WeeklyWatch – Upbeat Easter figures round off strong Q1 performance

3rd April 2024

Stock Take

Easter caps strong first quarter

For many, it was a weekend of sweet treats, and there was an extra Easter cherry on top for investors – ending an already-strong Q1 on a high note. On the menu was encouraging inflationary news in the UK and growth in most major markets.

On home soil, shop price inflation eased to 1.3% in March, down from 2.5% in February, according to the British Retail Consortium (BRC). This was the lowest level recorded since December 2021.

Unsurprisingly, as Easter hopped closer towards the end of March, chocolate sales were going strong. The BRC noted that although Easter treats were more expensive than in previous years due to high global cocoa and sugar prices, falling dairy prices and strong retail deals led to lower prices when compared to February.

Mike Watkins, Head of Retailer and Business Insight at NielsenIQ (who collate the data for the BRC), said:

“The slowdown in inflation continues and a key driver this month was a further fall in food prices. A year ago, food inflation was at 15% so this was to be expected. But it is also helped by intense competition amongst the supermarkets as they look to drive footfall, with focused price cuts and promotional offers earlier in the month for Mother’s Day and now again in the weeks leading up to Easter.”

A rocky road for inflation

Falling food inflation will likely be promising news for UK investors who are trying to predict when interest rates will move and hatch a plan accordingly.

With that being said, the journey towards interest rate reductions may not be as straightforward as some are hoping. Catherine Mann, a policy maker at the Bank of England, expressed last week that in her view, “the market was anticipating an excessive number of cuts.” Similarly, Jonathan Haskel, an external member of the Monetary Policy Committee, said, “I think cuts are a long way off”.

Overall, the FTSE ended the week up slightly, meaning it rose 3.5% over the first quarter.

Spreading the investor joy

The UK wasn’t the only country enjoying a spring bounce, however. Several markets experienced growth throughout the quarter, with notable upticks observed in the US and Italy.

In the US, the S&P 500 closed the week at yet another record high, having surged over 10% during Q1. Concurrently, the NASDAQ concluded the quarter nearly 10% higher. Last week, US markets received an extra boost after the GDP growth rate for the fourth quarter of 2023 was revised upward to 3.4%, surpassing the previous estimate of 3.2%.

Looking beyond the ‘magnificent seven’

Those monitoring the US market are likely familiar with the ‘magnificent seven’. Referring to Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla, these prominent technology companies have dominated performance since the beginning of last year. This means that, although US markets as a whole are trading at record highs, beneath the surface there may still be opportunities.

Roberta Barr, Head of Value ESG and Fund Manager at Schroders, noted:

“Beneath the massive outperformance of the S&P 500, you have a lot of companies in normal cyclical troughs on huge valuation discounts. There’s the saying that it’s always ‘darkest before the dawn’ and actually, as a value investor, we are beginning to see some amazing opportunities. We have these quite high-quality, cash-generative, pretty robust businesses that aren’t the ‘magnificent seven’, which you’re getting on a real discount today.”

Yen and now

Bucking the trend of its exceptional year to date, last week was less positive for the Japanese market. The Nikkei 225 slipped 1.27%, as investors zoned in on the volatile Yen versus Dollar exchange rate. This came under pressure amid speculation that authorities could intervene in the foreign exchange markets to support the weakening Yen currency. Japan’s large-cap exporters have been benefited by a weaker Yen recently, as they derive a significant share of their earnings from overseas.

Wealth Check

Many of us can find that our financial responsibility extends beyond supporting just one generation. Those in the ‘sandwich generation’ can find themselves financing three – shouldering the dual responsibility of securing their children’s future financial well-being and caring for their ageing parents.

At the same time, you’ll be contemplating your own plans – and whether the numbers add up. You may want to consolidate your own investments, so you have enough money to enjoy your own retirement.

We all want to save ourselves some money, and leveraging available tax allowances is a sensible approach. Especially the ones we’re most familiar with, such as the annual £20,000 ISA allowance.

ISAs are simple, tax-friendly savings accounts that offer various benefits. Cash ISAs serve as a secure home for rainy day funds, while Stocks & Shares ISAs present opportunities for potential growth in investments. This growth can significantly contribute to achieving long-term goals, like purchasing a new home or funding a child’s education.

For providing children with a financial head start, opening a Junior ISA (JISA) allows them to grow funds tax-efficiently. The maximum annual contribution to a JISA is £9,000, accessible at 18 or transferrable into a standard ISA. Although a parent or legal guardian must initiate the JISA setup, anyone can contribute thereafter.

Additionally, parents or legal guardians can establish a Junior Pension for their child soon after birth. Typically, contributions to a Junior Pension are capped at £2,880 per year, with a 20% pension tax relief boosting this to £3,600.

