WeeklyWatch – Inflation struggles for the US while Europe prospers

19th March 2024

Stock Take

American markets struggled under last week’s slight increase in inflation while Europe received better news.

Changes in US inflation

In February, CPI Inflation was 3.2%, compared to 3.1% in January. ‘Core’ inflation fell slightly from 3.9% to 3.8% – this doesn’t include food and energy prices – but it was still higher than initially predicted.

Without noticeable changes to inflation, it may well become a prominent political contention in the lead-up to the election later in the year. This also piqued the interest of investors, as the news meant that the Federal Reserve is unlikely to act on reducing interest rates any time soon.

Even though the Federal Reserve is due to meet on Wednesday to discuss interest rates, few are anticipating any significant movements. However, the market is expected to noticeably react to whatever is said during and post-meeting. Most believe that interest rates will fall this year but cannot say by how much. Whenever it’s suggested that interest rates will be falling slowly, there’s generally a subsequent short-term fluctuation in the market.

The fall in US equities seemed to confirm this when the S&P 500 ended the week slightly down as a result of the inflation news. Large technology companies like Nvidia and Microsoft have been mostly responsible for boosting positive growth since the start of 2023. These resulting fluctuations are a reminder of the issues of trying to time the market.

Better European inflation numbers

In Norway, inflation numbers surpassed expectations by falling to 4.9% in February when original forecasts predicted a fall to 5.3%. Interest rates were increased in December, which led to many questions about when they would be cut.

The Finance Minister, Trygve Slagsvold Vedum, stated:

“Lower inflation is good for consumers and the wider economy. We are on the right track.”

The UK also had some positive news to share when the economy grew by approximately 0.2% in January. In the second half of last year, the country entered into recession, but January’s figures and the extra day in February because of the leap year have given the UK a better chance to start growing again in the first quarter of 2024. This contributed to the FTSE 100 increasing by 0.9%.

It’s worth remembering that the January figure is an approximation and can still change – for better or worse – in later analysis.

Over recent years, the British economy has battled with extremely slow growth in productivity, which has been an issue since the financial crisis 15 years ago.

Member of the Office for Budget Responsibility David Miles, in his address to MPs last week, said:

“Productivity might change in the coming years, thanks to technologies like AI. The last 15 years have been so bad that, more likely than not, things will be a bit better over the next five to 10 years. But this is no more than an educated guess.”

Across Japan and China

The Nikkei 225 retreated by 2.5% (local currency), fuelling the idea that the Bank of Japan will move away from its negative interest rate policy over the next few months. However, in China, the Shanghai Composite added 0.3% on growing investor confidence in light of the difficult economic backdrop.

The Executive Managing Director at Sands Capitol, Brian Christiansen, notes:

“Over the past five years, several headwinds put pressure on emerging market equities. Looking ahead, we’re optimistic that those pressures, ranging from a strong US dollar to Chinese equities’ drag on returns, will decrease and that significant growth drivers have the potential to propel select emerging markets equities and our emerging markets growth strategy to generate attractive returns.”

Wealth Check

How can downsizing help?

Downsizing can be a solution when a house is too big or costly to maintain. It can also help release money so that you can make the most of your retirement and help your children out. Downsizing could also mark the beginning of a brand-new single life and starting over.

Family homes often require a lot of maintenance and come with a lot of running costs, particularly energy bills. Under these circumstances, downsizing is a good option. By doing so, you may be able to pay off any remaining mortgage and at the same time release a large lump sum.

There’s a new trend in the market where older people are looking to downsize and link up with their children who need to upsize after outgrowing their current home.

The Head of Mortgages, Development and Technical Consultancy at St James’s Place, Paul Johnson, said:

“There’s a rise in older people selling up and moving in with their children, especially in the last 18 months. It’s mutually beneficial – the children upsize, with the help of money from their parents. And the parents downsize.”

However, there are some tax implications that come with this. It’s highly advised that you speak to your financial adviser as a family before you begin your search for a family home with an annexe.

