WeeklyWatch – Inflation interferes with economic direction

23rd April 2024

Stock Take

Chocolate prices are the mark of inflation

Last year, the chocolate digestive was voted the UK’s favourite biscuit. Its popularity will continue to resonate, as last week it was announced that a fall in prices of chocolate biscuits had contributed to UK inflation hitting its lowest level in two and a half years.

UK inflation interferes with interest rate plans

Inflation fell to 3.2% in March, an improvement from the 3.4% in February, but it was still less than initially predicted. Furthermore, Core CPI inflation – excluding food and energy – was higher than expected. These statistics showed that inflation rates will remain a continuous battle for Britain. The Bank of England (BoE) had previously expressed hope that they would introduce their first interest rate cut, but the recent revelation indicates that they could be further away from this than first thought. Investors have adjusted their forecasts and predict that fully pricing in one quarter-point cut by the end of the year is more likely; this could come as late as November.

UK inflation impacts jobs

Stubborn inflation was also showcased by the revelation that UK wage growth remained high in the first three months of the year, which had slowed to 6.0% from 6.1% in the prior quarter. However, there were hints that pressure in the UK jobs market is easing. Newly released figures revealed that between December and February, unemployment increased to its highest level in six months to 4.2%.

The BoE may still hold out hope for interest rate cuts as there are some small, promising signs that the labour market is cooling, but the current issues surrounding inflation increase the UK’s risk of following the same path as the US where inflation stagnates.

Another change in interest rate direction for the US?

Across the pond, Federal Reserve Chair Jerome Powell reiterated on Tuesday that there’s not enough confidence in the current trend of inflation to start cutting rates. This statement was upheld by US retail sales figures in March, which defied analyst forecasts and online retailers relished a highly successful month.

This release of data came on the back of good job gains and a positive move in consumer inflation. It all served as evidence that the US economy ended the first quarter in a reasonably strong position and has once again started to fuel expectations that the Fed can hold off cutting interest rates until September at the earliest. However, the chance of a second interest rate cut is highly unlikely.

Senior US economist at Schroders, George Brown, believes that the groundwork for policy easing could be outlined by Powell in August during his keynote speech at the Jackson Hole economic symposium, with a rate cut to follow in September and a further two in December and March. Brown went on to say:

“There’s also a decent likelihood that the Fed doesn’t ease policy at all this year. We now place a 40% probability on such a scenario; a risk that we think is currently being underpriced by the market. And if inflation starts to re-accelerate, the next move from the committee might not be a cut, but instead could be a hike.”

Middle East conflict troubles European markets

Tuesday saw falls across global markets. European shares recorded their worst day for nine months, as concerns surrounding the conflict in the Middle East were heightened after Israel’s declaration that they would retaliate against Iran’s missile attack that took place at the weekend.

Although US inflation figures are surprisingly high, European Central Bank (ECB) officials reasserted their plans to cut interest rates in June, “barring major shocks and surprises.” The ECB President, Christine Lagarde, asserted that the disinflationary process was moving within expectation, given what is unfolding in the Middle East, and that so far it hadn’t had a huge impact on commodity prices.

During their spring meetings, the International Monetary Fund set the tone for the global economy trajectory. They predicted another year of slow yet steady growth, garnering strength from the US and offsetting consistent high inflation, geopolitical conflict and weak demand in China and across Europe.

This bleak outlook on the market resulted in leading US indices registering their steepest five-day losses since March last year. However, by the end of the week, markets expressed more hope that tensions in the Middle East would plateau after Iran were more nonchalant about Israel’s retaliatory drone strike.

S&P takes a hit

The S&P 500 is down around 5.5% after charging 25% higher over the last six months. For investors, seeing pull-backs of this size in a year is a typical trend, with markets starting to consolidate and some investors reaping some profits, particularly after such a challenging period.

The VIX volatility index represents market predictions for potential upcoming instability in the S&P 500. Its reached its highest point of the year so far and has been influenced by three key factors.

- Markets repricing the chances of rate cuts by the Fed and, as a result, adapting to a ‘higher-for-longer’ perspective.

- The rise in geopolitical tensions had put upward pressure on oil and commodity prices.

- The first quarter earnings season for S&P 500 businesses has seen them beat predictions but are now offering forecasts that are softer than initially thought.

This upcoming week will see earnings reports come in from the mega-cap technology companies – Microsoft, Google and Meta. Initial expectations are very high, but there’s a yearning from markets to see these big companies assure a solid forecast to create stability in the technology and growth sectors.

Wealth Check

What does increased inflation mean for savings?

There can be huge fluctuations in interest and inflation rates, and this has big repercussions on the spending power of your savings and investments, in addition to your daily household expenses.

