WeeklyWatch – Central banks reveal plans for interest rates

26th March 2024

Stock Take

Japan ends negative interest rates

The magnificent cherry blossom season in Japan is regarded to be symbolic of new beginnings. And the timing couldn’t be more appropriate, as the country celebrates ending eight years of negative interest rates, with the Bank of Japan (BoJ) optimistic that a new era is coming forward for the country’s stagnating economy.

Investors were bombarded with numerous central bank meetings last week. The BoJ was the first of more than 11 banks to announce their decision on the latest interest rates on Tuesday. They increased their interest rates from -0.1% to a range of 0%–0.1%, which was a presumed course of action, but it was the first time in 17 years that the cost of borrowing was raised.

The plan behind the negative rates is that instead of people paying to deposit money in a bank, they will spend it. However, many policymakers accept that this didn’t work as well as initially thought, and Japan’s actions mean that there are no more countries with negative rates.

Another key part of these decisions saw the BoJ end its yield curve control policy, through which it purchased Japanese government bonds to try and control interest rates. They were forced to act due to the strong wage growth and core consumer inflation remaining steady within the bank’s 2% target. But it also suggested that more rate hikes were unlikely for the moment.

SJP Asia’s Head of Investment Advisory and Communications, Martin Hennecke, warned:

“Given the situation with wages and consumer inflation, the BoJ might have been expected to go further with rate hikes, but the elephant in the room is that Japan’s sovereign debt to GDP ratio is so high that it can’t afford to. However, persistent negative real rates should continue to encourage Japanese retail investors into the market.”

Central bank announcements across the world

In other parts of the world, central bank announcements stayed very similar to their previous statements. The US Federal Reserve (Fed) maintained steady rates as predicted, but they did imply that they expect to reduce them by three-quarters of a percentage point, with three cuts by the end of the year. This is in light of the fact that the Fed is expecting substantial progress towards its 2% inflation target.

Chairman of the Fed, Jerome Powell, said:

“We want to be careful and, fortunately, with the economy growing, the labour market strong and inflation coming down, we can be.”

The job market showed its resistance due to the fall in new claims for unemployment benefits in the previous week.

It is assumed by policymakers that the US economy will grow to 2.1% this year, a much more optimistic forecast than the 1.4% that was predicted in December. Now that there is refreshed hope over a US rate cut in June, Wall Street and Japan’s Nikkei 225 index peaked at record highs.

The Swiss National Bank dropped its main interest rate by 25 basis points to 1.5%, this came as a surprise for central banks and Switzerland became the first developed economy to cut rates during this cycle.

Despite residual inflation concerns, central banks remain in a steady position with global rate cuts also coming sooner, which was met with much enthusiasm by investors. In the US and across Europe, benchmark share indices continued to enjoy record highs. Additionally, the S&P 500 revealed its biggest weekly gain of the year so far.

Good news for the UK economy

Official data showed that inflation slowed in February to 3.4% from 4% – the weakest pace of price rises since September 2021. Despite this, out of the G7 advanced economies, the UK has the highest rate of headline inflation. Since the end of 2020, consumer prices have increased by more than 21%.

Out of all the central banks, the Bank of England (BoE) was the last one to reveal their interest rate action. Even though there was encouragement from the inflation news, the Monetary Policy Committee voted by a majority of 8–1 to keep rates unchanged, holding interest rates at 5.25% for the fifth time in a row.

According to the BoE, the UK’s short-lived recession could be over, and the economy will return to growth in the first quarter. They put this down to the improvement in consumer confidence. Bank of England Governor Andrew Bailey stated that “things are moving in the direction”, but it was not yet the time to begin cutting rates.

The uncertainty that he outlined was reiterated on Friday by the news that UK retail sales flatlined in February – wet weather and cost-of-living concerns meant that many shoppers stayed at home. However, this didn’t stop the FTSE 100 from getting close to its all-time high as the week drew to a close.

Decreasing fears surrounding recession and optimism for rate cuts have resulted in risk assets delivering some great returns. However, a call for caution is warranted.

BlueBay Asset Management’s Mark Dowding warned:

“Policymakers are feeding the market’s greed, and history tells us that markets can often be most vulnerable when risk attitudes become complacent. Greed has consequences, and it rarely ends well. Investors need to remain vigilant and disciplined.”

Wealth Check

Many of us struggle when we ask ourselves those searching questions like: How do I see my older self? What life am I currently leading? This shapes how we save and what our long-term financial plans are.

