WeeklyWatch – Do markets rely too much on technology?

3rd September 2024

Stock Take

Nvidia calling the shots

There was wide media interest in tech giant Nvidia’s publishing of their second-quarter results last week; it only went to showcase how significant just a few large technology companies are to the US market. And the market reaction continued to demonstrate how much is expected of these companies.

Nvidia reported a second quarter revenue of $30 billion, exceeding expectations of $28.7 billion. They went on to announce a further $50 billion share buyback and stated that they’re expecting to generate $32.5 billion in the current quarter, which is $10 billion more than was initially predicted.

But is all as it seems?

But for some, this wasn’t enough. Nvidia suffered a significant drop in their share prices, and the company ended the week down by over 8%.

While Nvidia may have been the most noticeably volatile out of the tech companies, several other large tech and communications companies have been struggling in comparison to the wider US market ever since the start of August when the general slump began.

This is in contrast to recent history, where many of the same tech companies have been responsible for the growth in US equities. As a result, value has become more concentrated in a small group of big companies, dubbed the ‘Magnificent Seven’.

US equities soldiering on

Having said this, US equities have continued to perform well over the last few weeks. The markets have reacted positively to the Fed’s indication that interest rates are likely to be cut and will be done so this month.

The feeling of momentum was emphasised towards the end of last week. The core Personal Consumption Expenditures price index – a key inflation metric for the Federal Reserve – came in at an annual rate of 2.6%, slightly lower than expected but still within grasp of the 2% target set by the Fed.

Any remnants of fear surrounding the possibility of a recession have faded even further into the background on the back of the US Commerce Department’s revised figures, revealing that second-quarter GDP figures grew from 2.8% to 3%.

From US robust to German frailty

Things may be looking pretty sturdy for the US at the moment; however, the same couldn’t be said for Europe, which faced much more challenging news.

The German economic unease was prolonged when the largest European economy shrank by 0.1% in the second quarter. Germany has battled with several issues in recent years; these include a rise in energy costs, which has consequently negatively affected manufacturing output. Data from the end of last week revealed that unemployment rose less than expected; however, it still stands at 6%. These figures, coupled with the fall in job openings reported by the labour office, strongly indicate that Germany’s battle will continue.

From financial frailty to political shifting

Over the week, regional election results showed that there had been notable gains for the far-right group Alternative for Germany Party – particularly in the regions of Thuringia and Saxony. But the party is unlikely to gain total control over either state without collaboration from other parties, which has not been offered so far.

French stubbornness

Over in France, President Macron has rejected the candidacy of left-wing Lucie Castets as the next Prime Minister for the nation. Consequently, the French political system has been left in a state of limbo; the leadership remains undecided following the success of the left-wing coalition, which won the most seats in the snap election held over two months ago – which Macron called for. A decision is required to be made soon. Under French law, the government has to submit a draft 2025 budget to parliament by the beginning of October.

A gloomy Europe

As economic discomfort looms over the continent, Chief Investment Officer at BlueBay Mark Dowding believes that Europe needs to spend a lot of money in areas like defence and energy. He says:

“It is questionable whether EU leaders will want to cede increased authority to Brussels to spend, at a time when domestic priorities and national interests are dominating the debate. However, we still expect a material increase in spending in the months ahead, we just don’t know by how much – and the extent to which this may offset the need for lower interest rates in the eurozone.”

Wealth Check

Invest for their future during their youth

While you’re taking the kids to soft play, dropping them off at school or reading them bedtime stories, saving for their retirement is probably one of the last things on your mind. But by opening a pension for your children, you can set them and their future families up for a secure financial future.

Setting up a pension for a child allows even the smallest contributions plenty of time to grow. And being part of an ageing population means that planning in the early stages has the potential to cover multiple generations of your family and have a significant and positive impact. Seeking out financial advice can successfully guide you to the best tax-efficient way to help share your wealth to cover generations of your family while making sure that you’re not giving away more than you can afford.

How do I set up a pension for my child?

There’s no minimum age for having a pension. You can create one from your child’s birth if you wish!

Only a parent or guardian is able to set up a pension for a child, but once it’s in place, anyone can contribute to it; this could be parents, grandparents, friends or other family members. Any contribution that is made from these groups is counted as a gift.

Just like an adult pension operates, eligible contributions receive a 20% boost from the government, even though your child isn’t paying tax yet. The tax relief that you receive from the government is something you won’t get from contributions towards a Junior ISA, which is another tax-efficient saving tool for eligible children.

