a repeat of Biden vs Trump in November.

A similar pattern was seen on Thursday from the European Central Bank, keeping interest rates at a record high, but preparing the way for rate cuts to take place in June, indicating that first- quarter wage data would be key in achieving its inflation target.

Excitement in the expectation of transatlantic interest rates coming within the next few months spearheaded global shares to record highs, even though most major indices ended the week fractionally lower with investors scooping some profits. A mixed US jobs report gave markets encouragement, which meant that the plan for a June rate cut was still feasible. US employers added 275,000 jobs in the previous month, but this still remained a huge reduction from months prior. The unemployment rate increased to 3.9% – a two-year high. This also hinted at a softening of underlying labour market conditions.

Wealth Check

Using pensions and ISAs to reduce your tax bill

Pensions and ISAs remain the most popular and tax-friendly ways to save for many people in the UK. If you use all your pension and ISA allowances before the end of the tax year, it will bring your tax bills down.

Despite the Budget announcing a National Insurance cut, a large number of us will still be facing more expensive tax bills. The personal allowance has been frozen until 2027/2028, and the additional rate threshold will drop to £125,140.

Furthermore, the tax-free allowances for Dividend and Capital Gains Tax will be halved in 2024/2025 to £500 and £3,000 respectively.

As a result of these changes, you may be required to invest more if you wish to achieve your long-term targets – or just to pay your tax bill. It’s strongly advised that you make the most of all your pension and ISA allowances.

Pensions are still more tax-efficient than ISAs. The basic-rate tax relief assures you of a 20% cash boost from the government based on contributions that you make (subject to certain limits). Additionally, if you’re still included in a workplace pension scheme, your employer is contributing at least 3% of your qualifying earnings.

Why should you be saving more into your pension?

You can’t access your pension until you’re 55 (this is set to increase to 57 in 2028) and it prevents temptations to use your savings. Also, you can opt to pass your pension pot on when you pass away.

Pension contributions don’t just save you tax in the short term, but they can also save on your Inheritance Tax (IHT) liability. For the most part, pensions fall outside of a person’s state when it comes to paying IHT, and it’s a great parting gift to leave to a loved one.

ISAs remain immensely popular, as they’re tax-efficient, simple and a flexible way to save money. Types of ISA include cash, stocks and shares, lifetime and innovative finance.

As you don’t pay tax on interest, Income Tax or Capital Gains Tax in any of these ISAs, they don’t need to be declared on a tax return.

A financial adviser can assist you in your decision on how you split your money between pensions and ISAs and progress your financial welfare in the present and the future.

The value of an investment with St James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. It’s possible that you may get back less than the amount invested.

Levels of taxation, and reliefs from taxation, can change at variable times. The value of any tax relief depends on individual circumstances.

Please note that St James’s Place doesn’t offer cash, lifetime or innovative finance ISAs.

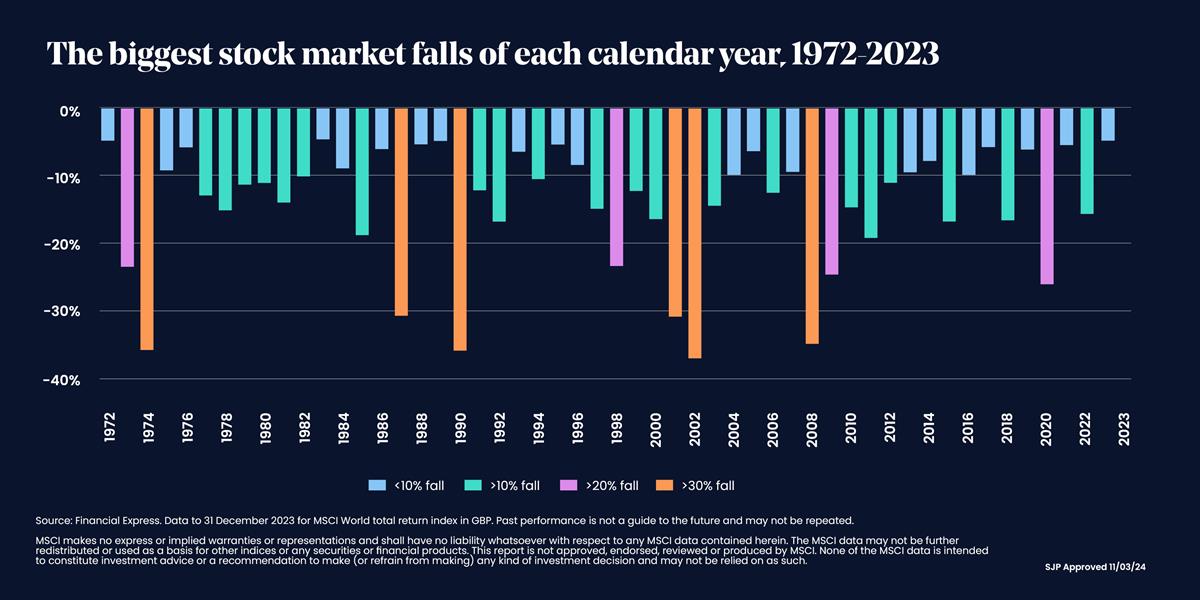

In The Picture

Although markets can look like they’re doing well, it’s worth remembering that prominent drops in prices are expected now and then. They’re not a reason to panic, as over time markets have always made a recovery.

The Last Word

“To the Academy – movies are just a little bit over 100 years old… We don’t know where this incredible journey is going from here. But to know that you think I’m a meaningful part of it means the world to me.”

– Christopher Nolan celebrates winning the Oscar for Best Director on Sunday night, one of seven awards Oppenheimer won.

Schroders is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 11/03/2024