WeeklyWatch – Markets embrace the festive period with good cheer

12th December 2023

Stock Take

Mixed news around interest rates

The festive period is drawing nearer, and UK investors will be holding out for an early gift from the Bank of England’s Monetary Policy Committee when they convene later this week. It’s broadly anticipated that interest will be retained at the current rate of 5.25%.

Indeed, the Bank’s November Inflation Attitudes Survey would have bolstered this perspective last week in disclosing that public expectations of inflation had slumped to their lowest level in two years. The median expectation of the rate of inflation over the year ahead was 3.3%, which contrasts with 3.6% in the August edition of the survey.

Such surveys can prove to be a helpful touchstone – if employers foresee lower inflation, this suggests that wage growth may also decline. To this end, the survey forms part of the Monetary Policy Committee’s extensive dataset for determining interest rates.

Nevertheless, it wasn’t all positive news. Yesterday morning, the Confederation of British Industry announced it anticipated that 2024 would be another year of weak growth for the UK economy. Further to GDP growth of 0.6% in 2023, the Confederation now expects growth of merely 0.8% in 2024. It specifically predicts that growth in consumer spending will continue to be fragile next year due to higher interest rates taking a larger chunk out of household incomes.

Likewise, Schroders said it expects the UK to fall into recession within the first half of 2024.

Given that a General Election is set to be called next year, this might prove difficult for the sitting government. It’s important to remember that, from an investment standpoint, the majority of revenues in the FTSE 100 comes from abroad. In this way, even if the wider UK economy is struggling, there will still be opportunities for fund managers to find growth.

Data across the globe

Shifting the gaze to mainland Europe, equities sustained their recent rally last week. There is a sense of hope that the European Central Bank (ECB) may cut interest rates in the near future.

The decline in inflation over recent months has stoked this optimism, with headline inflation now only a fraction ahead of the ECB’s target of 2.0%. Several senior policymakers signalled last week that future rate increases are doubtful, given the disinflationary backdrop. This helped to elevate the MSCI Europe ex. UK Index by 1.6% by the close of play on Friday.

The ECB will hold its final policy meeting of 2023 this week, and while no changes to interest rates are expected, any intimation of a near-term change in direction will be warmly received by the market.

In the US, the S&P 500 crept 0.2% higher. Yet again, growth stocks outmatched their value counterparts thanks to the likes of Alphabet and Apple, the latter of which returned to a $3 trillion market capitalisation.

Guided by such large tech companies, US equities have been a driving force in global markets throughout 2023. However, Eoin Walsh, Partner at TwentyFour Asset Management, forewarned that US consumer sentiment is diminishing, which might prove to be a challenge in 2024.

Walsh noted:

“The US economy looks to be in ‘late cycle’ and therefore more vulnerable to an external shock – although it is impossible to predict, or time, an event like this. However, should the economy suffer a significant slowdown or recession, we think it will very likely have been caused by the Fed’s rate-hiking policy – but importantly, the Fed is now in a place to help again by cutting rates. This is a strong position to be in, and healthier for the market, and while we think the Fed will be supportive, we are not predicting a return of low, COVID-era rates or quantitative easing.”

The upcoming Presidential election, due to be held next year, adds further notes of unpredictability to the US market. As things stand, it would appear that the election will once again see Joe Biden encounter Donald Trump, and, at the time of writing, it seems that the election could be extremely close.

Wealth Check

In your 40s and 50s, many people can feel as though they’re responsible for financing three generations – not just one. This is known as being caught in the ‘sandwich’ generation – being liable for both your children’s future financial well-being and that of your parents in later life. Equally, you may also be contemplating maximising your investments so that you’ve got enough funds to enjoy your own retirement.

Tony Clark, Senior Propositions Manager at St. James’s Place, considers the following:

“Your priorities change over time, especially when you’re working out how to balance your own financial well-being with that of your children’s in the future. Our mindset about money is changing, just as our attitude to work and careers is changing. Our personal goals become family goals.

“Money is moving up, down and across generations. Nowadays, people are thinking: ‘How can I make the most of my money for me and my family?’ Where we can add real value and peace of mind is helping make sure that it’s happening in the most tax-efficient and future-proof way.”

Given that there are so many demands on your money, it’s wise to take advantage of the tax allowances that are right in front of you, including the ones most familiar to you.

In the UK, ISAs are a great, tax-friendly way to get started. Cash ISAs are tax-efficient for those rainy-day funds, and Stocks & Shares ISAs can provide the potential for growth from your investments to help meet your longer-term goals, from buying a new home to providing a solid education for your children.

Tax-efficient savings could support your loved ones with long-term care costs, relieving the burden from their mind and yours.

Most of the tax allowances and tax reliefs you can claim are on a use-it-or-lose-it basis. This means that planning ahead is vital, particularly as the tax-year end in April is drawing ever nearer.

