WeeklyWatch – UK economic growth surpasses expectations

16th April 2024

Stock Take

Is the UK economy doing better than expected?

Late last week, UK Chancellor Jeremy Hunt said that the UK was finally “turning a corner”. His declaration comes off the back of the revelation from the Office for National Statistics (ONS) that the British economy grew by 0.1% in February.

The ONS has since revisited their initial growth figures, with January going up from 0.2% to 0.3%. Overall, these figures strongly indicate that the UK will end the first quarter having gained some economic growth and also leaving its recession.

However, there are some important factors to bear in mind. 2024 is a leap year, and therefore there was an extra day in February to generate GDP. Despite the 0.1% growth, the ONS predicts that the UK economy is smaller than it was at the same time last year, with very little movement in the economy since 2022.

But regardless of the small improvements, these latest figures still mark a positive step forward for the UK. What’s more, there’s hope from economists that the reduction in the National Insurance rate will help encourage consumer spending and result in growth further down the line.

Some even believe that the UK could be the first Western economy that reduces its interest rates.

Chief Global Market Strategist at Invesco, Kristina Hooper, stated:

“I believe the combination of a tepid economy and significant disinflationary progress means rate cuts can begin very soon. It seems markets are anticipating a cut in June, but I think we could see Bank Rate cuts as early as the May Monetary Policy Committee (MPC) meeting.”

Middle Eastern tensions impact stocks

Investment markets were greatly encouraged by the latest figures, which was made evident by the FTSE approaching record levels and ending the week up by 1.1%.

As tensions continue to escalate in the Middle East, the UK stock market was a beneficiary. The conflict between Israel and Iran boosted the prices of oil and metals, which resulted in an elevation of energy and mining stocks. The FTSE 100 has significant dealings in both sectors, and the changes boosted the overall index.

Inflation dominates US focus

Wednesday’s news revealed that headline CPI inflation hit 3.5% in February, which surpassed market predictions. These figures were up from the 3.2% that was noted in January. An increase in energy and shelter costs also contributed to raising inflation to its highest rate since September.

This recent uplift in statistics is contesting the belief that US inflation is on a single-direction downward track to 2%.

The increase in inflation alongside the reasonably strong economic growth are working together to delay the Federal Reserve’s interest rate cut timeline. It’s now widely expected that any action on the matter won’t take place until the third quarter of the year, quashing hopes of any decisive notion being put in place in June. Consequently, markets were pushed down, which was made noticeable through the S&P 500 concluding the week 1.6% lower (in relation to dollars).

BlueBay Asset Management’s Mark Dowding noted:

“In DC, there remains a narrative that Powell would like to cut rates, if only data would permit him to do so.”

Conversations are arising that Jerome Powell, the Fed Chair, wants to make history as the central banker to accomplish the soft landing and secure himself a financial hero’s legacy. Regardless of the motives behind the decision, the data is being defiant. It’s still worth noting that if an opportunity does arise, then it’s possible that a rate cut ahead of the election could still happen.

Varied results across Asia

Japanese equities moved forward and the Nikkei 225 increased by 1.4% which was largely as a result of the consistent weakness in Japanese currency.

In China, the Shanghai Composite revealed a 1.6% fall (local currency) following muted economic data. Other contributory factors include weak inflation numbers and low export and import figures throughout March.

Wealth Check

Raising funds for your business

After starting Heatio in April 2022, Thomas Farquhar and his co-founder Simon Roberts needed to move quickly and decisively. The company helps UK homeowners use modern technology to improve their energy efficiency.

The Heatio’s Flexx platform works to combine sensors, smart-meter data, artificial intelligence and home-energy modelling (software simulation of energy use). It then compiles a comprehensive energy profile for each home and informs customers as to the ways they can cut down on their energy use.

In April 2024, the first version of the Heatio Flexx platform is expected to be launched. From its first two years of testing and use, it’s learnt a lot of information, and in this case study, Chief Commercial Officer Thomas Farquhar shares his insights.

Learn ways to acquire investment

Farquhar summarises:

“Raising funds for your company can be incredibly time-consuming and challenging, taking focus away from the business. Raising finance is similar to selling, except investors have different motivations and proof points. We found it a new, scary and daunting world. You’re immediately thrown in front of the headlights. It can become an all-consuming part of your business that never stops.”

Don’t be afraid to fail fast

Farquhar goes on to advise:

“Nothing is more expensive than delaying a decision to change something that isn’t working or delaying a necessary pivot. It’s better to go quicker, harder and invest slightly more so you can get failures out of the way and the business can evolve faster. Knowing when to change course and acting rapidly is vital. For example, we hired technical expertise, then realised within a month that the task was way beyond the person we’d recruited. But they didn’t want to admit that.”