It’s common for individuals to overlook their annual Capital Gains Tax (CGT) exemption, which can impact the amount of money available for investment or savings. CGT is levied on profits from the sale of assets like property (excluding primary residences) or appreciating assets. For the 2024/25 tax year, the CGT exemption allows the first £3,000 of profit to be tax-free.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

An investment in a Stocks and Shares ISA will not provide the same security of capital associated with a Cash ISA or a deposit with a bank or building society.

The levels and bases of taxation, and reliefs from taxation, can change at any time and are generally dependent on individual circumstances.

Cash ISAs are not available through St. James’s Place.

In The Picture

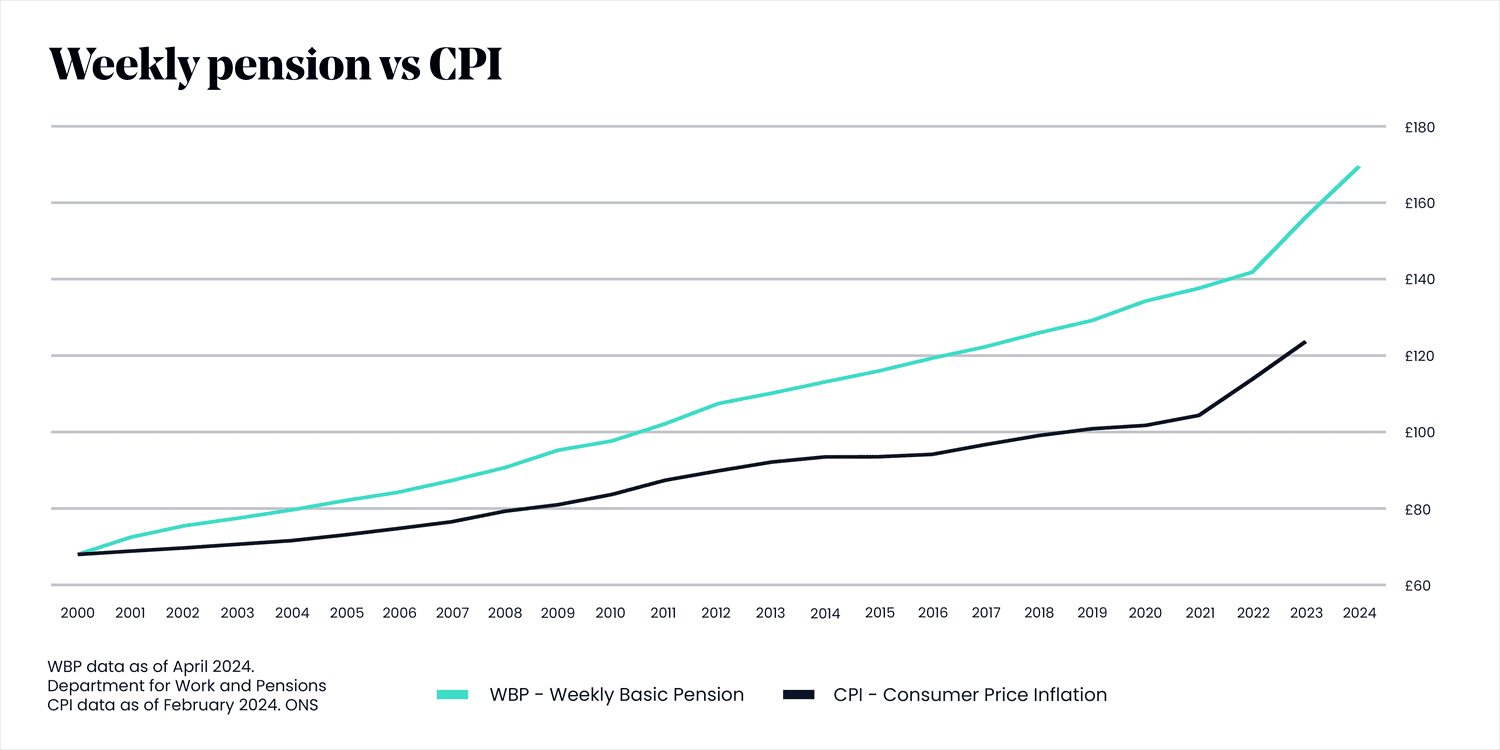

With a UK election on the horizon, the pension ‘triple lock’ has again become a hot political topic. This refers to state pensions rising in line with one of three factors: average earnings growth, inflation or 2.5% – whichever is highest.

The Last Word

“The primary role of the government is first of all to protect customers, and secondly, to protect the environment.”

– Sir Robert Goodwill, Chair of the Environment, Food and Rural Affairs Select Committee, speaking on BBC Radio 4 about the uncertain future of Thames Water.

Schroders is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 02/04/2024