WeeklyWatch – Is the latest market growth sustainable?

9th April 2024

Stock Take

Who wants the land?

As famous writer Mark Twain once said: “Buy land, they’re not making it anymore.” In the first quarter of 2024, investors focused their spending on stocks, gold and cryptocurrencies, which all hit level highs, with land being one of the only things that they chose not to spend on.

This behaviour has been exercised because of the belief that the global interest rate cycle is turning. As the next quarter starts to unfold, this will show whether this belief is reasonable, and this last week has already given some indicators as to its direction.

Soaring success for China

Over the bank holiday, China received some good news, sending shares soaring. Manufacturing activity grew in March – its fastest pace in over a year. Furthermore, business confidence grew to its highest for the first time in 11 months. These successes came as a result of the export and retail sales data, which were much better than expected. However, analysts have highlighted that policymakers will have to deliver more stimulus if the country’s economy is going to hit its sizeable 5% growth target.

Decisive action required for the eurozone?

Figures were released on Wednesday, showing that eurozone inflation had an unexpected fall last month, having slowed to 2.4% from 2.6% in February. The headline figure was pulled down by food, energy and industrial goods. The resulting figures boosted the case for the European Central Bank to begin to unravel its record interest hikes. Even though the central bank will meet this week, policymakers continue to signal that June will be the month when they will make more firm decisions on the matter. It’s therefore unlikely that there’ll be any cuts this week.

Additional data revealed that unemployment hit a record low of 6.5% in the region, but the information does indicate there is robustness in the job market. The policymakers who have been arguing the case for a cut have emphasised that economic growth is very weak because the eurozone has been on the edge of recession for six quarters.

Is the growth sustainable for the US?

The US captured investors’ attention the most last week when key US stock indices hit two-week lows on Tuesday. Despite strong economic numbers, there was still doubt as to whether the Federal Reserve could act on the proposed three rate cuts that they’d outlined in their latest forecast. Orders for manufactured goods surged beyond expectations with significant assessments presenting findings that revealed that the manufacturing sector had grown for the first time since September 2022.

In terms of the US’s economic growth prospects, this was good news; however, the rise in raw material prices poses a risk of a hike in goods inflation later on and this will have an impact on plans for interest rates for the rest of the year.

There are arguments that markets have been hasty in dismissing the US economy and assuming that benign inflation will encourage an extensive monetary easing cycle.

BlueBay Asset Management’s Mark Dowding argues:

“We will be meeting policymakers in Washington in the coming week, though our sense is currently that Federal Reserve Chair [Jerome] Powell is eager to gamble on a soft landing, in order to secure an enviable legacy. Moreover, there’s a desire to start to cut rates before the election cycle gets into full swing. On this basis, we still think that the Fed may cut in July, but that we are likely to see only one or two rate cuts this year unless the pace of economic activity cools materially.”

In contrast to the positive growth data in US manufacturing, further figures from March revealed slowed growth in the US services industry and services inflation continued to moderate. The main driver of this inflation is higher wages.

On Friday, the US jobs figures were unveiled, with employers adding more than 300,000 jobs last month, steamrolling initial predictions of around 200,000 and subsequently achieving one of the biggest monthly gains in nearly a year.

Over the past year, the labour market has benefited from the increase in immigration and has also been boosted by government spending in high-tech manufacturing and infrastructure. Additionally, the unemployment rate fell to 3.8% meaning that the rate has remained below 4% for 26 months, which is the longest period since the late 1960s.

But analysts stressed that the excess energy in the economy, hinted at by the positive job growth, could make it challenging for the Fed to get inflation down to its 2% target. The figures also heightened hopes that the Fed will be able to deliberate for longer and delay cutting interest rates as there is a much smaller risk of recession.

In light of the mixed economic data, by the end of the week, leading US stock indices showed modest declines and money markets are expecting just two rate cuts this year. The next predictions for the US’s rate cuts are expected to emerge after the US releases its next inflation figures.

Wealth Check

Getting prepared for the new tax year

The new tax year is here – are you ready for it? The general election is looking likely to take place in November, and the UK’s economic performance and high cost of living are predicted to be the biggest areas of contention. In order to improve your short- and long-term financial security and well-being, it’s advisable to use all available tax breaks while they remain available.

The Spring Budget saw the second cut of employee National Insurance contributions by Chancellor Jeremy Hunt.

- The personal allowance: This is the amount of income that you don’t have to pay tax on. This remains at £12,570.

- Basic tax rate: This remains at 20%.

- The higher rate threshold: Earnings of £50,270 or more per year are taxed by 40%.

- Additional-rate tax threshold: Earnings of over £125,140 per year are taxed by 45%.

All of these rates are frozen until 2028.

What do Personal Savings Allowances mean for the different tax brackets?

- Basic-rate taxpayers can still earn £1,000 interest on savings before they have to pay taxes in 2024 and 2025.

- Higher-rate taxpayers retain a £500 allowance.

- Additional-rate taxpayers receive no allowance.

Impact of tax changes

There are some important changes coming to Dividend Tax – the dividend allowance is dropping by 50% to £500. This is very likely to impact people who own shares in a company or get dividends from funds or investment trusts.