Downsizing can still be costly. Paul advises people to ‘sell before you buy’. He goes on to say:

“They want to downsize but can’t sell their current one, so they take out a bridging loan. Used correctly, they’re a good way to bridge the gap between one property and the other. Bridging loans can be more expensive than standard mortgages, and there may be hidden charges when you repay the loan. These can be punitive. If you can rent or stay with family while you look, you won’t feel rushed into a costly decision. You’ll be a cash buyer too, giving you a head start in the market.”

Regardless of the situation or reasons for wanting to downsize, taking financial advice well ahead will set you in good stead. We’re able to help guide you through this huge life change.

If you don’t keep up repayments on your mortgage, your home may be repossessed.

In The Picture

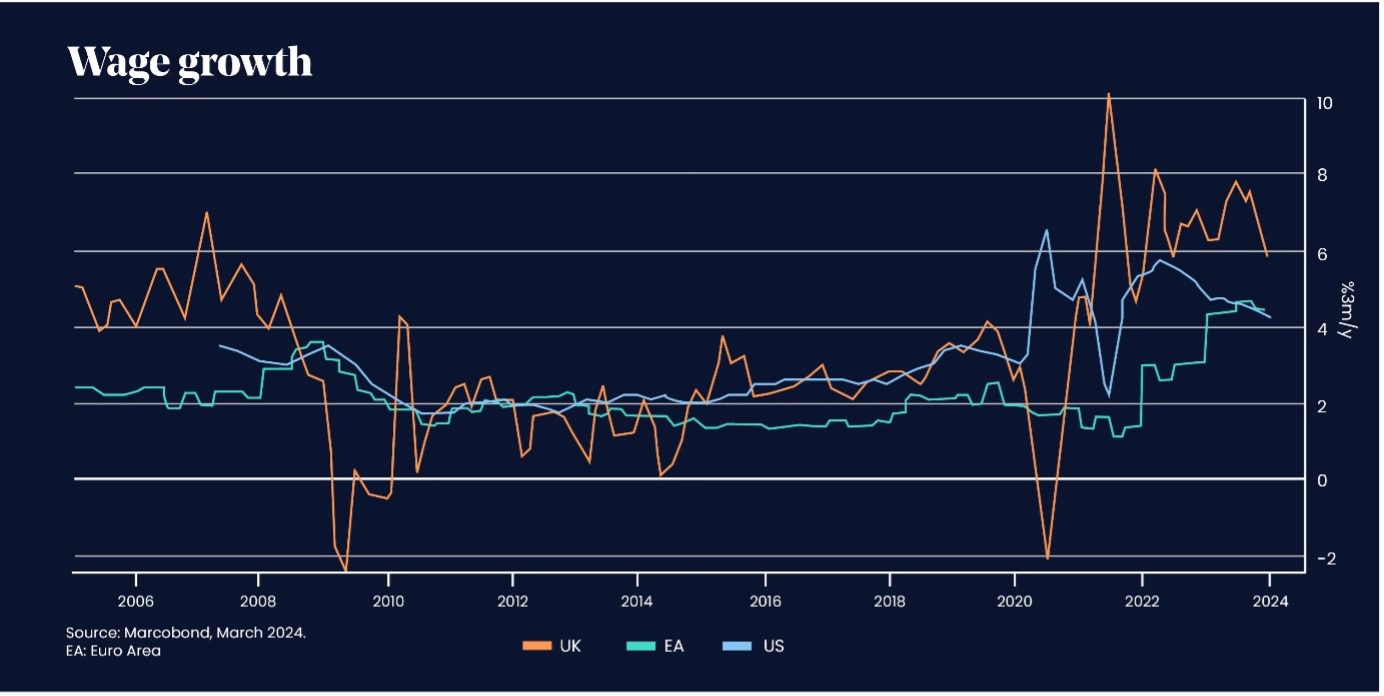

Even though the economy is currently very flat, UK wage growth remains fairly high, particularly when compared with the rest of Europe and the US.

The Last Word

“To be consistently at your best is probably impossible, but that is what we’re going after, like I keep on saying.”

– Andy Farrell, Head Coach of Ireland’s National Rugby Team, celebrates winning the Six Nations over the weekend.

Sands Capital is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 18/03/2024