Protecting the pension

A parent or guardian is responsible for looking after a child’s pension until they turn 18, which is when control changes to them. However, the same pension rules apply, they won’t be able to access their pension until they reach the normal minimum pension age – this is rising to 57 in 2028 and is predicted to rise again after that.

For a rewarding way to spread your wealth among your family, specifically, your children and grandchildren, saving into a child’s pension is a great option. It also serves well in mitigating an Inheritance Tax (IHT) liability by reducing the size of your estate. Payments may be covered by the annual £3,000 tax-free gifting allowance, or the exemption for regular payments if made out of surplus income.

The value of an investment with Wellesley will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

In The Picture

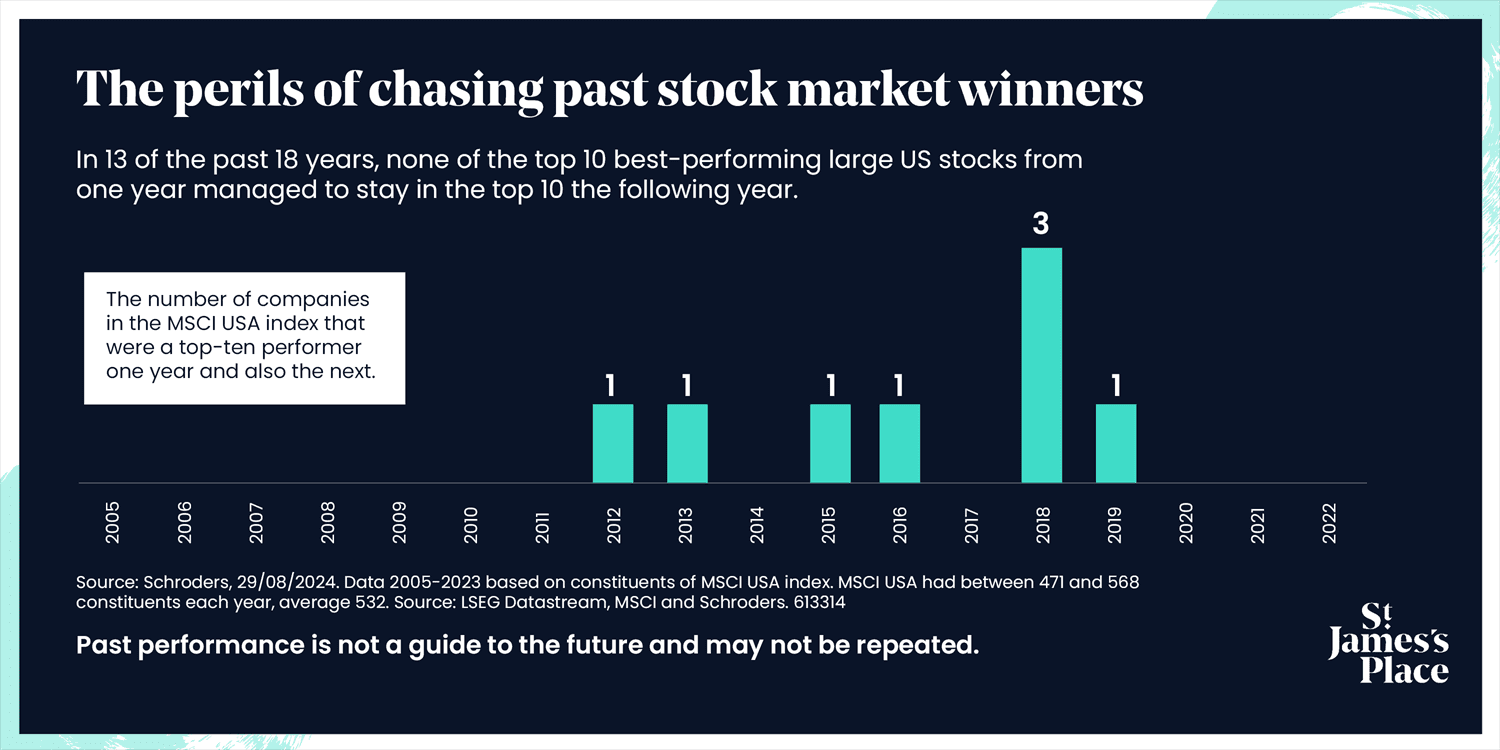

None of the top 10 performing US stocks repeated their top 10 performances the following year in 13 of the past 18 years, underscoring the risks of chasing past performance. Past performance is not a guide to the future and may not be repeated.

The Last Word

“A company that refuses to name a legal representative in Brazil cannot operate in Brazilian territory.”

– Luis Roberto Barroso, Brazilian Chief Justice, on the vote to ban X (formerly Twitter) in Brazil.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 02/09/2024