Hire people who are experienced in core roles

Thomas notes that although it’s initially costly, employing experienced staff in key business areas will save time and errors. He goes on to comment:

“There may be people better than you at that job, and the best thing you can do is hire them. Many founders employ junior people because it’s cheaper. These risks are slowing you down. We hire more experienced heavyweights because we need to develop quickly.”

Find a co-founder that complements your skills

Discussing his working partnership with his co-founder, Simon Roberts, Thomas states:

“Simon and I have complementary skills – I’m technical; he’s commercial. If you’re a founder with no commercial experience, I’d advise finding a commercially minded co-founder.”

Staying grounded and realistic is crucial

Thomas concludes by saying:

“If you win funding, investors can put you on a pedestal and say you’re the next big thing. They’ll ask how much you think you’re worth. Founders can pull figures out of the air. Instead, put your ego aside and calculate the minimum you need to get, proof of concept, and validate your model. Your business is worth nothing until you’ve proved the concept. So, stay grounded.”

Opinions of third parties offered may not necessarily reflect those of St. James’s Place or Wellesley.

In The Picture

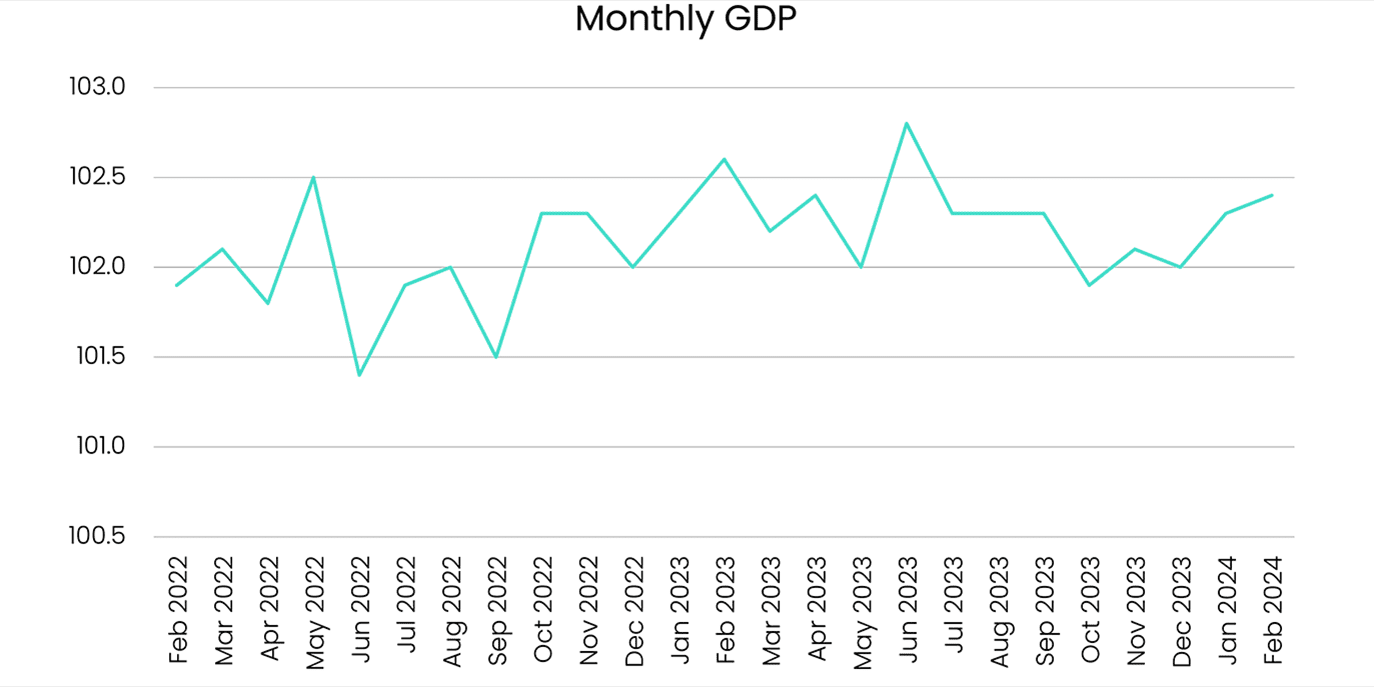

Despite growth for the UK economy in February, it’s remained fairly flat since the beginning of 2022.

Source: ONS, Index, 2019 = 100

The Last Word

“This is a time to think with head as well as heart, and be smart as well as tough.”

– UK Foreign Secretary, David Cameron, urging restraint after Iran’s missile and drone attack on Israel over the weekend.

BlueBay and Invesco are fund managers for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 16/04/2024