Clark concludes:

“If you’re thinking about moving money around or splitting your money, have a chat with your adviser. Talking your options through with an expert who understands your financial goals as a family will help you feel confident about the choices you’re making for your children.”

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

An investment in a Stocks and Shares ISA will not provide the same security of capital associated with a Cash ISA or a deposit with a bank or building society.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

Cash ISAs are not available through St. James’s Place.

In The Picture

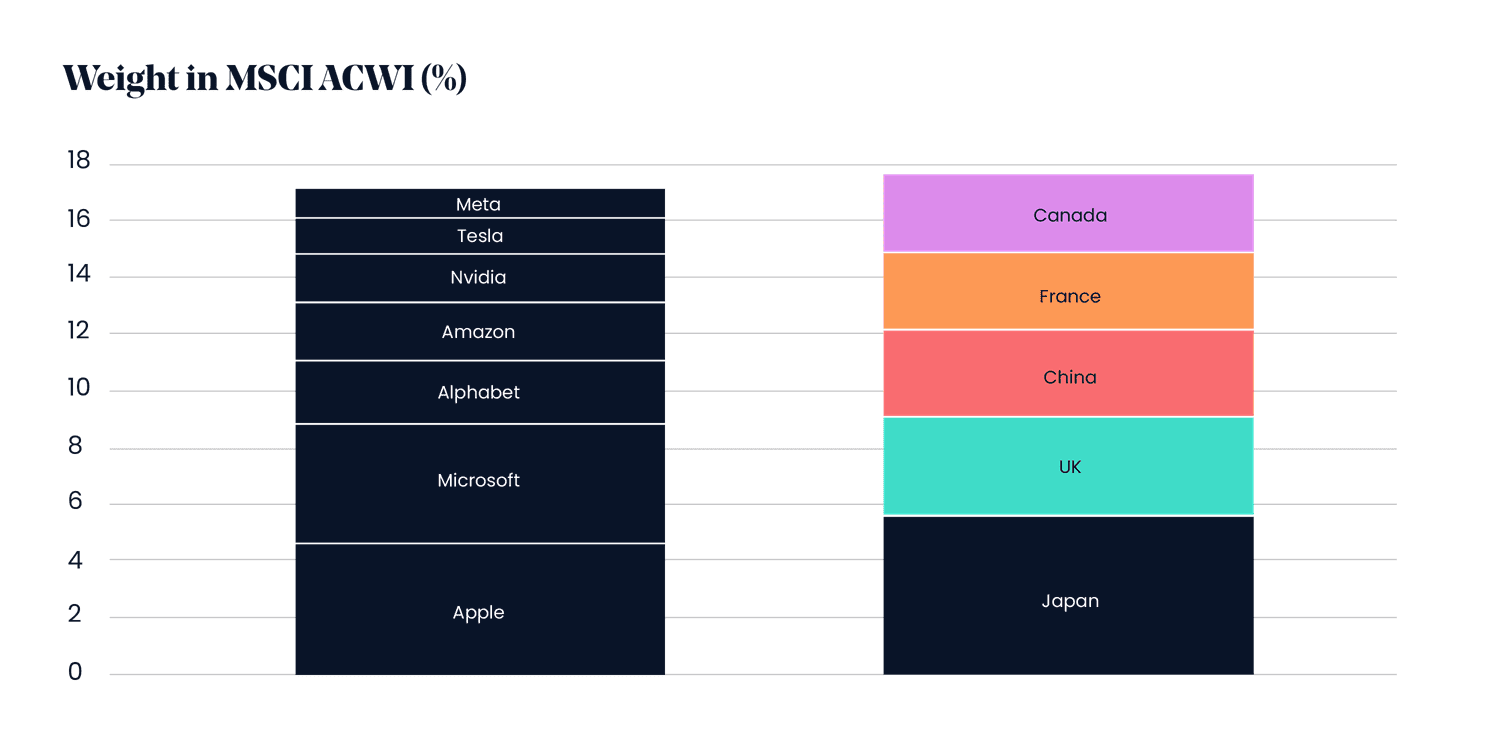

The commonly named ‘Magnificent Seven’ US tech companies now make up almost as much of the MSCI All Country World Index as Japan, France, Canada, China and the UK put together.

Data as at 30th November 2023.

Source: LSEG Datastream, Schroders.

The Last Word

“I didn’t think I was even going to be invited onto this show, let alone be sat here [on the winner’s throne].”

– Radio presenter Sam Thompson expresses his surprise after winning this year’s I’m a Celebrity Get Me Out of Here, which attracted an average daily audience of 6.6 million.

Schroders and TwentyFour Asset Management are fund managers for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2023; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved 11/12/2023