Where self-visualisation is helpful in setting your goals, money makes them achievable. Being certain of your financial goals helps motivate you to make smart, practical steps towards succeeding to secure that future.

One of the best places to start with this is to regularly put aside sums of money in an account that’s easily accessible or in a Cash ISA in case of emergencies. Alternatively, you can save regular monthly amounts in other tax-efficient ISAs or into your pension for both medium- and long-term goals.

Options of where to save are plentiful: stocks and shares, ISAs, Cash ISAs or other investments and pensions. Each of these has different tax advantages and comes with a number of positives and negatives, and with expert advice, you can feel confident about your choice.

If you want to really boost your savings, then a workplace pension can do just that. If you have one, it’s a good idea to see how much your employer contributes. The more money you put in as part of an employee scheme, the more many employers will match. For self-employed or business owners, it is strongly advised that you start a private pension sooner rather than later.

Generally, the longer you invest, the more your money will benefit from compounding – interest on interest. The longer your money remains invested, the faster your growth accelerates – the main thing is to start early.

Opting out of a workplace scheme can be tempting if money is tight. Similarly, if you’re in charge of your own pension, it’s easy to think that missing a contribution or pausing for a short while won’t make much of an impact. However, halting regular pension input can have a significant effect on the power of compounding and the overall size of your pension fund for when you’re older.

The value of an investment with St James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. It’s possible that you may get back less than the amount invested.

Investing in equities doesn’t offer the capital security provided by a Cash ISA or a deposit account with a bank or building society.

Levels of taxation, and reliefs from taxation, can change at variable times. The value of any tax relief depends on individual circumstances.

Please note that St James’s Place doesn’t offer cash ISAs.

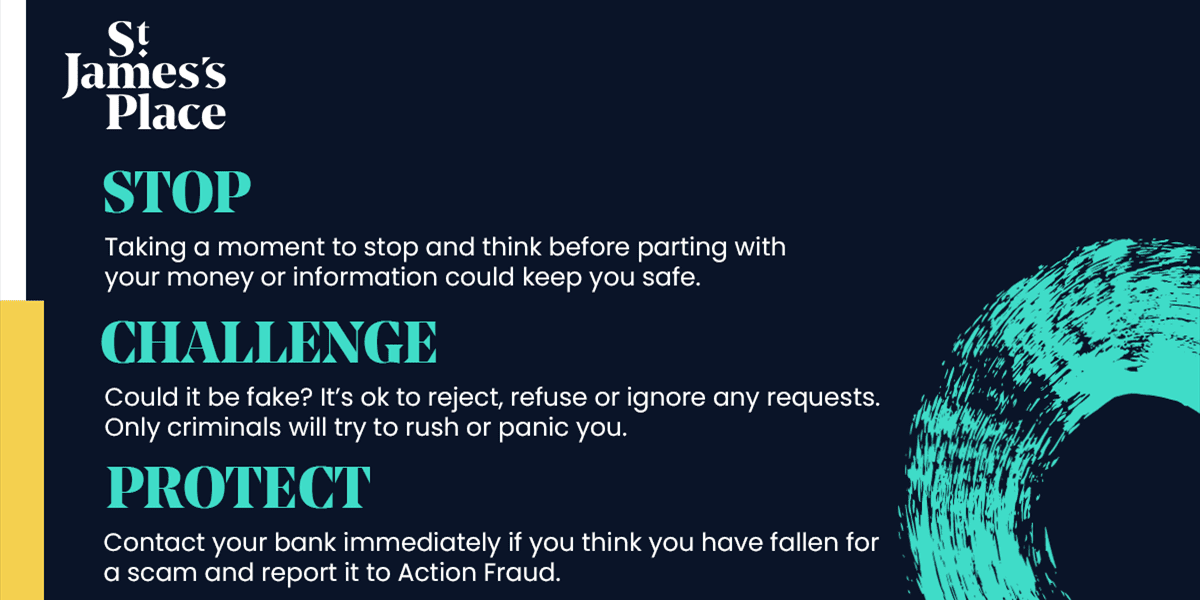

In The Picture

Everyone faces the risk of fraud; it’s an unfortunate reality in today’s world. Take a look at these easy steps you can take to make sure that you’re protected.

The Last Word

“But I’m glad that I kind of did it for women worldwide as well – not just runners – but any woman that wants to take on a challenge and maybe doesn’t have the confidence.”

– Jasmin Paris on becoming the first woman to complete the Barkley Marathons. She is only one of 20 people to have done so since 1989 when it reached its current length.

BlueBay is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 25/03/2024