WeeklyWatch – ‘Trump Trade’ sways US markets

19th November 2024

Stock Take

Investors respond to the president-elect’s agenda

After the preceding week’s relentless news cycle, markets had less to absorb last week.

Wall Street kicked off the week by extending its post-election rally and hitting new highs. However, global stocks pulled back as the so-called ‘Trump Trade’ saw investors lean towards assets likely to benefit from the president-elect’s proposed policies. Among these were plans for aggressive tax cuts targeting workers, businesses and retirees.

Forecasters project that Trump’s tax and spending agenda could add $7.5 trillion to the already substantial $35 trillion national debt. A Reuters poll found that 62% of Americans expect his policies to drive the debt even higher. Vaccine makers also weighed on the market after Trump indicated he wanted Robert F. Kennedy Jr., a vocal anti-vaccine advocate, to lead the Department of Health and Human Services.

The week ended with Wall Street giving back some of its recent gains, as some investors took profits after the post-election surge.

Consumer inflation weighs on markets

Last week also saw investors focus on the latest US consumer inflation figures and what they might mean for interest rates.

On Wednesday, the US Department of Labor reported that consumer price inflation accelerated last month, reaching an annual rate of 2.6%. Shortly after, it was revealed that rising service costs had driven up US producer inflation in October as well. This slowdown in progress toward the lower inflation target fuelled speculation that the Federal Reserve may scale back the extent of its anticipated interest rate cuts.

Wall Street tracked higher on the view that the inflation data kept the Fed on track to cut rates in December, but its performance was ultimately impacted by the aforementioned Trump Trade movements. The MSCI World Index also slipped to register its biggest weekly drop in two months as investors digested the prospect of a slower pace of interest rate cuts ahead.

Looking further ahead, in comments on Thursday, Fed chair Jerome Powell said there was no rush to lower interest rates given the strength of the economy, but he would not be drawn on the politics of what impact Trump’s tariff and tax plans might have on future moves.

US households faring well

Meanwhile, a fall in weekly jobless claims suggested the sharp drop in job growth in October was an anomaly and the US labour market was still pottering along.

In another indicator of the health of the US economy, retail sales rose 0.4% last month – more than expected – as US households splurged on motor vehicles and electrical goods. Traders subsequently pared back expectations that the Fed would deliver its third rate cut in December.

China under pressure

Heading east, Asian markets retreated as Beijing’s latest stimulus measures failed to meet investor expectations. Deflationary pressures in China were highlighted by news that consumer prices in October rose at their slowest pace in four months, weighed down by declining food prices.

A sustained recovery in consumer spending hinges on a revival of the domestic housing market. With 70% of household wealth tied up in the struggling real estate sector, Chinese consumers remain cautious with their spending. Meanwhile, factory-gate prices experienced their steepest decline in 11 months, marking the 25th consecutive monthly drop and underscoring the significant deflationary challenges facing policymakers.

UK grocery inflation on the up

In contrast to China, UK grocery inflation edged higher for the second month in a row – just as supermarkets warned of the inflationary impact of the tax rises announced in the recent Budget.

The annual grocery inflation rose to 2.3%, up from 2% the previous month. Retailers noted that consumers have begun their Christmas shopping early, with grocery sales hitting their highest level of the year so far – despite sharp price increases in items like chocolate confectionery.

A questionable Q3

Concerns about the Budget was blamed for a slowdown in the UK economy. According to the Office for National Statistics, the economy grew by just 0.1% in the third quarter, down from 0.5% in the previous quarter, and contracted in September. A key factor was a slowdown in the services sector, which includes retail, hospitality and leisure.

The UK’s third-quarter performance lagged behind other major economies, including the US, France, Germany and Japan, highlighting the challenge for Chancellor Rachel Reeves, who has emphasised that boosting growth is the government’s “number one mission”.

Wealth Check

Are you missing out on the support you need? The role of financial advisers during times of vulnerability

Who would your first port of call be if you found yourself in challenging circumstances? Would you turn to your financial adviser for guidance or support?

Whether due to a bereavement, unexpected job loss, an accident or even a physical or mental health condition, we all face vulnerable moments in life. In fact, one in two people will experience such a time at some point in their lives.1

The taboo around vulnerability

Despite this, the latest chapter of St. James’s Place’s ‘Real Life Advice Report’ reveals a concerning finding: fewer than half of us seek help from our financial advisers during these difficult times.2 This is despite the fact that one in four of those surveyed said that financial advice had made them feel more secure when facing personal challenges.

What do we mean by vulnerability?

Two and a half million people across the UK first seek out professional advice as a result of a major life event or change. A change doesn’t always mean a challenge. However, we see that traumatic events can impair our decision-making and knock our confidence. All of these can increase our risk of financial vulnerability.

So why did more than half (52%) of respondents say they shy away from asking our financial advisers for support when they’re struggling?

Anna Blake, Chair of the Vulnerable Clients Steering Group at St. James’s Place, surmises:

“People can be reluctant to disclose vulnerabilities because they worry that it will negatively impact how they are perceived or how they’re treated.”

