WeeklyWatch – Interest rates decisions take centre stage

8th May 2024

Stock Take

The Japanese yen vs the US dollar

May started with a bang, with high-profile earnings competing with crucial economic data to spur the broader market into action. At the top of the list of these economic clues was the result of the US Federal Reserve’s two-day meeting over interest rate setting.

Japanese authorities were at the centre of attention at both the start and conclusion of the week. In order to try and control the rapid decline of the yen, it’s widely believed that the Ministry of Finance had to intervene twice in currency markets – something which hasn’t been seen since the end of 2022.

As US interest rates have risen, it has put the yen under pressure and caused Japan’s interest rates to stay near zero. However, Japan’s interest rates did surge against the dollar on Thursday, allowing the authorities to maximise the benefits, as the surge coincided with US markets being closed just a few hours after the Fed’s interest meeting had concluded.

BlueBay Asset Management’s Mark Dowding noted:

“The Bank of Japan (BoJ) needs to adjust its mindset and recognise that its monetary policy decisions are driving the yen. With the Japanese currency undermined by excessively accommodative monetary policy, the impact of intervention may prove short-lived. Commonly, we have always seen that intervention can only smooth moves and change in the directional trend requires a change in BoJ policy.”

More figures from the Magnificent Seven

The last two tech giants – Amazon and Apple – revealed their first-quarter results last week. Cloud computing and a 24% growth in advertising were responsible for more than tripling Amazon’s profits.

Apple shares, meanwhile, have struggled when competing against the other big-tech companies. They have seen a 10% fall this year due to low demand for the iPhone and are facing stiffer competition from brands like Huawei. The world’s second most valuable company announced their quarterly results on Thursday, which quashed modest predictions and saw a 4% increase in its dividend. In addition, it was able to grant the largest share buyback in company history of $110 billion.

Global indices take a hit

At the end of April, all major US equity indices clocked their first monthly percentage losses since October and were joined in the negative by global counterparts. Despite this, the UK’s FTSE 100 defied the odds by rising another 2.4% after its run of record closes.

US stocks and the influence of the Magnificent Seven have had a huge impact on global equity returns. Since 2020, US stocks are suspected to have accounted for 80% of total returns from the MSCI World Index, while big tech stocks have been responsible for 60% of the S&P 500 returns over the last year.

The Fed has its say on interest rates

Ahead of the US Federal Reserve rates announcement, investors processed the news that during the first quarter, US labour costs had increased more than first predicted, which only contributed more to the bleak inflation forecast. The faster wage growth runs the risk of stoking inflation further, especially if employers pass on higher labour costs to consumers.

US consumer confidence took a hit in April before any of this impact could be felt, as people became concerned over the labour market and higher prices for food and fuel.

Most markets across Europe and Asia closed on Wednesday for the May holiday and ahead of the Fed’s policy decision.

The Fed held rates steady and gave no indication as to when they were going to lower them, all of which came as little surprise. A rate cut will happen down the line, but the central bank was strong in their stance that the start of 2024 had inspired little confidence to show that inflation was falling.

Chairman of the Fed, Jerome Powell, said:

“The difference between the United States and other countries that are now considering rate cuts is they’re just not having the kind of growth we’re having. We can be patient.”

The huge reaction across the markets was one of relief that the Fed had quashed any rumours of rates needing to be raised again. The announcement meant that stocks across the world were elevated.

The OECD weighs in

The US’s integral role in the global economy and proven resilience in its recent activity was further highlighted in the upgraded outlook for global growth for 2024 and 2025 by the Organisation for Economic Cooperation and Development (OECD). They stated the consistent lethargy in Europe and Japan was being offset by the US, where the growth forecast for 2024 has been increased to 2.6% compared to its previous expectation of 2.1%.

The OECD went on to say that out of all the largest developed nations, the UK economy would have the slowest growth and Germany would have the slowest expansion this year.

US employment figures

One of the final actions of the week was the announcement of the highly anticipated US employment figures. They showed that job growth had slowed much more than expected over April, and there had been a rise in the unemployment rate from 3.8% to 3.9%.

Global shares were positive towards the end of the week, and there was renewed hope that there was evidence of weakness in the jobs markets to give the Fed more of an incentive to cut interest rates later in the year.

Markets made the decision to move to price in two cuts of 0.25% for the year, compared to the one that was forecast before the job numbers were revealed.

Encouraging news for European interest rate cut cause

The call for a June interest rate cut by the European Central Bank received a boost when the eurozone showed that it had recovered from its shallow recession and exceeded expectations by its ‘big four’ economies in the first three months of 2024.

There was a 0.3% growth for the single currency area, which was its best performance since the third quarter of 2022. Germany and France experienced a growth of 0.2%, whereas Italy and Spain saw increases of 0.3% and 0.7% respectively.

As a result of falling inflation, activity was boosted and new figures revealed that eurozone inflation had remained steady in April at 2.4%, adding further encouragement to the prospect of a rate cut. Core inflation, which doesn’t include unstable food and energy prices, slowed down to 2.7% from 2.9%.