The Lifetime Allowance is no longer available as of 6th April 2024, and there’s limitless accumulation for pensions.

£20,000 remains the tax-efficient ISA allowance for 2024/25, this includes both Stocks and Shares ISAs and Cash ISAs. Similarly, the Junior ISA annual allowance will stay the same at £9,000.

However, a new ISA is being put forward called the British or UK Stocks and Shares ISA. At the time of publication, this ISA is being deliberated until June 2024.

Fixed rates remain in place for the Inheritance Tax nil-rate band – £325,000 (frozen until 2028) and the Residence Nil Rate Band (where your main place of residence is able to pass directly to your lineal descendants) – £175,000.

From the start of the new tax year, the Capital Gains Tax allowance – the amount you can make before you begin to pay tax – has dropped to £3,000.

The value of an investment with St James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. It’s possible that you may get back less than the amount invested.

Investing in a Stocks and Shares ISA doesn’t offer the capital security provided by a Cash ISA.

Levels of taxation, and reliefs from taxation, can change at variable times. The value of any tax relief depends on individual circumstances.

Please note that St. James’s Place doesn’t offer cash ISAs.

In The Picture

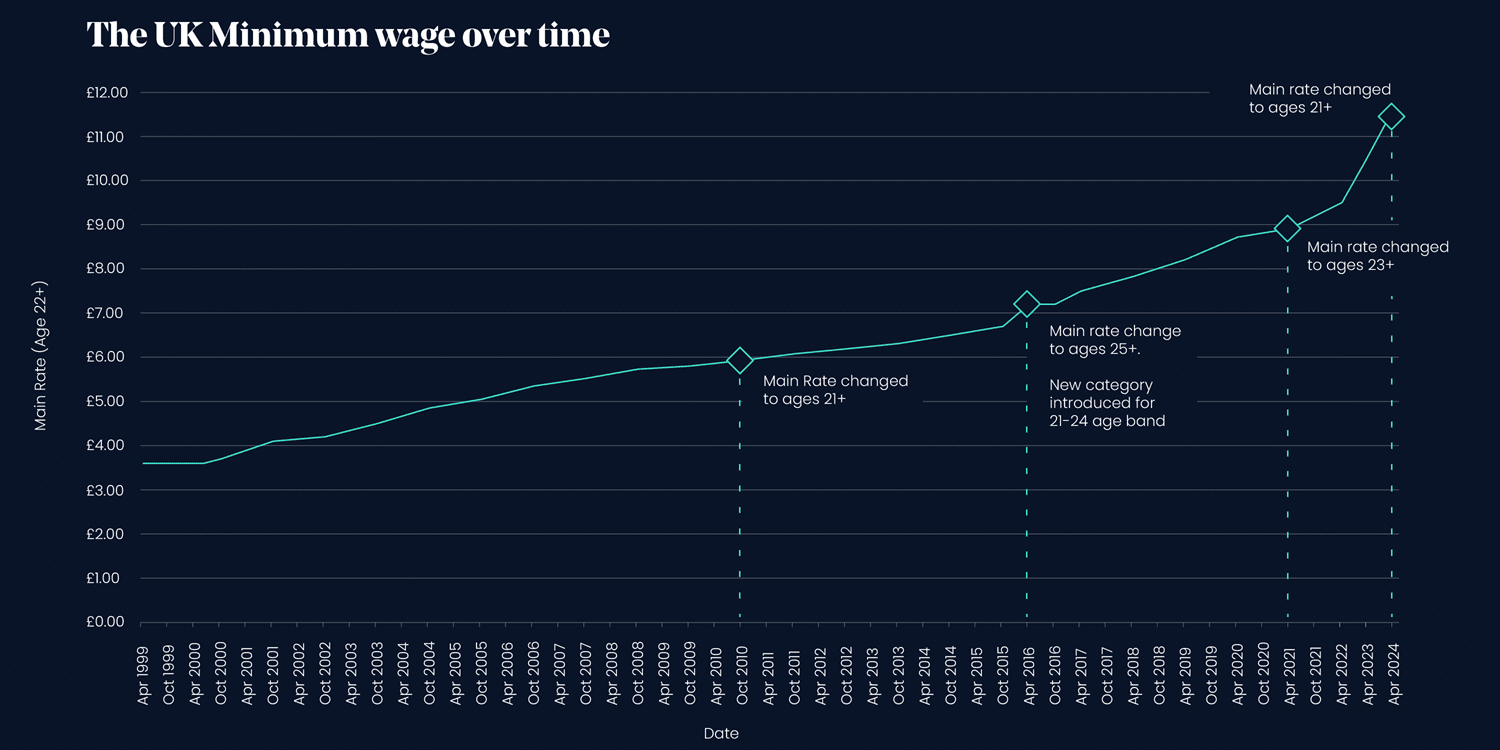

The UK’s Minimum Wage celebrated its 25th anniversary last week. The graph below shows how it’s progressed over the years.

The Last Word

“It was quite overwhelming yesterday to be honest. There were so many people here and we had so much support. I’ve tried to soak it all in and enjoy it.”

– Russell Cook speaking to Good Morning Britain over the weekend, having run the entire length of Africa in 352 days.

BlueBay is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 08/04/2024