Advice can be a force for good

The report calls on the financial services industry to help bridge the vulnerability advice gap. Blake says she’s seen a three-fold increase in the number of clients being identified as having characteristics of vulnerability since July 2020. She adds:

“As an industry, we need to get better at communicating our value and come together to address our gaps and champion our strengths. If we do so, we have an opportunity to make a real difference and demonstrate more clearly how advice is a force for good in supporting all clients at risk of vulnerability.”

We can help you

Protect your financial future with a trusted adviser by your side. Don’t hold half of us back from asking for support when you need it most. Get in touch to secure peace of mind.

Sources:

1Financial Conduct Authority, 8 November 2023.

2The Real Life Advice Report was commissioned by St. James’s Place. Opinium surveyed just under 12,000 UK adults between May and August 2024. Quotas and post-weighting were applied to the sample to make the dataset representative of the UK adult population. Quantative data referenced is sourced from the first poll which had a total sample of 7,995 respondents.

In The Picture

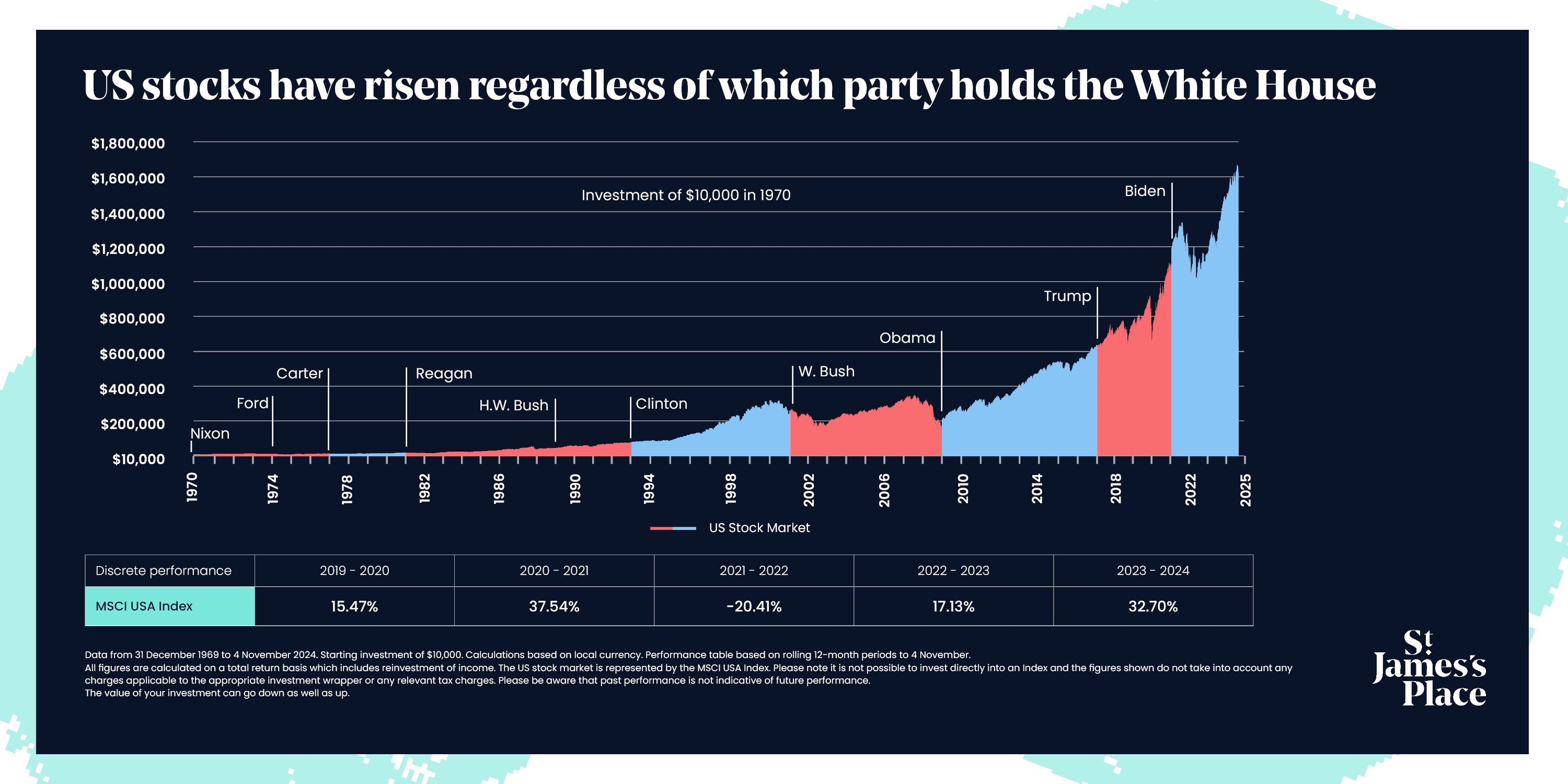

With last week’s announcement that the Republican Party has gained full control of Congress, the chances of President-elect Donald Trump’s policies being implemented have significantly increased. But what could this mean for the markets? The chart below highlights a compelling reality from the past 50+ years: for long-term investors, US stocks have consistently delivered positive returns.

The Last Word

“The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

– Chair of the Federal Reserve, Jerome Powell, dampened investors’ hopes of a further interest rate cut this year.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 18/11/2024