Wealth Check

What does a death-in-service benefit mean for my inheritance?

Receiving an inheritance can change everything. By receiving an inherited lump sum, you can send your children or grandchildren to a good school or enable them to see the world during a gap year. It can also mean that a mortgage can be paid off early, or you could even launch a new business or passion project.

As it stands in the UK, IHT is usually charged at a rate of 40% on the portion of an estate over the £325,000 threshold, or up to £500,000 if it includes a family home worth £175,000 or over that is passed on to children, grandchildren or another descendent.

People aren’t always aware that death-in-service benefits or workplace pension lump sums can aid your family in avoiding a high IHT bill. These are not usually counted as part of your estate, meaning that you don’t pay IHT on them.

Even though those large amounts of money won’t be considered part of your estate, they will eventually be counted as part of your beneficiary’s estate when they die. It’s at this point that IHT will be payable.

A lump sum from a death-in-service benefit or workplace pension payout is intended to be a financial help to families, but it can in fact be a mixed blessing.

Death-in-service benefits are often multiples of salary. If people don’t cross any thresholds with IHT, a payment from one of these schemes can take them over the nil rate band (£325,000) and they’ll face IHT liability.

Is a Legacy Preservation Trust (LPT) the answer to IHT?

As part of legacy planning, trusts play a huge role in securing and protecting money for your family for years to come – one such trust is a Legacy Preservation Trust (LPT).

The trust does exactly what it states: it preserves your legacy for longer and allows your money to pass on in a more tax-efficient way.

An SJP LPT is designed to hold assets such as death-in-service and pension death benefits so that your beneficiaries can access the money if they need to. But the money itself sits outside your estate, protected from IHT. If or when the beneficiaries draw on the money, there may be various tax liabilities to consider.

These trusts and legacy planning may sound complicated, and you want to do the best thing for your family. So we highly recommend that you consult with a financial adviser when you’re considering inheritance and legacy planning.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

Trusts are not regulated by the Financial Conduct Authority.

In The Picture

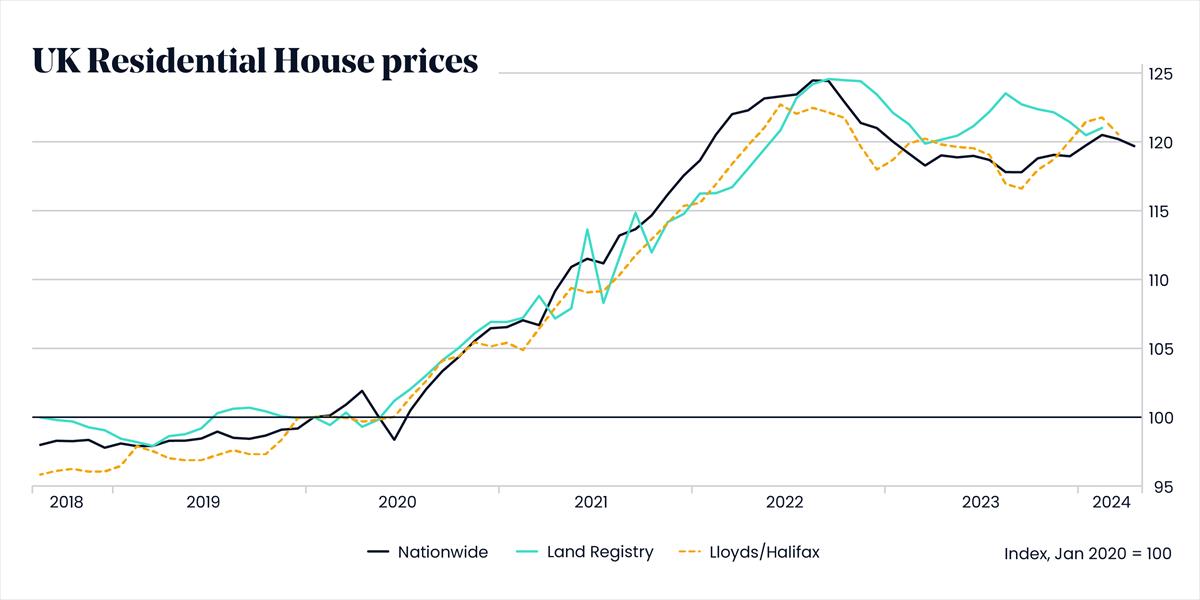

Higher mortgage rates and the cost-of-living crisis have reduced house prices since their 2022 peak, but prices mostly remain well above pre-Covid levels.

Data accurate as of 02/04/2024.

The Last Word

“I think it was Harold Wilson who said a week is a long time in politics… We have several months now before the next general election.”

– Mel Stride, Work and Pensions Secretary, appearing to rule out a snap general election following local elections that saw Labour and the Liberal Democrats make a number of gains.

BlueBay is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 07/05/2024