As inflation gets higher, it means that goods cost more. As a result, your current savings won’t be able to purchase as much in the future, unless the interest earned exceeds the rate of inflation.

Banks aren’t always the solution

Relying on the high street banks isn’t always the best strategy to beat inflation. Banks do pay interest on instant access savings and Cash ISAs, but this interest doesn’t always exceed or keep up with inflation rates. Ultimately, the purchasing power of savings will dwindle over time.

If a gap exists between the Consumer Price Index or inflation rate and the best interest rate, it’s difficult to find savings providers that would be willing to offer returns that are above the rate of inflation.

Investing to combat inflation

If saving over the long term is part of your financial plan, then investing could be a great avenue for protecting your money from the impact of inflation.

Investing in assets that produce a higher rate of return than interest rates is a hugely effective way to beat inflation. In a long-term plan, this is usually in the form of equities (stocks and shares). These can overtake inflation, but there’s never a guarantee that they will do this.

Diversifying your investments

Investing always comes with an element of risk. You can reduce this risk by investing in different types of assets including equities, bonds and property – this also diversifies and bolsters your portfolio.

It’s worth noting that different assets perform differently depending on the economic situation. There will never be a ‘best performing asset’ which is why it’s important to have variety in your portfolio, as you give yourself a better chance of making your investments more durable.

Please be aware past performance is not indicative of future performance.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select, and the value can therefore go down as well as up. You may get back less than you invested.

Equities do not provide the security of capital which is characteristic of a deposit with a bank or building society.

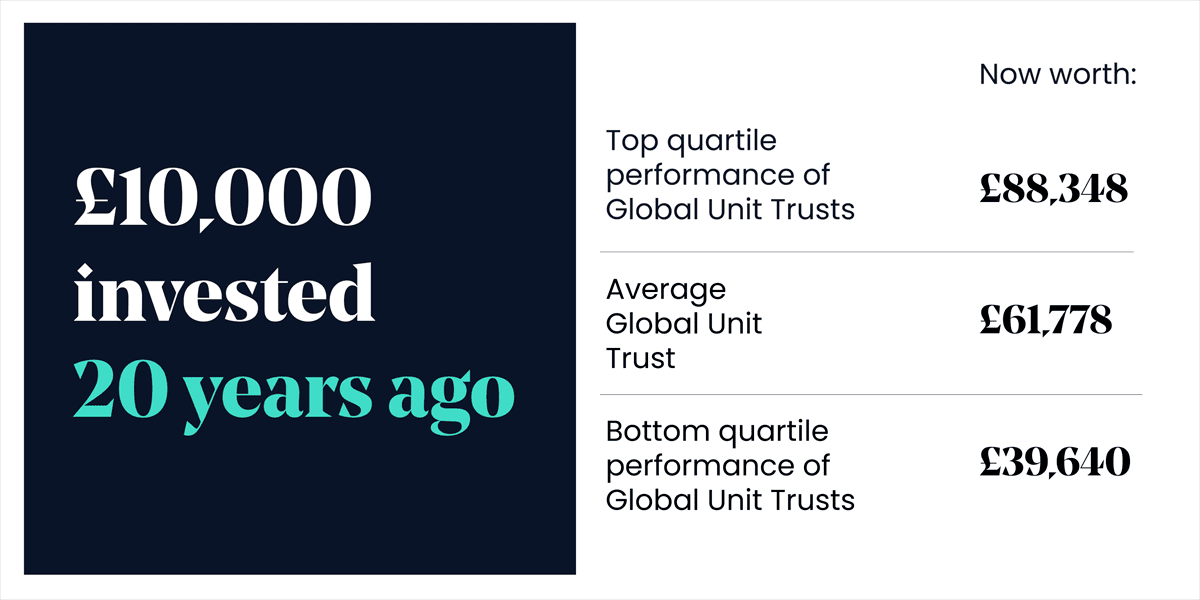

In The Picture

In long-term plans, different funds will offer a range of performance. Remember that each fund carries its own risk and objective which can impact its returns.

Source: Financial Express. Bid to bid basis. Data as of 31st March 2024.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

The Last Word

“The vital US aid bill passed today by the House will keep the war from expanding, save thousands and thousands of lives and help both of our nations to become stronger.”

– Ukrainian President, Volodymyr Zelensky, thanks the US for its ongoing support.

Schroders is a fund manager for St. James’s Place.

The information contained is correct as at the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results are indicative of future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James’s Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). ©LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies.

“FTSE Russell®” is a trademark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

© S&P Dow Jones LLC 2024; all rights reserved.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

SJP approved: 23/04/2024